In another excellent post on Moneyness, J P Koning likens the monetary system to the plot in the movie Inception, featuring a dream piled on a dream piled on a dream piled on a dream. Koning explains that [l]ike Inception, our monetary system is a layer upon a layer upon a layer. Anyone who withdraws cash at an ATM is ‘kicking’ back into the underlying central bank layer from the banking layer; depositing cash is like sedating oneself back into the overlying banking layer. Monetary...

Read More »Money without a Government

In the FT, David Pilling reports about Somalia which has managed without central bank issued money for decades. … up to 98 per cent of local banknotes are fake … With the help of the International Monetary Fund, Mogadishu plans to print official banknotes for the first time in more than a quarter of a century … No official Somali currency has left the presses since the Horn of Africa nation descended into clan warfare after the collapse of the government in 1991. … warlords, businessmen...

Read More »Video: The Swiss National Bank Is Acting Like A Hedge Fund

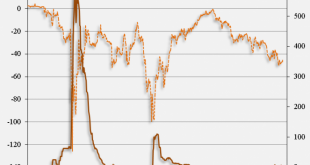

By EconMatters In this Video, we discuss the fact that Central Banks have basically morphed into Hedge Funds with similar risky investing strategies, except they buy without any regard to the underlying fundamentals of the assets they are buying. When did the Swiss Citizens say it was the proper role for the Swiss National Bank to be buying US Stocks? How is this stimulating the Swiss Economy? Central Banks have really...

Read More »What Will Trump Do About The Central-Bank Cartel?

Submitted by Thorstein Polleit via The Mises Institute, The US is by far the biggest economy in the world. Its financial markets — be it equity, bonds or derivatives markets — are the largest and most liquid. The Greenback is the most important transaction currency. Many currencies in the world — be it the euro, the Chinese renminbi, the British pound or the Swiss franc — have actually been built upon the US dollar. The...

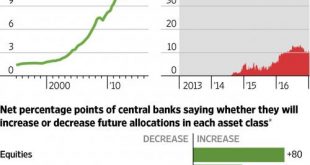

Read More »80 percent Of Central Banks Plan To Buy More Stocks

Regular readers remember how, when we first reported around the time of our launch eight years ago that central banks buy stocks, intervene and prop up markets, and generally manipulate equities in order to maintain confidence in a collapsing system, and avoid a liquidation panic and bank runs, it was branded “fake news” by the established financial “kommentariat.” What a difference eight years makes, because today none...

Read More »The Bank of England and its Contemporaries

In the Journal of Economic Literature, William Roberds reviews Christine Desan’s “Making Money: Coin, Currency, and the Coming of Capitalism” and he provides his own perspective on European monetary history. … the transition of the Bank of England’s notes from the status of experimental debt securities (in 1694) to “as good as gold” (1833) required more than a century of legal accommodation and business comfort with their use. Desan emphasizes England’s traditions of nominalism (as...

Read More »“Kosten eines Vollgeld-Systems sind hoch (Costly Sovereign Money),” Die Volkswirtschaft, 2016

Die Volkswirtschaft 1–2 2017, December 21, 2016. HTML, PDF. Banning inside money creation would be unnecessary, insufficient, not enforceable, and besides the point. The way forward is to grant everyone access to central bank reserves and let investors choose between reserves and deposits.

Read More »“Kosten eines Vollgeld-Systems sind hoch (Costly Sovereign Money),” Die Volkswirtschaft, 2016

Kosten eines Vollgeld-Systems sind hoch Eine Umsetzung der Vollgeld-Initiative würde grossen Schaden anrichten und dürfte im Ergebnis selbst die Initianten enttäuschen. Verbesserungen verspricht dagegen eine «sanfte» Reform: die Einführung von elektronischem SNB-Geld für alle. Der Präsident des Vereins Monetäre Modernisierung Hansruedi Weber (Mitte) und zwei verkleidete Aktivisten reichen im Dezember 2015 bei der...

Read More »Kosten eines Vollgeld-Systems sind hoch (Costly Sovereign Money)

Kosten eines Vollgeld-Systems sind hoch Eine Umsetzung der Vollgeld-Initiative würde grossen Schaden anrichten und dürfte im Ergebnis selbst die Initianten enttäuschen. Verbesserungen verspricht dagegen eine «sanfte» Reform: die Einführung von elektronischem SNB-Geld für alle. Der Präsident des Vereins Monetäre Modernisierung Hansruedi Weber (Mitte) und zwei verkleidete Aktivisten reichen im Dezember 2015 bei der...

Read More »How Problematic Is a Large Central Bank Balance Sheet?

On his blog, John Cochrane reports about a Hoover panel including him, Charles Plosser, and John Taylor. Cochrane focuses on the liability side. He favors a large quantity of (possibly interest bearing) reserves for financial stability reasons. Plosser focuses on the asset side and is worried about credit allocation by the Fed, for political economy reasons. Taylor favors a small balance sheet. Cochrane also talks about reserves for everyone, but issued by the Treasury.

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org