Summary: Japan’s fiscal stimulus if smaller than it appear and is unlikely to boost the economy as much as officials may think. The problem in Japan is not that interest rates are too high or that pubic investment is too weak. The risk is that the yen strengthens further, and we suggest the dollar may fall toward JPY94.60. The Japanese government is delivering the other half of its fiscal policy today....

Read More »FX Daily, August 01: Dog Days of August Begin

Swiss Franc Click to enlarge. FX Rates The US dollar is trading with a small upside bias in narrow trading ranges. The main news has consisted of PMI reports, while investors continue to digest last week’s developments. In particular the BOJ’s underwhelming response to poor economic data and a missed opportunity to reinforce the fiscal stimulus, and the dismal US GDP. The dollar has been pinned today in the lower...

Read More »FX Weekly Preview: After this Week, Does August Matter?

Summary: RBA meeting is a close call. BOE meeting consensus on rate cut, maybe new QE and lending-for-funding. More details of Japan’s fiscal policy. U.S. jobs data. After this week, and outside of RBNZ rate cut, August may be uneventful. There are four events this week that will command the attention of global investors. The Reserve of Bank of Australia is first.It is a close call, though the median in the...

Read More »FX Daily, July 29: Kuroda Hesitates, Yen Advances, Focus Turns to Europe and North America

Prospects for the Swiss Economy Remain Favourable The KOF Economic Barometer has only changed little and reached a value of 102.7 in July. In June, and therefore before the referendum in the United Kingdom about its membership in the EU, the KOF Economic Barometer stood at a value of 102.6 (revised from 102.4). Thus the Barometer has been standing above the historical average since February this year. Despite the...

Read More »FX Daily, July 28: Dollar Pulls Back Further Post-FOMC

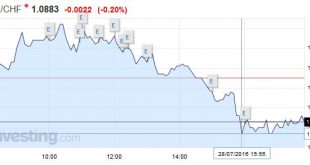

Swiss Franc The Swiss Franc is having a very volatile week. With the European stress tests approaching and with a bad U.S. durable goods release, the EUR/CHF is on the descent again. Data on net immigration to Switzerland has been published. The number of people who are leaving Switzerland is on the rise and the net immigration number has fallen. This is positive for the euro and negative for CHF. This decrease in...

Read More »Fasten Your Seat Belts: Tomorrow Promises to be Tumultuous

Summary: Japan reports on labor, consumption, inflation and industrial output before the BOJ meeting. ECB reports inflation and Q2 GDP and the results of the stress test on banks. US reports first look at Q2 GDP. Tomorrow could be among the most challenging sessions of the third quarter. The focus is primarily on Japan and Europe, but the US reports its first estimate of Q2 GDP. After a six-month soft...

Read More »FX Daily, July 27: Yen Falls on Fiscal Stimulus, while Sterling and Aussie Can’t Sustain Upticks

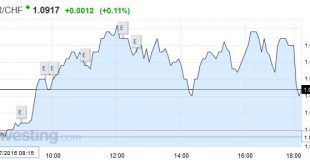

Swiss Franc The Euro kept on climbing, after yesterday’s rapid rise. Click to enlarge. The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy. Switzerland UBS Consumption Indicator Japan As uncertainty over Japan’s fiscal stimulus roiled the yen and domestic...

Read More »FX Daily, July 25: Big Week Begins Slowly

Swiss Franc Click to enlarge. FX Rates What promises to be a busy week has begun off slowly. The US dollar has been largely confined to its pre-weekend ranges against most of the major currencies. Equity markets are mostly firmer following the new record highs on Wall Street. The MSCI Asia Pacific Index eked out a small gain (0.1%), with losses in Japan, Taiwan, and Singapore offsetting gains elsewhere. ...

Read More »FX Daily, July 22: Flash PMIs Show Brexit Impact Localized

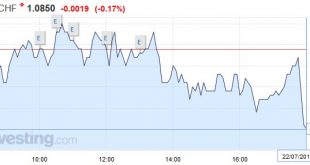

Swiss Franc The EUR/CHF ended lower today. Today’s data showed that Germany has stronger growth than the rest of the Eurozone. Given the strong Swiss trade ties with Germany, the Swiss franc appreciated. See more in Correlation between CHF and the German Economy Click to enlarge. FX Rates As the week draws to a close, there are three main developments in the capital markets. First, the profit-taking seen in US...

Read More »FX Daily, July 21: Monetary Policy Expectations are Driving Foreign Exchange

Swiss Franc The Swiss trade balance was published today, and once again, it remained close to record-high. For us, the trade balance is the most important indicator if a currency is fairly valued. Over the long-term the Swiss trade surplus must adjust towards zero, while the currency must appreciate. The consequence of the stronger currency is a higher purchasing power which leads to more spending and finally more...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org