The appalling attack in Manchester overnight in which over 22 people have been killed has led to a slight uptick in risk aversion in markets. Investors are cautious after police said they were treating a bombing at a concert in the Manchester Arena as a “terrorist incident”. Asian stocks gave up gains after the attacks and European indices had a subdued start. Gold rose in the aftermath of the attacks to three week highs prior to giving up some of the gains by mid morning trading. Sterling fell marginally and gold in sterling terms rose as high as £973.55 prior to consolidating near £970. Sterling was down 0.2 percent against the dollar to .2978 after falling 0.3 percent on Monday. If the blast is confirmed as a

Topics:

Mark O'Byrne considers the following as important: Daily Market Update, Featured, GoldCore, newslettersent

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

| The appalling attack in Manchester overnight in which over 22 people have been killed has led to a slight uptick in risk aversion in markets.

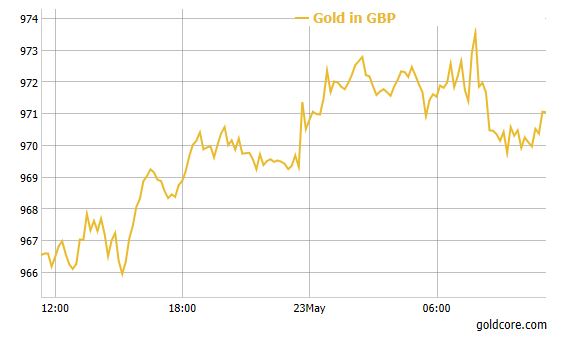

Investors are cautious after police said they were treating a bombing at a concert in the Manchester Arena as a “terrorist incident”. Asian stocks gave up gains after the attacks and European indices had a subdued start. Gold rose in the aftermath of the attacks to three week highs prior to giving up some of the gains by mid morning trading. Sterling fell marginally and gold in sterling terms rose as high as £973.55 prior to consolidating near £970. Sterling was down 0.2 percent against the dollar to $1.2978 after falling 0.3 percent on Monday. If the blast is confirmed as a terrorist incident, it would be the deadliest attack in Britain by militants since four British Muslims killed 52 people in suicide bombings on London’s transport system in July 2005. |

Gold In GBP(see more posts on Gold, ) |

| The attack has come just two-and-a-half weeks before an election that British Prime Minister Theresa May is expected to win easily.

Polls showing that the contest was tightening had added to sterling’s woes recently. A terrorist attack will likely benefit the Tory Party and Theresa May as they are perceived to be tougher on terrorism than the Labour Party. Terrorist events have not impacted markets globally in recent months and years. However, the concern is that with consumers indebted and consumer sentiment vulnerable, a spate of terrorist attacks or worse a terrorist ‘spectacular’ akin to ‘September 11’ could badly impact already fragile economies and increasingly frothy financial markets. The UK’s counter-terrorism chief has said that terrorists want to inflict an “enormous and spectacular” terrorist atrocity on the UK. The uncertain political climate in the UK and the United States is weighing on the dollar and sterling. Concerns over U.S. political turmoil and the complete mess that is the current U.S. political situation will lead to continuing demand for safe haven gold. This has led to gold’s recent gains and should contribute to gold eking out further gains in the coming weeks. |

Tags: Daily Market Update,Featured,newslettersent