So, you’re convinced that low rates are powerful stimulus. You believe, like any good standing Economist, that reduced interest costs can only lead to more credit across-the-board. That with more credit will emerge more economic activity and, better, activity of the inflationary variety. A recovery, in other words. Ceteris paribus. What happens, however, if you also believe you’ve been responsible for bringing rates down all across the curve…and then no recovery....

Read More »Costs and Benefits of Unconventional Monetary Policy

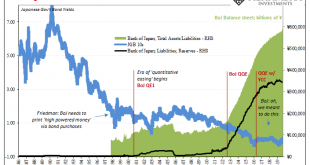

The BIS has issued two reports that assess the implications of unconventional monetary policies. The report prepared by the Committee on the Global Financial System discusses … a number of unconventional monetary policy tools (UMPTs). After a decade of experience with UMPTs the report takes stock of central banks’ experience and draws some lessons for the future. The report focuses on four sets of tools: negative interest rate policies, new central bank lending operations, asset purchase...

Read More »Claudio Grass Interviews Ronald Stoeferle: Central Banks In A Lose-Lose Situation

A Fragile System Claudio Grass, Global Gold: Ronald, it is a pleasure to have the opportunity to speak with you. We’ve known each other for a very long time, both on a personal and professional level. Because of our central banks, we find our economies today operating on artificial stimulus and negative interest rates. How would you summarize the consequences of this policy? Mr. Stoeferle: I have always considered...

Read More »Longer-Term Interest Rate Pegs

In his blog, Ben Bernanke discusses the merits of longer-term interest rate targeting as a monetary policy tool. A lot would depend on the credibility of the Fed’s announcement. If investors do not believe that the Fed will be successful at pushing down the two-year rate … they will immediately sell their securities of two years’ maturity or less to the Fed. … the Fed could end up owning most or all of the eligible securities, with uncertain consequences for interest rates overall. On the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org