Originally published September 1977 in Libertarian Review.In any debate between a socialist and a free-market capitalist, all too often the socialist quickly puts the free-market advocate on the defensive, and the entire time is consumed by the free-market person fending off attacks on the ability of the market to prevent inequality, or business cycles, or even the ravages of affluence and "materialism." Being on the offensive, socialism emerges spotless and...

Read More »Gold price remains on the defensive below 50-day SMA amid reviving USD demand

Gold price remains confined in a narrow band heading into the European session. Hawkish Fed expectations underpin the USD and act as a headwind for the metal. The downside seems limited ahead of the crucial US PCE Price Index on Thursday. Gold price (XAU/USD) extends its sideways consolidative price move around the 50-day Simple Moving Average (SMA) on Wednesday as traders await fresh catalyst before positioning for the next leg of a directional move. Hence, the...

Read More »Swiss exports to Russia suspected of evading sanctions

Swiss goods enter Russia via third countries. KEYSTON Since the beginning of the Ukraine war, Swiss exports to countries close to Russia have increased significantly – which points to a possible evasion of sanctions. Shortly after the Russian attack on Ukraine, Western countries imposed sanctions on Russia. On February 28, 2022, Switzerland also reacted and adopted the EU sanctions. Since then, exports to Russia have been banned, with some exceptions such as...

Read More »USD/CHF Price Analysis: Trades back and forth around 0.8800

USD/CHF trades sideways near 0.8800 as the focus shifts to US economic data. The Swiss economy is expected to have growth at a moderate pace of 0.1% in the last quarter of 2023. Fed policymakers support holding interest rates unchanged in the range of 5.25%-5.50%. The USD/CHF is stuck in a tight range near the round-level resistance of 0.8800 since Friday’s trading session. The Swiss Franc asset struggles to find a direction as investors await the United States core...

Read More »Weak US Durable Goods may Herald Pullback in Capex

Overview: Most of the G10 currencies are trading quietly in narrow ranges today. After a slightly firmer than expected national CPI reading, which still moderated, and a pullback in US yields, the Japanese yen is the strongest of the major currencies. The dollar has pulled back from almost JPY151 to nearly JPY150. The New Zealand dollar is the weakest, off about 0.2% ahead of tomorrow's central bank meeting. After selling $127 bln of coupons yesterday, the US...

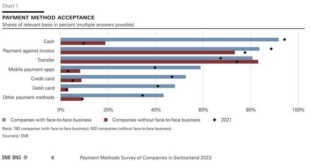

Read More »SNB Study: Results of the Swiss Payment Methods Survey

In spring 2023, the Swiss National Bank conducted its second payment methods survey of companies in Switzerland. Around 1,750 companies, across all sizes, language regions and industries, participated in this survey on payment method topics. In-depth knowledge of these topics helps the SNB to fulfil its statutory tasks in relation to the supply and distribution of cash and to cashless payments. . The most important findings of the payment methods survey of...

Read More »Rates, Risk and Debt: The Unavoidable Reckoning Ahead

Policy errors have consequences, and we’re only in the first inning of those consequences. Please note: Of Two Minds subscription rates are going up this Friday 3/1/24 from $5/month or $50/year to $7/month or $70/year, so subscribe by Thursday if you want to lock in current rates. Thank you for understanding the necessity of adjusting rates that have been unchanged since 2011. If we ask, “what’s changed?,” two under-appreciated dynamics pop out: risk and...

Read More »EUR/CHF hits ten-week highs above 0.9550 as Franc continues to soften

EUR/CHF up over 3% from December’s lows. ECB President Lagarde looks ahead to growth rebound. Swiss Franc is broadly weaker across the majors market. EUR/CHF knocked into fresh multi-month highs on Monday as the pair steps into a ten-week peak above 0.9550. The Swiss Franc (CHF) has depreciated notably against the majority of its major currency peers in 2024, and is down 2.88% YTD against the Euro (EUR). European Central Bank (ECB) President Christine Lagarde hit...

Read More »Who Hijacked Our Free Will?

Imagine someone giving a State of the World address that begins with a reminder that people possess free will and ought to be doing a better job of exercising it. This could possibly raise doubts about the speaker’s mental stability—at least until the talk went into the dark details of civilization’s condition. If the state of the world reflects the choices people make, and if those choices are autonomous, originating from within the minds of individuals, then the...

Read More »After Trump, Then What?

There will be life after Trump one way or another, but in the long run, it seems as though the ruling party always wins. Original Article: After Trump, Then What? [embedded content] Tags: Featured,newsletter

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org