– London property market vulnerable to crash– House prices in London are falling – London property up 84% in 10 years (see chart) – House prices have risen over 450% in 20 years– Brexit tensions as seen over weekend and outlook for U.K. economy to impact property– Global property bubble fragile – Risks to global economy– Gold bullion a great hedge for property investors For the bargain price of 36 AED (£5) I can buy...

Read More »Gold Bullion Imports Into China via Hong Kong More Than Doubles in March

Gold bullion imports into China via main conduit Hong Kong more than doubled month-on-month in March, data showed on Tuesday as reported by Reuters. Net-gold imports by the world’s top gold consumer through the port of Hong Kong rose to 111.647 tonnes in March from 47.931 tonnes in February, according to data emailed to Reuters by the Hong Kong Census and Statistics Department. China’s net-gold imports rose to its best...

Read More »Gold Sovereigns – ‘Treasure’ Trove Found In UK – Don’t Be The Piano Owner

Gold Sovereigns – ‘Life Changing’ ‘Treasure’ Trove Found In UK The gold sovereigns – semi-numismatic gold coins made up of both gold sovereigns and half gold sovereigns dating from the reigns of Victoria, Edward VII and George V – were discovered inside an old piano after it was donated to a school last year. A gold sovereign from that period is currently valued at between £200-250, with a half sovereign worth between...

Read More »Silver, Platinum and Palladium as Investments – Research Shows Diversification Benefits

– Silver, platinum and palladium see increased role as investment vehicles– Increase in academic output on the white precious metals is in line with this– Silver and particularly gold are safe haven assets– Silver was a safe haven at times during which gold failed to be– Platinum and palladium less so but have diversification benefits– Silver manipulation is possible and indications of, if not legal proof– Benefits...

Read More »Trump To “Bully” Fed Into Printing Money – Negative for Stocks, Positive for Gold

David McWilliams has written an interesting article in which he puts forward the case that Trump is likely to turn on the “enemy within,” the Federal Reserve and bully them into “printing money.” He points out that this was seen in 1971 when Nixon bullied the Fed into printing and debasing the dollar. McWilliams says this would be bad for stocks markets which would fall in value as was seen in the 1970s. This would be...

Read More »Silver Production Has “Huge Decline” In 2nd Largest Producer Peru

– Silver production sees “huge decline” in Peru – Production -12% in one month in 2nd largest producer – Silver decline is due to ‘exhaustion of reserves’ in Peru – GFMS recognise that ‘Peak Silver’ was reached in 2015 – Global silver market had large net supply deficit in 2016 – Silver rallied 13.5% in Q1 in 2017 – Base metal production accounts for 56% of silver mining – Base metal demand under threat from global...

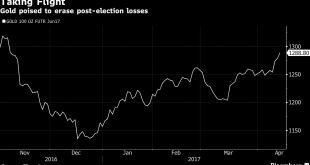

Read More »Gold Bullion Erases Post- Election Fall as Trump Wrong on Dollar – Daily Prophet

Gold Bullion Erases Post- Election Fall as Trump Wrong on Dollar – Daily Prophet Robert Burgess of Bloomberg Prophets President Donald Trump sent currency markets into a tizzy late Wednesday when he signaled his preference for a weaker dollar. “I think our dollar is getting too strong, and partially that’s my fault because people have confidence in me,” Trump told the Wall Street Journal. Although the greenback...

Read More »Perth Mint Silver Bullion Sales Rise 43 percent In March

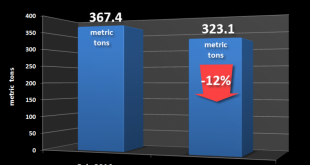

– Perth Mint’s silver bullion sales rise 43% in March.– Perth Mint’s monthly gold coin, bars sales fall 12%.– Gold silver ratio of 32 – 32 times more silver ounces sold.– Gold: 22,232 oz and Silver: 716,283 oz – bullion coins and minted bars sold. – Gold is 2.6% higher and silver surged 3.1% in the shortened week with markets closed for Good Friday tomorrow. Australian Kangaroo 2017, 1 oz 9999 Silver The Perth Mint’s...

Read More »Gold Price Surges Above Key 200 Day Moving Average $1270 Level

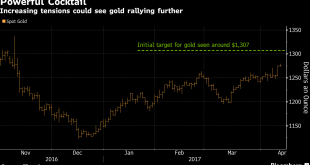

– Gold price breaks above key 200-day moving average– Gold hits 5-month high on back of investor nervousness– Safe haven has 10% gains in 2017 after 9% gains in 2016– Gold options signal more gains as ETF buying increases– Geopolitical uncertainty over North Korea & Middle East– Tensions high -World awaits US move & Russia response– Russia says chemical attack was terrorist “false flag”– Poor March jobs report...

Read More »Gold Price Surges Above Key 200 Day Moving Average $1270 Level

– Gold price breaks above key 200-day moving average– Gold hits 5-month high on back of investor nervousness– Safe haven has 10% gains in 2017 after 9% gains in 2016– Gold options signal more gains as ETF buying increases– Geopolitical uncertainty over North Korea & Middle East– Tensions high -World awaits US move & Russia response– Russia says chemical attack was terrorist “false flag”– Poor March jobs report...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org

-310x165.jpg)