A poster against lower corporate tax rates in a 2017 national vote campaign argues that such cuts would increase taxes for the middle class. On Sunday, Bern voters again rejected a package of corporate tax cuts. Voters in canton Bern have rejected a proposal to lower corporate taxes, dealing a surprise blow to the government and parliament trying to give the canton a competitive edge. Nearly 54% of voters on Sunday came...

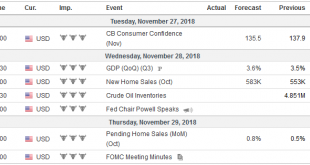

Read More »FX Weekly Preview: Powell and Draghi, Xi and Trump

The investment climate will be shaped by three events next week. ECB President Draghi’s testimony before the European Parliament to kick-off the week. Fed Chairman Powell speaks to the NY Economic Club in the middle of the week. Presidents Trump and Xi are to meet at the G20 meeting to end the week in hopes of dialing back the escalating trade conflict. Also at the G20 summit, the NAFTA2.0 is expected to be signed, and...

Read More »Swiss Post Office appoints CEO to steer clear of controversy

Cirillo has been identified as the right person to take the Post Office forward. The Swiss Post Office has appointed a new chief executive to lead the state-owned company out of a troubled few months following a subsidies scandal that came to light earlier this year. Roberto Cirillo will take over at the helm next April, replacing interim boss Ulrich Hurni, the Swiss Post announced on Thursday. Hurni has been minding...

Read More »Switzerland’s electronic motorway vignette to be optional

This week, Switzerland’s Federal Council decided the planned electronic motorway vignette will be optional. Drivers will be able to choose. ©-Denis-Linine-_-Dreamstime.com_ - Click to enlarge Anyone wanting to drive on Switzerland’s motorway network must first buy a vignette, a road tax sticker introduced in 1985, which must be displayed on the windscreen. It currently costs CHF 40. The government’s announcement that...

Read More »Swiss Unemployment Benefits Cut for a one-day filing delay

Switzerland’s unemployment benefits might be generous but they are strictly policed, as one recipient recently discovered. ©-Phartisan-_-Dreamstime.com_ - Click to enlarge For a period of up to approximately two years after losing a job, most workers in Switzerland receive 70% of their former salary up to a maximum of CHF 88,200 a year – the amount paid varies depending on circumstances1. To continue receiving the...

Read More »FX Daily, November 23: Friday

Swiss Franc The Euro has fallen by 0.27% at 1.1311 EUR/CHF and USD/CHF, November 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US dollar is firmer against most of the major currencies. Japanese and Indian markets were closed for holidays and a weaker than expected flash EMU PMI helped keep the euro pinned near this week’s lows. Although the EU seemed...

Read More »Two-thirds of Swiss see artificial intelligence as job threat

People are in favour of taxing robots if unemployment increases as a result of technological advances. Only 34% of Swiss people believe their jobs are not at risk from automation and machine learning, according to a survey commissioned by the Swiss Broadcasting Corporation (SBC). Almost half of the 2,092 people surveyed by the Link Institute for SBC felt that some of their daily tasks could be done by machines and...

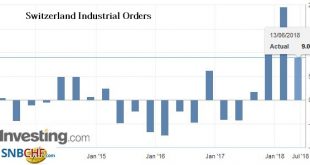

Read More »Construction Industry Production, Orders and Turnover Statistics: lncrease in construction production in Switzerland in 3rd quarter 2018

22.11.2018 – Secondary sector production rose by 1.1% in 3rd quarter 2018 in comparison with the same quarter a year earlier. Turnover rose by 3.1%. These are provisional findings from the Federal Statistical Office (FSO). In comparison with the previous year industrial production grew in July by 3.3%, in August by 1.7%, then fell in September (-0.4%). For the whole of the 3rd quarter 2018 production increased by 1.4%...

Read More »Cool Video: CNBC Squawk Box

I was part of the “Trading Block” on CNBC earlier today. The sharp fall in stocks and oil would have led many, like Joe, to anticipate dollar weakness. Instead, the dollar rallied. Perhaps, I suggested, the dollar was acting like a safe haven. Bill yields are high enough to make cash a reasonable alternative to park one’s savings. Even though the US economy is slowing from the fiscal goose of more than 4% in Q2 and more...

Read More »Skills Shortage on the Rise in Key Professions

Engineering, natural sciences professions and IT professions are experiencing an acute talent shortage in Switzerland. (Keystone) Switzerland’s talent shortage is more pronounced in 2018, a new survey has found. Technical, financial, and medical professions are most affected, while job seekers in the hospitality, retail, and administrative sectors face the greatest competition. These are the results of the 2018 Skills...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org