Overview: Broadly speaking, the dollar's recent pullback was extended today but the momentum appears to be slowing, perhaps ahead of tomorrow's US CPI report. The Dollar Index slipped to its lowest level since September 25 before steadying. The greenback is mixed as the North American market is set to open. The dollar bloc and Swedish krona are the underperformers. The Swiss franc is the best, up about 0.2%, while the yen and euro are little changed. Most emerging...

Read More »War in Israel Spurs Flight to Dollars, Yen and Gold, While Driving up the Price of Oil

Overview: There are three main developments. First, the market is digesting the implication of the US employment data, where the optics were strong (336k increase in nonfarm payrolls compared with 170k median forecast in Bloomberg and Dow Jones surveys) but some details were disappointing (like the third consecutive decline in full-time posts, seasonally adjusted). Second, Chinese mainland market re-opened after a six-day holiday). Chinese stocks slipped and...

Read More »US Yields and Dollar Rise After US Government Closure Averted

Overview: The US avoided a government shutdown, barely, and this eased one of the headwinds that were anticipated. In turn, this is spurring new gains in US interest rates and helping underpin the dollar at the start of the new quarter. The 10-year Treasury is holding above 4.60% and nearing last week's high (4.68%). The two-year yield gapped higher and is near 5.10%. The high from September 21 was almost 5.20%. The Swiss franc is the only G10 currency holding its...

Read More »Dollar Sets Back into Month- and Quarter-End Ahead of likely US Government Shutdown

Overview: The dollar's surge stalled yesterday, and follow-through selling has pressed it lower against all the G10 currencies today. The dollar-bloc and Scandis are leading the move. Month-end, quarter-end pressures, coupled with a likely partial shutdown of the government beginning Monday, and after key chart levels were approached or violated earlier this week, serving as a bit a cathartic event. The Swiss franc snapped a 12-day losing streak yesterday, its...

Read More »Firmer Bonds and Stocks, but the Dollar Presses Ahead

Overview: The S&P 500 hit three-month lows yesterday, while the Conference Board's measure of consumer confidence fell to a four-month low. New home sales fell to their lowest level in five years. The US federal government appears headed for a partial shutdown on October 1. Still, the greenback rides high. It is extending its gains against several G10 currencies, including the euro and sterling. The Swiss franc is moving lower for the 12th consecutive session....

Read More »In Uncoordinated Steps, Japan and China Help Slow Greenback’s Rally

Overview: The Bank of Japan Governor Ueda hinted the world's third-largest economy may exit negative interest rates before the end of the year. This sparked the strongest gain in the yen in a couple of months and lifted the 10-year yield to nearly 0.70%. In an uncoordinated fashion, Chinese officials stepped their rhetoric and indicated that corporate orders to sell $50 mln or more will need authorization. This helped arrest the yuan's slide. The Australian dollar...

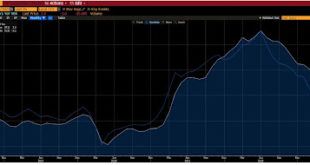

Read More »Yuan Sulks in to the Weekend, While Finishing Touches are Put on the Dollar Index’s Eighth Consecutive Weekly Gain

Overview: The greenback is lower against most currencies today as it consolidates ahead of the weekend. The Dollar Index's eight-week advance is the longest since a 12-week rally 2014. The Chinese yuan is an exception. Its losses were extended today. Against the offshore yuan, the dollar traded above the onshore band, which is most often respected. Equities ae extending this week's slump. All the large bourses in the Asia Pacific region but India fell. Europe's...

Read More »US Dollar Punches Higher

Overview: Disappointing data in Asia and Europe has sent the greenback broadly higher. The strong gains posted before the weekend were mostly consolidated yesterday when the US and Canadian markets were on holiday. The rally resumed today. The Antipodeans and Scandis have been hit the hardest (-0.7% to -1.25%) but all the G10 currencies are down. The Swiss franc and yen are off the least (-0.35%-0.45%), and the euro and sterling have taken out their recent lows....

Read More »China’s Measures Begin to Find Traction, US Employment Report on Tap

Overview: Beijing's seemingly steady stream of measures to support the economy and steady the yuan are beginning to produce the desired effect. The yuan is snapping a four-week decline and the CSI 300 halted a three-week drop. Some economists estimate that the bevy of measures may be worth as much as 1% for GDP. The dollar is narrowly mixed ahead of the US employment data, which is expected to see the pace of job growth slow to around 170k. Of note, the Mexican peso...

Read More »The Greenback is Softer Ahead of CPI but Key Chart Points Remain Intact

Overview: The deluge of Treasury supply is nearly over for this week. On tap today are 4- and 8-week T-bills and $23 bln 30-year bonds to finish the quarterly refunding. The sales will come after the July CPI print that is expected to see the first year-over-year increase since last June. The market is going into the report with about a 15% chance of a Fed hike next month discounted. Meanwhile, September crude oil extended its recover from $80 seen on Tuesday to a...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org