Overview: The dollar is bid as the upside correction that began last week continues today. The greenback is trading above last week's highs against most of the G10 currencies. The yen is the notable exception. Comments by BOJ Governor Ueda has reiterated his intention to raise rates further provided the economy continues to perform as the central bank expects. The dollar has unwound yesterday's gains against the yen and is lower than last week's close (~JPY146.15)....

Read More »Risks Facing Bullish Investors As September Begins

Since the end of the “Yen Carry Trade” correction in August, bullish positioning has returned with a vengeance, yet two key risks face investors as September begins. While bullish positioning and optimism are ingredients for a rising market, there is more to this story. It is true that “a rising tide lifts all boats,” meaning that as the market rises, investors begin to chase higher stock prices, leading to a virtual buying spiral. Such leads to an improvement in...

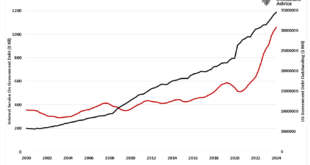

Read More »Japanese Style Policies And The Future Of America

In a recent discussion with Adam Taggart via Thoughtful Money, we quickly touched on the similarities between the U.S. and Japanese monetary policies around the 11-minute mark. However, that discussion warrants a deeper dive. As we will review, Japan has much to tell us about the future of the U.S. economically. Let’s start with the deficit. Much angst exists over the rise in interest rates. The concern is whether the government can continue to fund itself, given...

Read More »USD is Trading Mostly Firmer, but Yen and Swiss Franc Show Resilience

Overview: The US dollar is mostly firmer, though consolidating against most of the G10 currencies. The Japanese yen and Swiss franc are the strongest, while the Scandis and Antipodean currencies are the heaviest. Among emerging market currencies, a handful of Asian currencies, including the Chinese yuan are higher, but central European currencies, the South African rand, and the Mexican peso are softer.The news stream is light but the threat of the escalation of the...

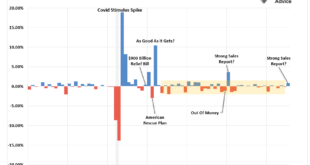

Read More »Red Flags In The Latest Retail Sales Report

The latest retail sales report seems to have given Wall Street something to cheer about. Headlines touting resilience in consumer spending increased hopes of a “soft landing” boosting the stock market. However, as is often the case, the devil is in the details. We uncover a more troubling picture when we peel back the layers of this seemingly positive data. Seasonal adjustments, downward revisions, and rising delinquency rates on credit cards and auto loans suggest...

Read More »US Benchmark Payroll Revisions Over-Hyped? Dollar may Benefit from Buying on Fact after Being Sold on Rumors

Overview: The preliminary annual revision to US jobs growth is front and center today. It has gotten more play that usual, amid speculation of a historically large revision. Yet, the direct impact on policy may be minimal. Federal Reserve officials, including Chair Powell, acknowledged that the payroll growth may have been overstated. Moreover, the Fed's judgment of the labor market is not based on one element of the multidimensional labor market. Indeed, given the...

Read More »Yen Slumps, Germany Contracts, and the Week’s Key Events Still Lie Ahead

Overview: An unexpected decline in Japan's unemployment did not prevent a retreat in the yen to a four-day low ahead of tomorrow's data and conclusion of the BOJ meeting. The dollar has probed the JPY155 area where nearly $3.5 bln options expire today. An unexpected contraction Germany's Q2 GDP was offset in the aggregate by better French, and especially Spanish figures, leaving the euro consolidating in a narrow range (~$1.0815-$1.0835). The greenback is softer...

Read More »Is the Dramatic Yen Short Squeeze Over?

Overview: The powerful yen short squeeze that has roiled the capital market this week has stalled today. It is the first day this week that the dollar has not fallen below the previous day's low and has risen, though slightly, above previous session's high. The Antipodeans and Scandis are trading with a firmer bias. The yen and Swiss franc are the only two G10 currencies that are not stronger today. The stability of the yen appears to have removed some of the...

Read More »Dollar Consolidation is Morphing into Correction

Jury duty assignment prevents a more comprehensive note, but here is a snapshot. Overview: The failure of computer systems has disrupted airlines, banks, media companies, and the London Stock Exchange, ostensibly stemming from an update from a third-party software update, according to Microsoft. The dollar is trading with a firmer bias. The consolidation, we anticipated, appears to be morphing into a correction. Weaker than expected retail sales has driven sterling...

Read More »Euro is Little Changed, while the Yen is Softer to Start the New Week

Overview: The dollar is narrowly mixed against the G10 and emerging market currencies today. The euro is little changed, holding on to last week's gains, after the surprising French election results, where the focus shifts finding a prime minister that can carry a majority of the new and closely divided National Assembly. Despite firm underlying wage data, the Japanese yen has given back its initial gains, and the dollar is pushing back above JPY161 in the European...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org