Overview: The 11 bp jump in the 10-year US yield yesterday after dropping nearly 26 bp in the previous three sessions, helped the greenback recover and took a toll on stocks. Still, the S&P 500 is above the low set on November 30 (~3939) before Fed Chair Powell’s talk that day. Global equities were dragged lower today. Most large bourses in the Asia Pacific region fell, including Hong Kong’s Hang Seng and the index of mainland companies that trade in Hong Kong....

Read More »Week Ahead: Focus Shifts away from the US after Robust Jobs Data and Stronger than Expected Inflation

The latest US employment and inflation figures are passed. The market is confident of a 75 bp rate hike next month. While a 50 bp in December is still the odds-on favorite, the market has a slight chance (~15%) of a 100 bp move instead after the robust jobs report and stronger-than-expected September CPI. The implied yield of the December Fed funds futures has ground higher for 12 consecutive sessions to about 4.23%. After two straight quarters of contraction, the...

Read More »Bank of England Steps in to Buy Inflation-Linked Bonds for the First Time

Overview: The dollar continues to ride high. It reached its highest level against the yen since the recent intervention. The Canadian dollar has fallen to its lowest level in two-and-a-half years and the New Zealand dollar is approaching the 2020 extreme. The greenback is firmer against all the major currencies but the Swiss franc, and against nearly all the emerging market currencies today. Equities have been sold. Japan, South Korea, and Taiwan re-opened after...

Read More »Dollar Slump Halted as Stocks and Bonds Retreat

Overview: Hopes that the global tightening cycle is entering its last phase supplied the fodder for a continued dramatic rally in equities and bonds. The euro traded at par for the first time in two weeks, while sterling reached almost $1.1490, its highest since September 15. The US 10-year yield has fallen by 45 bp in the past five sessions. Yet, the scar tissue from the last bear market rally is still fresh and US equity futures are lower after the S&P 500 had...

Read More »EU plant Einführung eines speziellen Crypto-Regulators

Wie genau dieser Regulator aussehen wird, ist noch nicht im Detail bekannt. Derzeit sprechen Offizielle lediglich von einem „Regulatory Body“, der Autorität über den Crypto-Sektor haben wird. Es ist jedoch anzunehmen, dass damit eine neue staatliche Organisation kreiert werden wird. Crypto News: EU plant Einführung eines speziellen Crypto-RegulatorsDamit kommt es zur Einführung einer sechsten Autorität des Finanzsektors, die das Ziel verfolgt, Geldwäsche innerhalb...

Read More »Greenback Softens, but Think Twice about Chasing It

Overview: Aside from political economic risks, three other challenges are emerging. First, the new sub-variant of Covid is spreading rapidly. BA5 reportedly is accounting for around 80% of the new cases. It is better able to evade antibodies from vaccines and earlier infections. Hospitalization rates are also climbing. Dining, retail, and travel may be impacted. Second, the World Health Organization declared monkeypox a global emergency. The US may make a similar...

Read More »The Greenback Bounces Back

Overview: After modest US equity gains yesterday, the weaker yen and Beijing’s approval of 60 new video games helped lift most of the large markets in the Asia Pacific region. South Korea and India were notable exceptions. Europe's Stoxx 600 is off for the second day as Monday's 0.9% advance continues to be pared. US futures are trading lower. The 10-year Treasury yield continues to hover around 3%, and European yields are up 3-5 bp today. The euro is little changed...

Read More »Inflation and Geopolitics in the Week Ahead

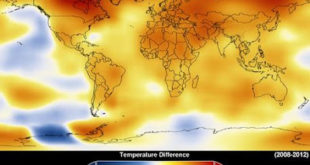

The Omicron variant may be less fatal than the earlier versions, but it is disrupting economies. The surge in the Delta variant well into Q4 in the US and Europe was already slowing the recoveries. Investors will likely take the high-frequency real sector data with the proverbial pinch of salt until January data available beginning later this month. While the tribalist approach, exemplified by “team transition” and “team permanent” debates about inflation, the...

Read More »FX Daily, December 6: Semblance of Stability Returns though Geopolitical Tensions Rise

Swiss Franc The Euro has risen by 0.26% to 1.041 EUR/CHF and USD/CHF, December 6(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The absence of negative developments surrounding Omicron over the weekend appears to be helping markets stabilize today after the dramatic moves at the end of last week. Asia Pacific equities traded heavily, and among the large markets, only South Korea and Australia escaped unscathed...

Read More »Big Week Begins Slowly

Overview: The global capital markets give little indication of the important economic and earnings data that lie ahead this week. There is an eerie calm. Equities in Asia were mixed. Japan and Hong Kong, and most small bourses were lower. Last week, the MSCI Asia Pacific Index gained almost 0.9%. Europe's Stoxx 600 is little changed after rising about 0.5% last week. US futures are firm. The S&P 500 and Dow Jones Industrials reached record-highs before the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org