Swiss Franc The Euro has risen by 0.18% at 1.1415 EUR/CHF and USD/CHF, May 07(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: News that the US tariff escalation did not scupper trade talks with China has helped the global capital markets stabilize today. China’s Vice Premier Liu He is still leading a delegation to the US. Most Asian equities recouped part of...

Read More »What Would It Take to Spark a Rural/Small-Town Revival?

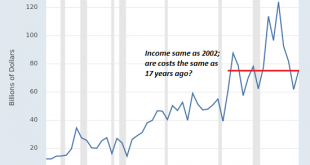

There are many historical models in which the spending/investing of wealthy families drives the expansion of local economies. The increase in farm debt while farm income declines is putting unbearable financial pressure on American farmers, who must be differentiated from giant agri-business corporations. This is placing immense pressure on farmers, pressure which manifests in rising suicide rates. If this isn’t the...

Read More »Nonmonetary Cause of Lower Prices, Report 5 May

Over the past several weeks, we have debunked the idea that purchasing power—i.e. what a dollar can buy—is intrinsic to the currency itself. We have discussed a large non-monetary force that drives up prices. Governments at every level force producers to add useless ingredients, via regulation, taxation, labor law, environmentalism, etc. These are ingredients that the consumer does not value, and often does not even...

Read More »FX Daily, May 06: Trump’s Tariff Tweets Help Investors Discover Volatility

Swiss Franc The Euro has risen by 0.04% at 1.1399 EUR/CHF and USD/CHF, May 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Reports that a US-China deal could be struck by May 10 before the weekend left investors ill-prepared for the presidential tweets yesterday that announced that the US was ending the tariff truce. Trump indicated that the 10% tariff on $200...

Read More »Seizures of illegally imported medicines triple in Switzerland

Last year Swissmedic and the Swiss customs officers seized 15 illegal shipments of Xanax from Cambodia, Hungary and other countries (Swissmedic) The Federal Customs Administration seized 3,203 shipments of illegally imported medicines in 2018 – triple the amount of the previous year. Erectile stimulants remain at the top of the list of illegally imported substances, the Swiss Agency for Therapeutic Products...

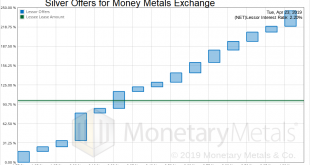

Read More »Money Metals Exchange Lease #1 (silver)

Monetary Metals leased silver to Money Metals Exchange, to support the growth of its gold and silver bullion business. The metal is held in the form of inventory in its vault. For more information see Monetary Metals’ press release. Metal: Silver Commencement Date: May 1, 2019 Term: 1 year Lease Rate: 2.2% net to investors Silver Offers for Money Metals Exchange - Click to enlarge...

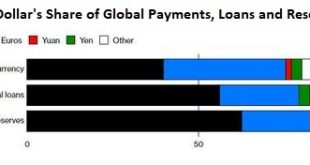

Read More »Good Riddance to a “Nothing-Burger” Trade Deal

China has expanded its domestic debt to fund its growth, much of which qualifies as malinvestment, creating financial vulnerabilities its government is anxious to mask. As I noted in Trade Deal Follies: The U.S. Has Embraced the World’s Worst Negotiating Tactics (April 8, 2019), the trade deal was a Nothing-Burger for the U.S. Without any consequences for violating trade deals, China violates all trade deals, starting...

Read More »Geneva blocks the erection of 5G mobile antennas

© Tpibernik | Dreamstime.com Last week, Antonio Hodgers, the head of Geneva’s executive, announced a ban on the erection of further 5G mobile antennas in the canton, according to an interview on RTS. Motivated by uncertainty on the potential health effects of the new technology, the temporary freeze is the most the cantonal government can do to stop the rollout of the technology. Switzerland’s federal government in Bern...

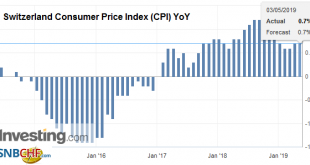

Read More »Swiss Consumer Price Index in April 2019: +0.7 percent YoY, +0.2 percent MoM

03.05.2019 – The consumer price index (CPI) increased by 0.2% in April 2019 compared with the previous month, reaching 102.4 points (December 2015 = 100). Inflation was 0.7% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO). The 0.2% increase compared with the previous month can be explained by several factors including rising prices for fuel and for air...

Read More »Income Inequality and the Decline of the Middle Class in Two Charts

Now look at the middle quintiles–the middle class: their income has gone nowhere in the past decade. These two charts of average incomes of U.S. households by quintile (bottom 20%, middle 60% (20%+20%+20%) and top 20%) have both good news and bad news. (Charts are from the non-partisan Congressional Budget Office — CBO). These charts depict 1) household income before transfers (means-tested government benefits) and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org