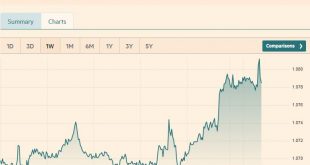

Headlines Week March 13, 2017 We were arguing in the last weeks, that the EUR/CHF is trending towards parity. There are three reasons: Continuing SNB interventions Strengthening Swiss local demand, as also visible in the GDP release. Speculators increase their dollar shorts against Euro and reduce them against CHF. Point 3 was not fulfilled last week. FX Last week: The EUR/CHF suddenly appreciated with the ECB meeting...

Read More »Weekly Sight Deposits and Speculative Positions: Each week an intervention record.

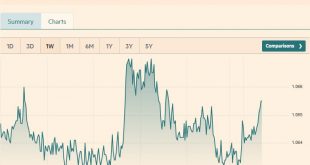

Headlines Week March 06, 2017 We were arguing in the last weeks, that the EUR/CHF is trending towards parity. There are three reasons: Continuing SNB interventions Strengthening Swiss local demand, as also visible in the GDP release. Speculators increase their dollar shorts against Euro and reduce them against CHF. Point 3 was not fulfilled last week. FX Last week:The EUR/CHF remained around 1.0650, the level where the...

Read More »Each Week the Same: Another SNB Intervention Record

Headlines Week February 27, 2017 We were arguing in the last weeks, that the EUR/CHF is trending towards parity. There are three reasons: Continuing SNB interventions Strengthening Swiss local demand Speculators increase their dollar shorts against Euro and reduce them against CHF. FX week until February 27 The EUR/CHF fell to new lows. The average rate in the week was 1.0648. The SNB is apparently ready to let the...

Read More »Weekly Sight Deposits and Speculative Positions: Once again a new SNB intervention record

Headlines Week February 20, 2017 Recently inflation rose more quickly in the euro zone, but this was mostly caused by a temporary oil price effect. Therefore the ECB might be dovish for a longer period than the SNB. Consumer price inflation will decide who is more dovish. Ultimately inflation will depend on the two key parameters wages and rents. Rents will rise first in Switzerland, while the Euro zone has downwards...

Read More »Weekly Sight Deposits and Speculative Positions: Another Post-Trump SNB Intervention Record

Headlines Week February 13, 2017 Recently inflation rose more quickly in the euro zone, but this was mostly caused by a temporary oil price effect. Therefore the ECB might be dovish for a longer period than the SNB. Consumer price inflation will decide who is more dovish. Ultimately inflation will depend on the two key parameters wages and rents. Rents will rise first in Switzerland, while the Euro zone has downwards...

Read More »Weekly Sight Deposits and Speculative Positions: SNB Intervenes for 2.4 bn CHF, while Speculators increase CHF Shorts

Headlines Week February 06, 2017 Recently inflation rose more quickly in the euro zone, but this was mostly caused by a temporary oil price effect. Therefore the ECB might be dovish for a longer period than the SNB. Consumer price inflation will decide who is more dovish. Ultimately inflation will depend on the two key parameters wages and rents. Rents will rise first in Switzerland, while the Euro zone has downwards...

Read More »Weekly Sight Deposits and Speculative Positions: Strong Swiss Trade Balance: SNB allows EUR/CHF to 1.0680

Headlines Week January 30, 2017 Recently inflation rose more quickly in the euro zone, but this was mostly caused by a temporary oil price effect. Therefore the ECB might be dovish for a longer period than the SNB. Consumer price inflation will decide who is more dovish. Ultimately inflation will depend on the two key parameters wages and rents. Rents will rise first in Switzerland, while the Euro zone has downwards...

Read More »Weekly Sight Deposits and Speculative Positions: Weaker dollar let SNB accumulates losses

Headlines Week January 23, 2017 Who has read Milton Friedman knows that the Trump reflation trade is now showing its positive side. US wages are rising by 2.5%, while inflation is still relatively low. According to Friedman, inflation will increase only later. This implies that speculators are long the dollar and short the Swiss franc and the euro during the weak inflation period. The last ECB meeting showed that the...

Read More »Weekly Sight Deposits and Speculative Positions: Stronger SNB interventions at more expensive EUR

Headlines Week January 13, 2017 Who has read Milton Friedman knows that the Trump reflation trade is now showing its positive side. US wages are rising by 2.5%, while inflation is still relatively low. According to Friedman, inflation will increase only later. This implies that speculators are long the dollar and short the Swiss franc and the euro during the weak inflation period. The last ECB meeting showed that the...

Read More »Weekly Sight Deposits and Speculative Positions: SNB Intervenes, Speculators Short CHF again

Headlines Week January 09, 2017 Who has read Milton Friedman knows that the Trump reflation trade is now showing its positive side. US wages are rising by 2.5%, while inflation is still relatively low. According to Friedman, inflation will increase only later. This implies that speculators are long the dollar and short the Swiss franc and the euro during the weak inflation period. The last ECB meeting showed that the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org