Summary: Euro fell to new 20-month lows before steadying. The dollar extended its recovery against the yen. Emerging markets remained under pressure, and Turkey’s central bank surprised with a 50 bp hike in the repo rate. While US markets were closed for the celebration of Thanksgiving, the underlying trends remained intact. Here is a summary of several developments. The euro edged to a new low, a little below...

Read More »Emerging Markets: Week Ahead Preview

Summary EM FX ended the week on a soft note, as higher US rates continue to take a toll. EM policymakers are getting more concerned about currency weakness, with Brazil, Malaysia, Korea, India, and Indonesia all taking action to help support their currencies. If the EM sell-off continues as we expect, more EM central banks are likely to act to slow the moves. Several EM central banks (Hungary, Malaysia, South Africa,...

Read More »Emerging Markets: What has Changed

Summary Malaysia appears to have enacted a subtle change in FX policy. Turkey cut foreign currency reserve requirements in an effort to increase the supply of foreign exchange. Brazil’s central bank suspended the sale of reverse currency swaps and started selling new regular swaps (equivalent to selling USD). Colombia reached a new peace agreement with FARC rebels. Mexico’s central bank hiked cash rates by 50...

Read More »Are Emerging Markets Still “A Thing”?

By Chris at www.CapitalistExploits.at Last week I jumped on a call with an old friend Thomas Hugger who I hadn’t spoken with in months. I recorded the call for your enjoyment but first a quick bit of background to Thomas. Thomas is a Swiss fund manager living and working in Asian frontier markets such as Vietnam, Bangladesh, and Cambodia, which is a bit like taking a Rolls Royce through the Gobi desert if you think...

Read More »Toward a New World Order?

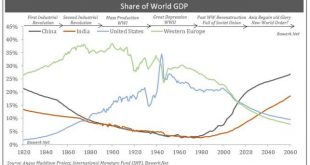

Share of World GDP A Brave New World is coming? Perhaps. We had a recent discussion with a group of people in the hopeless business of doing long term forecasting. This made us think about what the world will look like over the next 20 to 40 years. A pretty thankless task, but the bottom line is without a damn good war, Asia will be the way of the future. As an experiment, assume, as most long term forecasters do,...

Read More »China Update

Introduction by George Dorgan My articles About meMy booksFollow on:TwitterFacebookGoogle +YoutubeSeeking AlphaCFA SocietyLinkedINEconomicBlogs Summary: The evolving political situation in China is worth monitoring. China’s trade surplus with the US has fallen this year. It has been roughly 20 years since China was formally labeled a currency manipulator. Trump has indicated he would do so. There have...

Read More »Emerging Markets: Week Ahead Preview

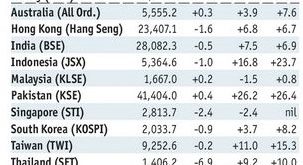

Stock Markets EM should trade firmer this week on news over the weekend that the FBI said its conclusion on Clinton’s emails remained unchanged. That should lift the cloud of suspicion that grew when the FBI said new emails had been uncovered. With risk appetite likely to rebound a bit, the Mexican peso should benefit the most as the week gets under way. The central banks of Korea, the Philippines, Thailand,...

Read More »Emerging Market: Week Ahead Preview

Stock Markets EM ended the week on a soft note, as markets were taken off guard by news that the FBI was reopening its investigation of Hillary Clinton’s emails. Risk off trading hit MXN particularly hard. FOMC meeting this week should be a non-event, but markets are likely to remain volatile ahead of the November 8 elections in the US. Individual country risk remains important. Brazil budget data is likely to provide...

Read More »Emerging Markets: What has Changed

Summary Chinese President Xi has strengthened his grip on power. Mozambique said it is in “debt distress” and hired advisors for a debt restructuring. South Africa revised its macro forecasts in the Finance Ministry’s Medium-Term Budget Program. Chile’s ruling center-left coalition lost municipal elections. Stock Markets In the EM equity space as measured by MSCI, Poland (+3.2%), Chile (+3.1%), and Hungary...

Read More »Emerging Markets: Week Ahead Preview

Stock Markets EM FX gained a little traction on Friday, but capped a week of steady losses. As the US election and FOMC meeting next month get closer, we believe markets and risk appetite will remain volatile. So far, September data from the US does not suggest any urgency to hike in November, and so we continue to believe that December is most likely for another hike. Looking at individual countries, South Africa...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org