Swiss Franc The Euro has risen by 0.30% at 1.1115 EUR/CHF and USD/CHF, June 21(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global capital markets are trading quietly ahead of the weekend. Equity markets are mostly narrowly mixed. Chinese shares extended their run, and the major benchmarks were up 4%+ on the week. Japan, Australia, South Korea, and...

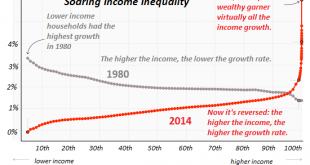

Read More »The Fed’s Casino Is Giving Away Free Gambling Chips (But Only to the Super-Rich)

The rest of us eat our losses, either all at once or in bitter bites as we trudge through the financial wasteland left after bubbles burst. The news that the Federal Reserve Casino is giving away free gambling chips triggered a frenzied rush that trampled the bears, including poor Yogi: There’s just one catch to the giveaway: you have to be rich, and if you want more than a token free gambling chip, you need to be...

Read More »A third of young Swiss experience financial hardship

Around 30% of young adults in Switzerland have faced financial difficulties at least once in their lives Around 30% of young adults in Switzerland have faced financial difficulties, according to data from the Young Adult Survey Switzerland (YASS). The survey, which questions some 70,000 19-year-olds around the country every four years, aims to gain an “empiric and interdisciplinary insight” into the “educational...

Read More »FX Daily, June 20: Doves Rules the Roost Except in Oslo

Swiss Franc The Euro has fallen by 0.48% at 1.1104 EUR/CHF and USD/CHF, June 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The prospect of “lower for longer” continues to fuel the bond and stock rally. The initial US equity response to the Fed was positive but not strong and closed about 0.3% higher. Asia Pacific equities followed suit with mostly modest...

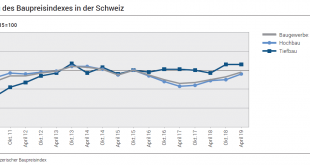

Read More »Switzerland Construction prices rose by 0.5 percent in April 2019

20.06.2019 – The construction price index recorded a rise of 0.5% between October 2018 and April 2019, reaching 99.8 points (October 2015 = 100). This result reflects an increase in building prices and a stabilisation in civil engineering prices. Year on year, construction prices increased by 0.7%. These are the results of the Federal Statistical Office (FSO). Development of the construction price index in Switzerland...

Read More »Dear Central Bankers: Prepare to be Swept Away in the Next Wave of Populism

The political moment when the “losers” connect their discontent and decline with central bankers is approaching. The Ruling Elites’ Chattering Classes still haven’t absorbed the key lesson of the 2016 U.S. presidential election: the percentage of the populace that’s becoming wealthier and more financially secure in the bloated, corrupt, self-serving Imperial status quo is declining and the percentage of the populace...

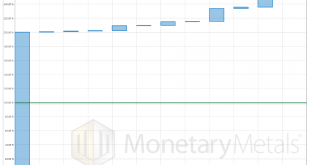

Read More »Gold Bullion International Lease #1 (gold)

Monetary Metals leased silver to Gold Bullion International, to support the growth of its gold jewelry line. The metal is held in the form of inventory in a third party depository. For more information see Monetary Metals’ press release. Metal: Gold Commencement Date: May 29, 2019 Term: 1 year Lease Rate: 2.0% net to investors The lease is 260% oversubscribed. The graph of the offers is less illustrative than others, as...

Read More »General Electric to slash 450 more Swiss jobs

General Electric Switzerland has already slashed some 2,000 posts since 2016. (© Keystone / Urs Flueeler) United States engineering giant General Electric has revealed it will cut a further 450 jobs at two of its Swiss sites. Since 2016, the company has already shed some 2,000 workers. The company, which generated profits of $954 million (CHF952 million) last year, blamed the latest cuts on “financially challenging...

Read More »China looks to new policies to boost infrastructure spending

To stabilise growth, the Chinese government will likely put more focus on infrastructure investment. A new policy announced recently could give a further boost to this sector. Activity data in May point to continued weakness in Chinese economic momentum, with growth in both fixed-asset investment and industrial production slowing last month. The only positive news came from retail sales, where growth picked up after the...

Read More »FX Daily, June 19: Still Patient?

Swiss Franc The Euro has fallen by 0.21% at 1.1169 EUR/CHF and USD/CHF, June 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Risk-taking was bolstered by the dramatic shift in Draghi’s rhetoric less than two weeks after the ECB meeting and a Trump’s tweet announcing that there was going to be an “extended” meeting between him and Xi at the G20 meeting and that...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org