– British people suddenly stopped buying cars – Massive debt including car loans, very low household savings – Brexit and decline in sterling and consumer confidence impacts – New cars being bought on PCP by people who could not normally afford them – UK car business has ‘exactly the same problems’ as the mortgage market 10 years ago, according to Morgan Stanley – Bank of England is investigating to make sure UK banks...

Read More »Buy Gold for Long Term as “Fiat Money Is Doomed”

– Buy gold for long term as fiat money is doomed warns Frisby– Gold’s “winning streak” will continue in long term– September is traditionally a good month for gold, as we head into the Indian wedding season– “It’s just a matter of time before gold comes good again…”by Dominic Frisby, Money Week Today folks, by popular demand, we’re talking gold. It’s had a nice summer run. What now? Gold Daily, Jul 2010 - Oct 2017(see...

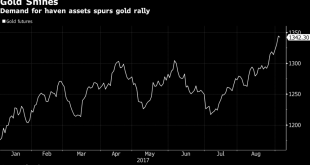

Read More »Safe Haven Gold Rises To $1338 as U.S. Warns of ‘Massive’ Military Response

– Safe haven gold extends rally to 11-month high after North Korea nuke test and U.S. warns of ‘massive’ response– Asian and European stocks fall, bonds flat, gold, silver, palladium, Swiss franc rise as Korea tensions flare as North Korea tests ‘hydrogen bomb’– North Korea prepares for possible ICBM launch says S. Korea– U.S. warns of ‘massive,’ ‘overwhelming’ military response to North Korea after meeting with Trump...

Read More »“Things Have Been Going Up For Too Long” – Goldman CEO

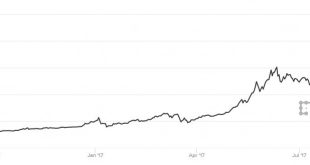

– “Things have been going up for too long…” – Goldman Sachs’ CEO – Lloyd Blankfein, Goldman CEO “unnerved by market” (see video) – Bitcoin bubble is no outlier says Bank of America Merrill Lynch– Bubbles are everywhere including London property– $14 trillion of monetary stimulus has pushed investors to take more risks– We are now in a new era of bigger booms and bigger busts – BAML– “Seeing signs of bubbles in more and...

Read More »Gold Has 2 percent Weekly Gain, 18 percent Higher YTD – Trump’s Debt Ceiling Deal Hurts Dollar

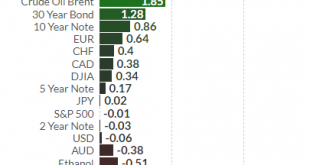

– Gold hits $1,355/oz as USD at 32-month low -concerns about Trump, US economy– Silver and platinum 2.3% and 1.2% higher in week; palladium 3% lower– Euro Stoxx flat for week – S&P 500, Nikkei down 0.65% and 2.2%– Geo-political concerns including North Korea, falling USD push gold 2.1% in week – Gold prices reach $1,355 this morning following Mexico earthquake– Safe haven demand sees gold over one year high,...

Read More »Physical Gold In Vault Is “True Hedge of Last Resort” – Goldman Sachs

– Physical gold is “the true currency of the last resort” – Goldman Sachs– “Gold is a good hedge against geopolitical risks when the event leads to a debasement of the dollar” – Trump and Washington risk bigger driver of gold than risks such as North Korea– Recent events such as N. Korea only explain fraction of 2017 gold price rally – Do not buy gold futures or ETFs rather “physical gold in a vault” [is] the “true...

Read More »Bitcoin Falls 20 percent as Mobius and Chinese Regulators Warn

– Bitcoin falls 20% as Mobius and Chinese regulators warn – “Cryptocurrencies are beginning to get out of control” – warns respected investor Mark Mobius – Mobius believes governments will begin to clamp down on cryptocurrencies sparking rush to gold– Yesterday China’s PBOC ruled Initial Coin Offerings (ICOs) are illegal and all related activity to halt– China is home to majority of bitcoin miners– Paris Hilton latest...

Read More »4 Reasons Why “Gold Has Entered A New Bull Market” – Schroders

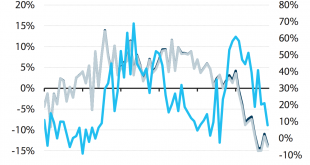

– 4 reasons why “gold has entered a new bull market” – Schroders– Market complacency is key to gold bull market say Schroders– Investors are currently pricing in the most benign risk environment in history as seen in the VIX– History shows gold has the potential to perform very well in periods of stock market weakness (see chart)– You should buy insurance when insurers don’t believe that the “risk event” will happen–...

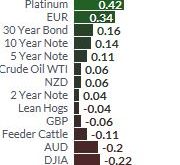

Read More »Precious Metals Outperform Markets In August – Gold +4 percents, Silver +5 percents

All four precious metals outperform markets in August Gold posts best month since January, up nearly 4% Gold reaches highest price since US election, climbs due to uncertainty and safe haven demand S&P 500 marginally higher; Euro Stoxx, Nikkei lower for month Platinum is best performing metal climbing over 5% Palladium climbs over 4% thanks to seven year supply squeeze Fear, uncertainty and political sanctions are...

Read More »Gold Reset To $10,000/oz Coming “By January 1, 2018” – Rickards

– Trump could be planning a radical “reboot” of the U.S. dollar– Currency reboot will see leading nations devalue their currencies against gold– New gold price would be nearly 8 times higher at $10,000/oz– Price based on mass exit of foreign governments and investors from the US Dollar– US total debt now over $80 Trillion – $20T national debt and $60T consumer debt– Monetary reboot or currency devaluation seen...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org