The strategic objective is to integrate China into the world economy. The liberal international solution was trade, investment flows, and cultural exchanges. The rise of nationalism and China’s own willingness to flaunt the international rules are defeating the strategy. President Trump may suggest that China would prefer to negotiate with his main Democrat rival 18-months away from the election, by both Pelosi and...

Read More »FX Daily, May 17: China Questions US Sincerity

Swiss Franc The Euro has risen by 0.04% at 1.1285 EUR/CHF and USD/CHF, May 17(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Since the presidential tweets on May 3, the US had the initiative in the negotiations with China, but today, China has pushed back. It is cool to the idea promoted by the US that trade talks will resume shortly. Now it may take the...

Read More »FX Daily, May 15: Angst Continues

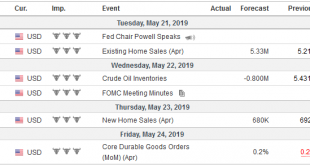

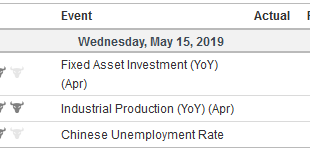

Swiss Franc The Euro has fallen by 0.28% at 1.1273 EUR/CHF and USD/CHF, May 15(see more posts on EUR/CHF, USD/CHF, ) Source: merkets.ft.com - Click to enlarge FX Rates Overview: Disappointing Chinese April data spurred speculation that more stimulus will be forthcoming and bolsters hopes that a trade deal with the US by the end of next month helped Asian Pacific equities advance for the first time this week....

Read More »Why China Finds it Difficult to Weaponize the Yuan and US Treasuries

It looks so easy on paper. China can sell its holding of US Treasuries and/or weaken the yuan to offset the tariffs and boost exports. It is the first and easy answers from strategists, journalists, and some academics. Often times, it is presented a novel idea; as if diplomats, investors, and policymakers have not thought it. The point is not that China cannot sell its Treasury holding or that it cannot devalue the...

Read More »FX Daily, May 14: Too Weak to Muster Much of a Turnaround Tuesday, Markets See Small Reprieve

Swiss Franc The Euro has risen by 0.09% at 1.1304 EUR/CHF and USD/CHF, May 14(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: President Trump’s willingness to meet China’s Xi at the G20 meeting at the end of next month and his “feeling” that an agreement will still be found seemed sufficient to break the momentum that had swept through the capital market....

Read More »FX Daily, May 13: Investors Still Looking for New Balance

Swiss Franc The Euro has fallen by 0.53% at 1.131 EUR/CHF and USD/CHF, May 13(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The end of the tariff truce between the US and China has discombobulated investors. They had been repeatedly that a deal was close and there had even been talk at the US Treasury about where Trump and Xi should meet to sign the...

Read More »FX Weekly Preview: Trade, the Dollar, and the Week Ahead

China is isolated on trade. No one supports its trade practices. The idea that China was going to “naturally” evolve to be more like the US, or Europe for that matter, was always fanciful and naive. The emergence of China, as Napoleon warned two centuries ago, would make the world shake. US administrations adopted a multi-prong strategy of managing the rise of China. On economic issues, the focus was on working through...

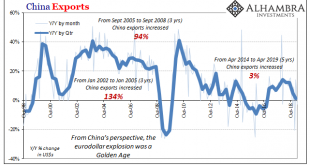

Read More »China’s Export Story Is Everyone’s Economic Base Case

The first time the global economy was all set to boom, officials were at least more cautious. Chastened by years of setbacks and false dawns, in early 2014 they were encouraged nonetheless. The US was on the precipice of a boom (the first time), it was said, and though Europe was struggling it was positive with a more aggressive ECB emerging. Even Japan was looking forward to a substantial QQE-based pickup – after the...

Read More »FX Daily, May 08: Markets Trying to Stabilize

Swiss Franc The Euro has fallen by 0.06% at 1.14 EUR/CHF and USD/CHF, May 08(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: It is taking investors a bit more than two sessions to find its footing after being the unexpected end of the tariff truce between the US and China struck last December. Asia Pacific equities tumbled after the S&P 500 shed nearly 1.7%...

Read More »FX Daily, May 06: Trump’s Tariff Tweets Help Investors Discover Volatility

Swiss Franc The Euro has risen by 0.04% at 1.1399 EUR/CHF and USD/CHF, May 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Reports that a US-China deal could be struck by May 10 before the weekend left investors ill-prepared for the presidential tweets yesterday that announced that the US was ending the tariff truce. Trump indicated that the 10% tariff on $200...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org