The BIS in its quarterly review published yesterday included a reference to the eurodollar market (thanks to M. Daya for pointing it out). The central bank to central banks, as the outfit is often called, is one of the few official institutions that have taken a more objective position with regard to the global money system. Of the very few who can identify eurodollars, or have even heard of them, the BIS while not...

Read More »Manufacturing Back To 2014

The ISM Manufacturing PMI registered 57.7 in February 2017, the highest value since August 2014 (revised). It was just slightly less than that peak in the 2014 “reflation” cycle. Given these comparisons, economic narratives have been spun further than even the past few years where “strong” was anything but. The ISM’s gauge of orders increased to the highest level in just over three years, while an index of production...

Read More »Economic Dissonance, Too

Germany is notoriously fickle when it comes to money, speaking as much of discipline in economy or industry as central banking. If ever there is disagreement about monetary arrangements, surely the Germans are behind it. Since ECB policy only ever attains the one direction, so-called accommodation, there never seems to be harmony. But that may only be true because “accommodation” doesn’t ever achieve what it aims to....

Read More »True Cognitive Dissonance

There is gold in Asia, at least gold of the intellectual variety for anyone who wishes to see it. The Chinese offer us perhaps the purest view of monetary conditions globally, where RMB money markets are by design tied directly to “dollar” behavior. It is, in my view, enormously helpful to obsess over China’s monetary system so as to be able to infer a great deal about the global monetary system deep down beyond the...

Read More »Real Disposable Income: Headwinds of the Negative

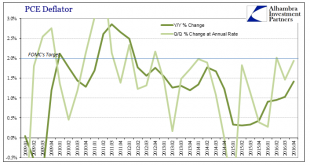

The PCE Deflator for January 2017 rose just 1.89% year-over-year. It was the 57th consecutive month less than the 2% mandate (given by the Fed itself when in early 2012 it made the 2% target for this metric its official definition of price stability). Though there is a chance that the streak will end with the update for February, it should not go unnoticed how weak that number is given that oil prices in January were...

Read More »Some Notes On GDP Past And Present

The second estimate for GDP was so similar to the first as to be in all likelihood statistically insignificant. The preliminary estimate for real GDP was given as $16,804.8 billion. The updated figure is now $16,804.1 billion. In nominal terms there was more variation, where the preliminary estimate of $18,860.8 billion is now replaced by one for $18,855.5 billion. Therefore, to net out with no change in real terms a...

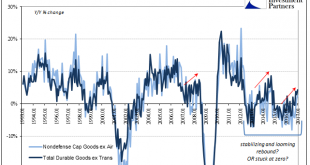

Read More »Durable Goods Groundhog

If the economy is repeating the after-effects of the latest “dollar” events, and it does seem more and more to be that case, then analysis starts with identifying a range for where it might be in the repetition. New orders for durable goods (ex transportation) rose 4.3% year-over-year in January 2017 (NSA, only 2.4% SA), the highest growth rate since September 2014 (though not meaningfully faster than the 3.9% rate in...

Read More »It Was ‘Dollars’ All Along

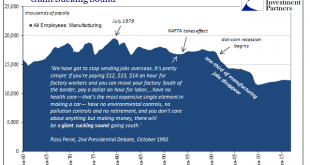

Ross Perot famously declared the “giant sucking sound” in the 1992 Presidential campaign. The debate over NAFTA did not end with George H. W. Bush’s defeat, as it simmered in one form or another for much of the 1990’s. Curiously, however, it seemed almost perfectly absent during the 2000’s, the very decade in which Perot’s prophecy came true. Americans didn’t notice because there was a bubble afoot. That bubble,...

Read More »Not Recession, Systemic Rupture – Again

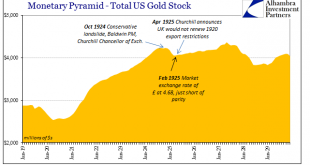

For the very few in the mainstream of economics who venture further back in history than October 1929, they typically still don’t go much last April 1925. And when they do, it is only to further bash the gold standard for its presumed role in creating the conditions for 1929. The Brits under guidance of Winston Churchill made a grave mistake, one from which gold advocates could never recover given what followed. There...

Read More »Not Recession, Systemic Rupture – Again

For the very few in the mainstream of economics who venture further back in history than October 1929, they typically still don’t go much last April 1925. And when they do, it is only to further bash the gold standard for its presumed role in creating the conditions for 1929. The Brits under guidance of Winston Churchill made a grave mistake, one from which gold advocates could never recover given what followed. There...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org