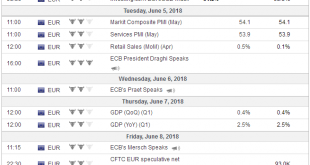

The consensus narrative is that with rising inflation it is understandable that next week’s meeting is live and that the confirmation of such has lifted the euro to ten-day highs, dragging the dollar broadly. However, to accept this is to accept the debasement of language. Until now, we dubbed central bank meeting that could result in action as “live.” For example, given that the Fed has not changed interest rates since...

Read More »FX Weekly Preview: Macro Matters Now, Just Not the Data

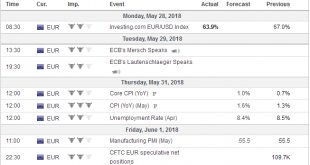

The main concerns of investors do not arise from the high-frequency data that are due in the coming days. Last week, the somewhat firmer than expected preliminary May CPI for the EMU failed to bolster the euro. The stronger than expected US jobs data, even if tipped by the President of the United States, and the pendulum of market sentiment swinging back in favor of two more Fed rate hikes this year did not trigger new...

Read More »FX Daily, June 01: Ironic Twists to End the Tumultuous Week

Swiss Franc The Euro has risen by 0.30% to 1.1558 CHF. EUR/CHF and USD/CHF, June 01(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The week is ending quite a bit different than it began. The main banking concern is not in Italy but in German, where shares in Deutsche Bank shares fell to a record low yesterday, and S&P Global cut its credit rating one step to BBB+...

Read More »FX Weekly Preview: Political Crises in Europe Rivals Economic Data and Trade to Drive Capital Markets

The end of the Greek assistance program that allowed them to keep their primarily official creditors whole, and the broad expansion in the eurozone, was supposed to usher in a new period of convergence. Monetary union was once again feted as a success, and some observers were forecasting a substantial increase in the euro as a reserve asset. Instead, the economy lost momentum, core inflation returned to its trough,...

Read More »FX Weekly Preview: Fed Can Look Through the Data Easier than the ECB and BOJ

Geopolitical issues will continue to bubble below the surface for the capital markets. The fallout from the reimposition of US sanctions on Iran has apparently helped lift oil prices in the face of the rising dollar, which often acts as a drag. In the coming days, the US will take the symbolic step of moving its embassy to Jerusalem. The conflict between Israel and Iranian forces in Syria is escalating. Meanwhile, US...

Read More »FX Daily, May 04: US Jobs-Not the Driver it Once Was

The US dollar fell last month in response to the disappointing non-farm payroll report. However, in general, the jobs report is not the market mover that it was in the past. With unemployment is at cyclical lows of 4.1% and poised to fall further. Weekly jobless claims and continuing claims at or near lows in a generation, though over qualification is more difficult than previously. The monthly net job creation is a...

Read More »FX Daily, May 02: Confident Fed Key to New Found Respect for the Dollar

Swiss Franc The Euro has fallen by 0.03% to 1.1944 CHF. EUR/CHF and USD/CHF, May 02(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates There is a brief respite in the powerful short squeeze that has fueled the dollar’s dramatic recovery. The greenback which was nearly friendless a month ago now has many suitors. It is higher on the year against all the major currencies but...

Read More »FX Daily, April 26: Euro Remains Soft Ahead of Draghi

Swiss Franc The Euro has risen by 0.03% to 1.1957 CHF. EUR/CHF and USD/CHF, April 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The euro made a marginal new low early in European turnover and held barely above the spike low on March 1 to $1.2155. So far, today is the first session since January 11 that the euro has not traded above $1.22. The euro stabilized as the...

Read More »FX Daily, April 25: Dollar Regains Luster, but Consolidation Likely Ahead of Key Events and Data

Swiss Franc The Euro has risen by 0.12% to 1.1984 CHF. EUR/CHF and USD/CHF, April 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge GBP/CHF The Swiss Franc has been weakening recently as global investors appear to be moving away from the safe haven of the Swiss banking system. The US Federal Reserve have continued to increase interest rates during last year and have already...

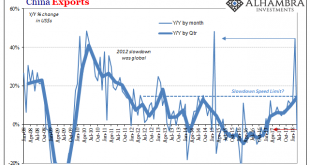

Read More »China’s Exports Are Interesting, But It’s Their Imports Where Reflation Lives or Dies

Last month Chinese trade statistics left us with several key questions. Export growth was a clear outlier, with outbound trade rising nearly 45% year-over-year in February 2018. There were the usual Golden Week distortions to consider, made more disruptive by the timing of it this year as different from last year. And then we have to consider possible effects of tariffs and restrictions at the start of what is called a...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org