The IMF’s debt sustainability analysis paints a bleak picture … about previous IMF assessments and about the prospects for Greece.

Read More »New Questions about Greece’s Indebtedness

On the FT’s Alphaville blog, Matthew Klein reports about discrepancies between IMF and Greek (and EU) assessments of Greek net indebtedness. The IMF appears to report lower Greek financial asset holdings than the Greek Central Bank. Matthew Klein quotes the Greek Central Bank: We would like to clarify that the Bank of Greece compiles its financial accounts, from which data on the general government’s net debt are derived, according to European standards. The Bank of Greece’s data are...

Read More »Greek Debt: Now and Then

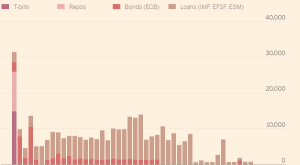

In the FT, Mehreen Khan offers a “Greek debt dilemma cheat sheet.” Face value: EUR 321 billion, thereof EUR 248 billion owed to official creditors. Official creditors: Eurozone countries (Greek loan facility), eurozone rescue funds (EFSF and ESM), IMF, ECB. Maturity profile: IMF proposal for restructuring:

Read More »IMFx

Last year, the IMF has joined the MOOC movement. On edX, the online education platform founded by Harvard University and MIT, the IMF contributes a set of “IMFx” courses developed by its Institute for Capacity Development. Courses cover Debt sustainability analysis; Energy subsidy reform; and soon Financial programming and policies (analysis and program design) as well as Macroeconomic forecasting.

Read More »U.S. Futures Flat After Oil Erases Overnight Losses; Dollar In The Driver’s Seat

In another quiet overnight session, the biggest - and unexpected - macro news was the surprise monetary easing by Singapore which as previously reported moved to a 2008 crisis policy response when it adopted a "zero currency appreciation" stance as a result of its trade-based economy grinding to a halt. As Richard Breslow accurately put it, "If you need yet another stark example of the fantasy storytelling we amuse ourselves with, juxtapose today’s Monetary Authority of Singapore policy...

Read More »ZIRP, NIRP, QE, Bank Collapse and Helicopters Coming Too Late – The Lehman Effect Hits Europe – Hard!

It’s official, I’m calling a banking crisis in Europe. Things didn’t go well the last time I did this. Of course, many will say, “But the rating agencies have learned their collective lessons. They would most assuredely warn us if the European banks are close to going bust, right?!!!”. Yeah, right! Reference our past research note on so-called trusted parties in private blockchains for banks. Those interested in purchasing the 22 page report on what is likely the first major bank to fall...

Read More »ZIRP, NIRP, QE, Bank Collapse and Helicopters Coming Too Late – The Lehman Effect Hits Europe – Hard!

It's official, I'm calling a banking crisis in Europe. Things didn't go well the last time I did this. Of course, many will say, "But the rating agencies have learned their collective lessons. They would most assuredely warn us if the European banks are close to going bust, right?!!!". Yeah, right! Reference our past research note on so-called trusted parties in private blockchains for banks. Those interested in purchasing the 22 page report on what is likely the first...

Read More »Exchange Rate Predictability

In a Study Center Gerzensee working paper, Pinar Yesin argues that the IMF’s Equilibrium Real Exchange Rate model (ERER) helps predict medium term exchange rate changes. The reduced form equation relates the real effective exchange rate to macroeconomic fundamentals. … one of the models, namely the ERER model, outperforms not only the other two in predicting future exchange rate movements, but also the (average) IMF assessment. … the IMF assessments are better at predicting future exchange...

Read More »Are Central Banks Setting Each Other Up?

Authored by Mark St.Cyr, There are times you try to connect the dots. There are others where those connections warrant adorning your trusted tin-foiled cap of choice; for you just can’t get there unless you do. This I believe is one of those times. And if correct? What at first might appear apocryphal, may in fact, be down right apocalyptic. And besides, what good is a tin-foil capped conspiracy theory anyhow if it doesn’t have the potential for doom, correct? So, with that in mind, let’s...

Read More »Are Central Banks Setting Each Other Up?

There are times you try to connect the dots. There are others where those connections warrant adorning your trusted tin-foiled cap of choice; for you just can’t get there unless you do. This I believe is one of those times. And if correct? What at first might appear apocryphal, may in fact, be down right apocalyptic. And besides, what good is a tin-foil capped conspiracy theory anyhow if it doesn’t have the potential for doom, correct? So, with that in mind, let’s venture down some roads...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org