Swiss Franc The Euro has fallen by 0.28% at 1.1273 EUR/CHF and USD/CHF, May 15(see more posts on EUR/CHF, USD/CHF, ) Source: merkets.ft.com - Click to enlarge FX Rates Overview: Disappointing Chinese April data spurred speculation that more stimulus will be forthcoming and bolsters hopes that a trade deal with the US by the end of next month helped Asian Pacific equities advance for the first time this week....

Read More »Why China Finds it Difficult to Weaponize the Yuan and US Treasuries

It looks so easy on paper. China can sell its holding of US Treasuries and/or weaken the yuan to offset the tariffs and boost exports. It is the first and easy answers from strategists, journalists, and some academics. Often times, it is presented a novel idea; as if diplomats, investors, and policymakers have not thought it. The point is not that China cannot sell its Treasury holding or that it cannot devalue the...

Read More »Gold Tops $1,300/oz As Trade Wars Escalate and Increased Risk of U.S. War With Iran

* Gold sees safe haven demand push it to highest in one month as it breaches key $1,300/oz and £1,000/oz levels * U.S. China trade wars escalates as China retaliates and imposes tariffs on $60 billion of U.S. goods * Increased risk of war in Middle East after U.S. alleges Iran bombed Saudi oil vessels destined for the U.S. Gold prices held steady near one-month highs today as an escalation in Sino-U.S. trade war saw...

Read More »Warmer weather sparks huge hike in Swiss e-bike sales

Bike riders are opting for a little electrical help to ease the strain on their muscles. (© Keystone / Gian Ehrenzeller) Unusually warm and dry weather conditions have been credited with boosting bicycle sales last year – with a greater proportion of cyclists opting to ease muscle strain with the assistance of e-bikes in Switzerland’s mountainous terrain. On Tuesday, the cycling enthusiasts group dynaMot added more...

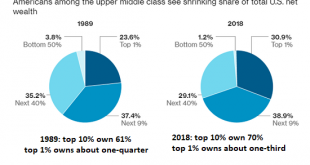

Read More »The Economy Has Fundamentally Changed in the 21st Century–and Not for the Better

The net result is we have an economy that’s supposedly expanding smartly while our well-being and financial security are collapsing. Gross Domestic Product (GDP) and other metrics of economic activity don’t measure either broad-based prosperity or well-being. Elites skimming financialization profits by expanding corporate debt and issuing more loans to commoners while spending more on their lifestyles boosts GDP quite...

Read More »FX Daily, May 14: Too Weak to Muster Much of a Turnaround Tuesday, Markets See Small Reprieve

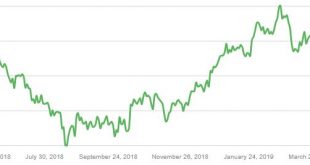

Swiss Franc The Euro has risen by 0.09% at 1.1304 EUR/CHF and USD/CHF, May 14(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: President Trump’s willingness to meet China’s Xi at the G20 meeting at the end of next month and his “feeling” that an agreement will still be found seemed sufficient to break the momentum that had swept through the capital market....

Read More »Pound to Swiss franc forecast: Brexit to continue to drive pound to swiss franc exchange rates

Since the start of the year the general trend for pound to swiss franc exchange rates has seen the pound strengthen. GBP/CHF mid-market levels started the year in the 1.23s and now are trading in the 1.30s. The pound strengthened as UK Prime Minister Theresa May extended Article50 by 6 months, which means the UK will not leave the EU without a deal. Brexit cross party talks However, in recent weeks the pound has...

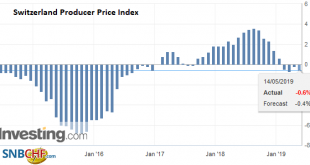

Read More »Swiss Producer and Import Price Index in April 2019: -0.6 percent YoY, unchanged MoM

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015...

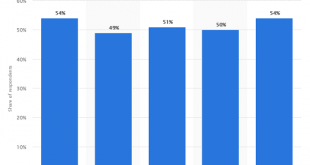

Read More »Burnout Nation

The economic and financial stresses will exceed the workforce’s carrying capacity in the next recession. A number of recent surveys reflect a widespread sense of financial stress and symptoms of poor health in America’s workers, particularly the younger generations. There’s no real mystery as to the cause of this economic anxiety: — competition for secure, well-paid jobs that were once considered the birthright of the...

Read More »The Monetary Cause of Lower Prices, Report 12 May

We have deviated, these past several weeks, from matters monetary. We have written a lot about a nonmonetary driver of higher prices—mandatory useless ingredients. The government forces businesses to put ingredients into their products that consumers don’t know about, and don’t want. These useless ingredients, such as ADA-compliant bathrooms and supply chain tracking, add a lot to the price of every good. Of course...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org