Overview: Yesterday’s retreat in US indices was part of and helped further this bout of profit-taking. The MSCI Asia Pacific Index ended an eight-day advance yesterday and fell further today. Japanese indices, which had set multiyear highs, fell for the first time in nine sessions. Hong Kong led the regional slide with a 2.3% decline as China’s crackdown on the gaming industry continued. Some companies in this space were reportedly to enforce the limits on minors,...

Read More »The Greenback Continues to Claw Back Recent Losses

Overview: The US dollar continues to pare its recent losses and is firm against most major currencies in what has the feel of a risk-off day. The other funding currencies, yen and Swiss franc, are steady, while the euro is heavy but holding up better than the Scandis and dollar-bloc currencies. Emerging market currencies are also lower, and the JP Morgan EM FX index is off for the third consecutive session. The Chinese yuan’s insignificant gain of less than...

Read More »FX Daily, July 22: Enguard Lagarde

Swiss Franc The Euro has risen by 0.08% to 1.0828 EUR/CHF and USD/CHF, July 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The rally in US shares yesterday, ostensibly fueled by strong earnings reports, is helping to encourage risk appetites today. The MSCI Asia Pacific Index is posting its biggest gain in around two weeks, though Japan’s markets are closed today and tomorrow. The Dow Jones Stoxx 600 is...

Read More »Inching Closer To Another Warning, This One From Japan

Central bankers nearly everywhere have succumbed to recovery fever. This has been a common occurrence among their cohort ever since the earliest days of the crisis; the first one. Many of them, or their predecessors, since this standard of fantasyland has gone on for so long, had caught the malady as early as 2007 and 2008 when the world was only falling apart. The disease is just that potent; delirium the chief symptom, especially among the virus’ central banker...

Read More »FX Daily, July 16: BOJ Tweaks Forecasts

Swiss Franc The Euro has risen by 0.10% to 1.085 EUR/CHF and USD/CHF, July 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The markets head into the weekend with little fanfare. Most large equity markets in the Asia Pacific region slipped earlier today. Hong Kong, which will be exempt from the need to secure mainland’s cybersecurity approval for foreign IPOs, and Australia were notable exceptions. European...

Read More »War on Cash: EU steps up the fight

by Claudio Grass, Hünenberg See, Switzerland The prolonged and repeated lockdowns, business closures and travel bans have caused widespread economic devastation and changed the way all of us live, work and interact with each other. These were the most obvious changes that the covid crisis brought with it, however, a lot more has been unfolding in the background. Governments in most advanced economies have grasped the opportunity of this crisis and all the fear and uncertainty that...

Read More »FX Daily, July 12: Markets Adrift ahead of Key Events

Swiss Franc The Euro has risen by 0.04% to 1.0849 EUR/CHF and USD/CHF, July 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The new week has begun quietly. The dollar is drifting a little higher against most major currencies, with the Scandis and dollar-bloc currencies the heaviest. The yen and Swiss franc’s resilience seen last week is carrying over. Most liquid and freely accessible emerging market...

Read More »Measuring Inflation and the Week Ahead

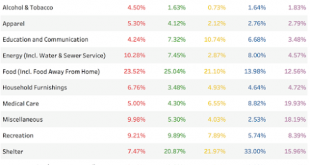

There is quite an unusual price context for new week’s economic events, which include June US CPI, retail sales, and industrial production, along with China’s Q2 GDP, and the meetings for the Reserve Bank of New Zealand, the Bank of Canada, and the Bank of Japan. In addition, the US Treasury will sell $120 bln in coupons while the US earned income tax credit and the child tax credit is rolled out. The dollar surged even while interest rates fell. The US 10-year yield...

Read More »FX Daily, June 10: ECB Meeting and US CPI: Transitory Impact

Swiss Franc The Euro has fallen by 0.06% to 1.09 EUR/CHF and USD/CHF, June 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The ECB meeting and the US May CPI report is at hand. The US dollar is consolidating at a higher level against most of the major currencies. Softer than expected, inflation readings are weighing on the Scandis, which are bearing the brunt. The US 10-year yield closed below 1.50% for...

Read More »FX Daily, May 28: The Yuan Extends Gains, While Sterling’s First Close above $1.42 in Three Years Goes for Nought

Swiss Franc The Euro has risen by 0.15% to 1.0948 EUR/CHF and USD/CHF, May 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The recovery of the US 10-year yield, so it is flat on the week near 1.61% coupled with month-end demand, is helping the US dollar firm. While the yen is bearing the burden on the week, with a 0.8% loss, the Antipodeans are leading the downside on the day. Although the New Zealand...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org