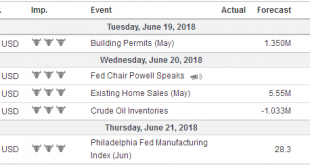

Swiss Franc The Euro has fallen by 0.27% to 1.1492 CHF. EUR/CHF and USD/CHF, June 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates There are large options that expire today at $1.1525 (1.2 bln euros) and $1.1550 (1.9 bln). Given the still substantial gross long euro positions in the futures market, it remains an open question of what level would trigger a capitulation. A...

Read More »FX Daily, June 20: Fragile Stability

Swiss Franc The Euro has fallen by 0.03% to 1.1514 CHF. EUR/CHF and USD/CHF, June 20(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The day began out with equity losses in Asia before a sharp recovery, perhaps initiated in China. The MSCI Asia Pacific Index was up a little more than 0.5%. The Shanghai Composite fell more than 1% before closing 0.25% better. Market...

Read More »FX Daily, June 19: America First Clashes With Made in China 2025

Swiss Franc The Euro has fallen by 0.60% to 1.1495 CHF. EUR/CHF and USD/CHF, June 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The escalation of trade tensions between the world’s two largest economies is scaring investors, who are liquidating equities and buying core bonds. The dollar and yen are the strongest of the major currencies. The Swiss franc is mostly steady...

Read More »FX Daily, June 18: Politics and Economics Weigh on European Currencies

Swiss Franc The Euro has fallen by 0.40% to 1.1533 CHF. EUR/CHF and USD/CHF, June 18(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is rising against most of the major and emerging market currencies. The prospects of escalating trade tensions and the divergence of policy that was confirmed by the major central banks are disrupting the markets. Norway’s...

Read More »FX Weekly Preview Warning: Treacherous Week Ahead

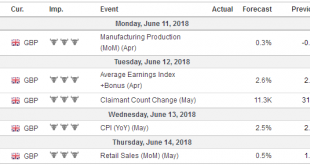

All three of the major central banks met last week and confirmed that monetary policy would continue to diverge for at least another year. The clarity of the trajectory of monetary policy reduces the impact of high-frequency economic data. There are three major disruptive forces the make for a challenging investment climate just the same: the US policy mix, trade tensions, and immigration. The mix of tighter monetary...

Read More »FX Daily, June 15: Dollar Slips While Escalating Trade Tensions may Roil Markets

Swiss Franc The Euro has risen by 0.40% to 1.1576 CHF. EUR/CHF and USD/CHF, June 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge The Dollar Index edged higher to its best level this year before turning down as market attention shifts from central banks to trade tensions. Reports confirm that the US will go ahead with the 25% tariff on $50 bln of Chinese goods and provide some...

Read More »FX Daily, June 14: Dollar Punished Ahead of ECB

Swiss Franc The Euro has risen by 0.43% to 1.1568 CHF. EUR/CHF and USD/CHF, June 14(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge The US dollar is slumping against all the major currencies in the aftermath of the hawkish Federal Reserve. In fact, the inability of the greenback to hold on to the gains scored in the initial reaction to the Fed’s hike, optimism on the economy,...

Read More »FX Daily, June 13: Dollar Edges Higher Ahead of FOMC

The US dollar is trading firmly as the FOMC decision looms. In many ways, the actionable outcome of this meeting has hardly been in doubt this year. By all accounts, the Fed will deliver its second hike of the year today. The question is not so much about the next meeting in August. The Fed has only hiked rates at meetings that a press conference follows. This is the source of one of our persistent criticisms of the...

Read More »FX Daily, June 12: US-Korea Summit Fails to Impress Investors

Swiss Franc The Euro has risen by 0.03% to 1.1609 CHF. EUR/CHF and USD/CHF, June 12(see more posts on EUR/CHF, EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar initially rallied in early Asia ahead of the US-North Korea summit but has subsequently shed the gains and more. As North American dealers return to their desks, the dollar is lower against nearly all the major...

Read More »FX Weekly Preview: Busy Week Ahead

The week ahead is eventful. The Federal Reserve, the European Central Bank, and the Bank of Japan hold policy meetings. This would make for a busy week by themselves, but there is more. Trade tensions are likely to escalate further, if the US, as scheduled provides a list of $50 bln of Chinese goods that will face another 25% tariff for intellectual property violations. If the US does so, China has threatened to retract...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org