Entering commoditized, fiercely competitive low-margin services cannot substitute for the high-margin profits that will be lost as global recession and saturation erode iPhone sales. Apple has always been equally an enterprise and a secular religion. The Apple Faithful do not tolerate heretics or critics, and non-believers “just don’t get it.” So the first thing any critic must do is establish their credentials as a...

Read More »Brexit and Learning To “Live With Boom and Bust Economic Cycles”

Generations of people have learned to live with boom and bust economic cycles. Years of relative plenty were followed, as night follows day, by grief including high unemployment and forced emigration on a large scale. In fact, if you go back much beyond the late 1960s, it would not be too cynical to say the cycles were often more about going from bust to really busted, as for decades the country was hit by crippling...

Read More »FX Daily, March 29: Equities Bounce While Bonds Pullback to End Q1

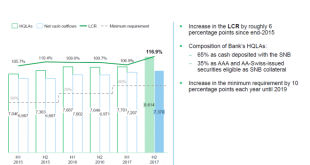

Swiss Franc The Euro has keep position 0.00% at 1.1194 EUR/CHF and USD/CHF, March 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global growth scare may be subsiding. It had been fanned by the ECB and Fed statements and projections. Poor US jobs growth reported in early March and the poor flash EMU PMI late in the month contributed. The slowdown in China...

Read More »Swiss Rail shares bumper profits with passengers

© Erix2005 | Dreamstime.com In 2018, Swiss Rail made a profit of CHF 568 million, 42.5% more than in 2017. Part of the rise was due to higher than average spending on maintenance in 2017. It is worth noting that Swiss Rail receives a large sum from taxpayers every year. In 2018, the company received CHF 3.5 billion of public funding, CHF 2.7 billion of it booked as income. Without this large lump of taxpayer help Swiss...

Read More »Watchdog confirms illegal activity by cryptocurrency firm Envion

The company is in the middle of bankruptcy proceedings handled by the Zug bankruptcy office. An investigation by the Swiss Financial Market Supervisory Authority (FINMA) has revealed the that Zug-based cryptocurrency venture Envion unlawfully received deposits from at least 37,000 investors. Envion unlawfully accepted over CHF90 million ($90.5 million) in its Initial Coin Offering (ICO) without the necessary statutory...

Read More »Is the World Becoming Wealthier or Poorer?

There is nothing intrinsically profitable about either robotics or AI. At the request of colleague/author Douglas Rushkoff (his latest book is Team Human), I’m publishing last week’s Musings Report, which was distributed only to subscribers and patrons of the site.) The core assumption of Universal Basic Income (UBI) and other plans to redistribute wealth and income more broadly is that the world is becoming wealthier,...

Read More »Dépossession. Des politiques monétaires mortifères…

L’économie du pays est promise à un effondrement. Il suffit pour s’en convaincre de voir la quantité de surfaces commerciales disponibles. En Suisse, près de 1200 entreprises ont fait faillite entre janvier et février! L’information du jour est un non-évènement, puisque annoncé de longue date sur ce site. Par ailleurs, elle ne semble intéresser personne à Berne, dans les « agglomérations », ou autres »Régions »....

Read More »FX Daily, March 28: Brexit Uncertainty Deepens as Parliament is Divided, while Turkey’s Short Squeeze Falters

Swiss Franc The Euro has risen by 0.07% at 1.1192 EUR/CHF and USD/CHF, March 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The lurch lower in global interest rates continue. The US 10-year yield is at new 15-month lows, five basis points through the average effective Fed funds rate. Late yesterday, it appeared that 10-year German Bund yields slipped below...

Read More »Swiss chocolate consumption slides

© Astra490 | Dreamstime.com In 2018, Switzerland’s population consumed around 87,000 tonnes of chocolate. However, average chocolate consumption dropped from 10.5 kg per person in 2017 to 10.3 kg in 2018, a decline of roughly 2%. This decline reflects last year’s longer hotter summer, according to the industry association Chocosuisse. The fall in consumption of Swiss chocolate in Switzerland declined further, dropping...

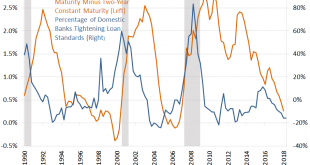

Read More »Monthly Macro Monitor: Well Worried

Don’t waste your time worrying about things that are well worried. Well worried. One of the best turns of phrase I’ve ever heard in this business that has more than its fair share of adages and idioms. It is also one of the first – and best – lessons I learned from my original mentor in this business. The things you see in the headlines, the things everyone is already worried about, aren’t usually worth fretting...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org