On the FT’s Alphaville blog, Matthew Klein reviews Swiss monetary policy over the last years and its effect on the real economy. He concludes that it seems the SNB’s relentless accumulation of foreign assets has been pointless — at best. More likely, the behaviour qualifies as predatory mercantilism at the expense of the rest of the world, especially Switzerland’s hard-hit neighbours.

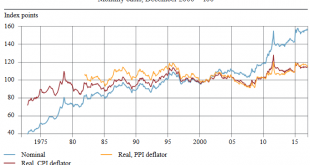

Read More »Swiss Franc Exchange Rate Index

The Swiss National Bank has updated its exchange rate indices. In an SNB Economic Studies paper, Robert Müller describes how. The upshot is that the SNB considers the Swiss Franc slightly less overvalued than before. From the abstract: The key aspects of the revision are: the application of the weighting method used by the IMF, which takes into account so-called third-market effects; continuous updating of the...

Read More »Swiss Franc Exchange Rate Index

The Swiss National Bank has updated its exchange rate indices. In an SNB Economic Studies paper, Robert Müller describes how. The upshot is that the SNB considers the Swiss Franc slightly less overvalued than before. From the abstract: The key aspects of the revision are: the application of the weighting method used by the IMF, which takes into account so-called third-market effects; continuous updating of the countries incorporated into the index; and calculation of a chained index....

Read More »MXN/USD

The Mexican Peso has been recovering ever since Donald Trump assumed office. Its value has climbed back to nearly where it was at the time of the US election. Time series as reported by xe.

Read More »Iceland Lifts Remaining Capital Controls

After nine years, Iceland has lifted its remaining capital controls. In the FT, Richard Milne reports. Exchange rate vis-a-vis the Euro.

Read More »Currency Denomination Risk in the Euro Area

In the FT (Alphaville), Marcello Minnena explains what type of currency denominations of Euro area sovereign debt constitute credit events; and how markets assess the risk of such denominations. After the Greek default in 2012 new ISDA standards entered into force: contracts made since 2014 protect against euro area countries redenominating their debt into new national currencies [unless the debt is redenominated] into a reserve currency: the US dollar, the Canadian dollar, the British...

Read More »FX Traders Have To (Re)Learn A New Skill

Dear FX traders: forget the dot plot, and prepare to learn a new – or to some forgotten – skill: how to read trade flows. As Bloomberg’s Vincent Cignarella and Andrea Wong point out, currency traders accustomed to analyzing the Fed’s dot plot and monthly U.S. jobs figures to predict the direction of the world’s reserve currency are having to learn, or in some cases re-learn, a largely forgotten ability: how to...

Read More »The US Dollar Is Now Overvalued Against Almost Every Currency In The World

In September 1986, The Economist weekly newspaper published its first-ever “Big Mac Index”. It was a light-hearted way for the paper to gauge whether foreign currencies are over- or under-valued by comparing the prices of Big Macs around the world. In theory, the price of a Big Mac in Rio de Janeiro should be the same as a Big Mac in Cairo or Toronto. After all, no matter where in the world you buy one, a Big Mac...

Read More »Macro Surprises and their Effects on the CHF

On VoxEU, Adrian Jäggi, Martin Schlegel and Attilio Zanetti report that the safe-haven currencies Swiss franc and Japanese yen react strongly to non-domestic macro surprises, and did so especially during the financial crisis. For European macro surprises, only German data influence safe-haven currencies.

Read More »How Derivatives Markets Responded to the De-Pegging of the Swiss Franc

In a Bank of England Financial Stability Paper, Olga Cielinska, Andreas Joseph, Ujwal Shreyas, John Tanner and Michalis Vasios analyze transactions on the Swiss Franc foreign exchange over-the-counter derivatives market around January 15, 2015, the day when the Swiss National Bank de-pegged the Swiss Franc. From the abstract: The removal of the floor led to extreme price moves in the forwards market, similar to those...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org