– Russia adds 1.1 million ounces to reserves in ongoing diversification from USD – 34 ton addition brings Russia’s Central Bank holdings to 1,779t; 6th highest – Russia’s gold reserves are at highest point in Putin’s 17-year reign – Russia’s central bank will buy gold for its reserves on the Moscow Exchange – Russia recognises gold’s role as independent currency and safe haven Russian Central Bank Gold Reserves, 2006 -...

Read More »Next Wall Street Crash Looms? Lessons On Anniversary Of 1987 Crash

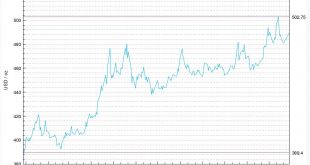

– Next Wall Street Crash looms? Lessons on anniversary of crash – 30 years since stock market ‘Black Monday’ crash of 1987 – Dow Jones Industrial Average fell 22.6% on October 19, 1987 – S&P 500, FTSE and DAX fell 20%, 11% & 9% respectively – Gold rose 24.5% in 1987 (see chart), acting as safe haven – Prior to crash, stocks hit successive record highs despite imbalances – Imbalances that lead to 1987 crash are...

Read More »Key Charts: Gold is Cheap and US Recession May Be Closer Than Think

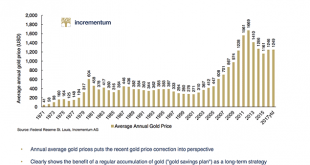

Every year, Ronald-Peter Stoeferle and Mark J Valek of investment and asset management company Incrementum put together the report In Gold We Trust – 160-plus pages of charts and thoughts, mostly gold-related, on the state of the world’s finances. There’s so much to look at and consider. It’s a sort of digital equivalent of a coffee-table book. Yesterday I got an email from them, containing a “best of” – a compendium of...

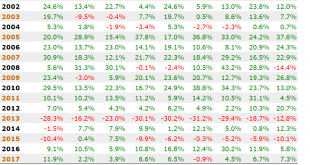

Read More »Gold Up 74% and One Of Top Performing Assets Since Last Market Peak 10 Years Ago

– 10 year anniversary of pre-Global Financial Crisis market peak in S&P 500 on October 9th– Gold up 74% since the last market peak a decade ago; 11% pa in USD, 9.4% pa in EUR and 12.4% pa in GBP– Precious metal has climbed $736/oz on Oct 9th 2007 to $1278.75 ten-years later– S&P 500’s 102% climb is thanks to asset-pumping policies by central banks, rather than value– Gold’s performance is slowly forcing...

Read More »Gold Up 74percent and One Of Top Performing Assets Since Last Market Peak 10 Years Ago

– 10 year anniversary of pre-Global Financial Crisis market peak in S&P 500 on October 9th– Gold up 74% since the last market peak a decade ago; 11% pa in USD, 9.4% pa in EUR and 12.4% pa in GBP– Precious metal has climbed $736/oz on Oct 9th 2007 to $1278.75 ten-years later– S&P 500’s 102% climb is thanks to asset-pumping policies by central banks, rather than value– Gold’s performance is slowly forcing...

Read More »How Gold Bullion Protects From Conflict And War

What Steel’s study shows is that, as with any monetary force, it is how it is managed rather than what it is that carries responsibility for conflicts and the resulting financial situation. Steel’s work also demonstrates the strength and protection access to gold will give a country or army during times of conflict. Allies are able to have faith in countries that have managed their gold supply and economy responsibly,...

Read More »Silver Bullion Prices Set to Soar

Silver bullion prices are expected to jump as solar and smartphone demand rises and the Fed tries to stave off economic weakness by Myra Saefong via Barrons Gold prices have far outpaced gains in silver so far this year, but silver will emerge as the winner for the second year in a row. With a per-ounce price of $17.41 for silver futures as of Friday, analysts say the white metal is poised for a big climb, particularly...

Read More »Brexit UK Vulnerable As Gold Bar Exports Distort UK Trade Figures

– Brexit UK vulnerable as gold bar exports distort UK trade figures – Britain’s gold exports worth more than any other physical export – Gold accounted for more than one in ten pounds of UK exports in July 2017– UK’s stock of wealth has collapsed from a surplus of £469bn to a net deficit of £22bn – ONS error– Brexiteers argue majority of trade is outside EU, this is due to large London gold exports– Single gold bar...

Read More »Brexit UK Vulnerable As Gold Bar Exports Distort UK Trade Figures

– Brexit UK vulnerable as gold bar exports distort UK trade figures – Britain’s gold exports worth more than any other physical export – Gold accounted for more than one in ten pounds of UK exports in July 2017– UK’s stock of wealth has collapsed from a surplus of £469bn to a net deficit of £22bn – ONS error– Brexiteers argue majority of trade is outside EU, this is due to large London gold exports– Single gold bar...

Read More »U.S. Mint Gold Coin Sales and VIX Point To Increased Market Volatility and Higher Gold

– US Mint gold coin sales and VIX at weakest in a decade– Very low gold coin sales and VIX signal volatility coming– Gold rises 1.7% this week after China’s Golden Week; pattern of higher prices after Golden Week– U.S. Mint sales do not provide the full picture of robust global gold demand– Perth Mint gold sales double in September reflecting increased gold demand in both Asia and Europe– Middle East demand likely high...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org