Count me among the bond vigilantes. On the issue of supply I yield (pun intended) to no one. The US government is the brokest entity humanity has ever conceived – and that was before March 2020. There will be a time, if nothing is done, where this will matter a great deal. That time isn’t today nor is it tomorrow or anytime soon because it’s the demand side which is so confusing and misdirected. Realizing this is true does not cancel your vigilantism. For two years...

Read More »There Was Never A Need To Translate ‘Weimar’ Into Japanese

After years of futility, he was sure of the answer. The Bank of Japan had spent the better part of the roaring nineties fighting against itself as much as the bubble which had burst at the outset of the decade. Letting fiscal authorities rule the day, Japan’s central bank had largely sat back introducing what it said was stimulus in the form of lower and lower rates. No, stupid, declared Milton Friedman. Lower rates don’t mean stimulus they mean monetary policy has...

Read More »Everyone Knows The Gov’t Wants A ‘Controlled’ Weimar

There are two parts behind the inflation mongering. The first, noted yesterday, is the Fed’s balance sheet, particularly its supposedly monetary remainder called bank reserves. The central bank is busy doing something, a whole bunch of something, therefore how can it possibly turn out to be anything other than inflationary? The answer: the Federal Reserve is not a central bank, not really. What it “prints” are, as Emil Kalinowski likes to call them, the equivalent...

Read More »(Almost) Everything Sold Off Today

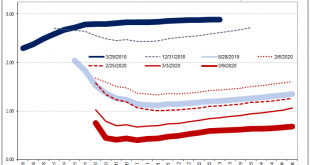

The eurodollar curve’s latest twist exposes what’s behind the long end. To recap: big down day in stocks which, for the first time in a while, wasn’t accompanied by massive buying in longer maturity UST’s. Instead, these were sold, too. Rumors of parity funds liquidating were all over the place, which is consistent with this curve behavior. Let’s start with eurodollar futures; the curve had absolutely collapsed up to Monday. It was remarkable even though not...

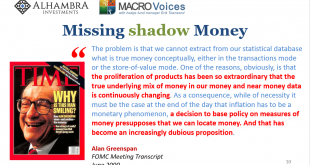

Read More »The Greenspan Moon Cult

Taking another look at what I wrote about repo and the latest developments yesterday, it may be worthwhile to spend some additional time on the “why” as it pertains to so much determined official blindness, an unshakeable devotion to otherwise easily explained lunar events. The short version: monetary authorities as well as the “experts” describe almost perfectly risk averse behavior among the central money dealing system in outbreaks like September’s repo – but...

Read More »Was It A Midpoint And Did We Already Pass Through It?

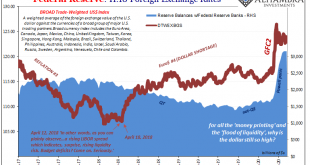

We certainly don’t have a crystal ball at the ready, and we can’t predict the future. The best we might hope is to entertain reasonable probabilities for it oftentimes derived from how we see the past. Which is just what statistics and econometrics attempt. Except, wherein they go wrong we don’t have to make their mistakes. For example, in the Fed’s main model ferbus there’s no way to input a global dollar shortage. Even if there was, to this statistical...

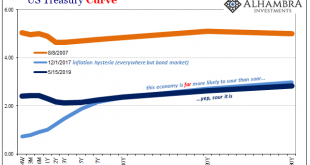

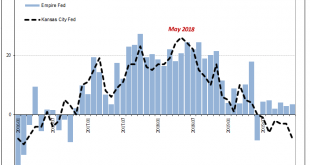

Read More »Manufacturing Clears Up Bond Yields

Yesterday, IHS Markit reported that the manufacturing turnaround its data has been suggesting stalled. After its flash manufacturing PMI had fallen below 50 several times during last summer (only to be revised to slightly above 50 every time the complete survey results were tabulated), beginning in September 2019 the index staged a rebound jumping first to 51.1 in that month. Subsequent months of data had continued the trend. By November, the PMI registered 52.6...

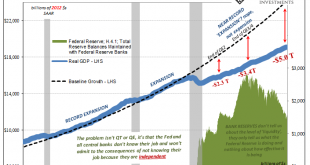

Read More »Three (Rate Cuts) And GDP, Where (How) Does It End?

The Federal Reserve has indicated that it will now pause – for a second time, supposedly. Remember the first: after raising its benchmark rates apparatus in December while still talking about an inflationary growth acceleration requiring even more hikes throughout 2019, in a matter of weeks that was transformed into a temporary suspension of them. Expecting the easy disappearance of “transitory” factors, that Fed pause was to be followed by the second half rebound...

Read More »Monthly Macro Monitor: Market Indicators Review

Is the recession scare over? Can we all come out from under our desks now? The market based economic indicators I follow have improved since my last update two months ago. The 10 year Treasury rate has moved 40 basis points off its low. Real interest rates have moved up as well but not quite as much. The difference is reflected in slightly higher inflation expectations. The yield curve has also steepened as the 10 year Treasury yield rose faster than the 2 year. This...

Read More »Not Buying The New Stimulus

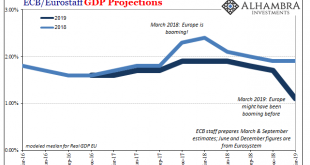

What just happened in Europe? The short answer is T-LTRO. The ECB is getting back to being “accommodative” again. This isn’t what was supposed to be happening at this point in time. Quite the contrary, Europe’s central bank had been expecting to end all its programs and begin normalizing interest rates. The reaction to this new round was immediately negative: The euro and euro zone government bond yields fell sharply...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org