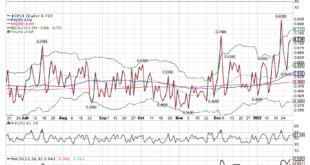

I’ll just get this out of the way right at the beginning. The question in the title of this post refers to the end of the ongoing stock market correction and the answer is likely no. There are no sure things in this business so it isn’t an unequivocal no, but based on history, the odds favor more weakness. I know a lot of people liked that rally into the close on Friday and it was a nice way to end a wild week but it also shows that traders/investors are all too...

Read More »Jim Grant: “Markets Trust Too Much In The Presence Of Central Banks”

James Grant, Wall Street expert and editor of the renowned investment newsletter «Grant’s Interest Rate Observer», warns of the unseen consequences of super low interest rate and questions the extraordinary actions of the Swiss National Bank. Nearly ten years after the financial crisis, extraordinary monetary policy has become the norm. The financial markets seem to like it: Stocks are close to record levels...

Read More »Jim Grant: “Markets Trust Too Much In The Presence Of Central Banks”

James Grant, Wall Street expert and editor of the renowned investment newsletter «Grant’s Interest Rate Observer», warns of the unseen consequences of super low interest rate and questions the extraordinary actions of the Swiss National Bank. Nearly ten years after the financial crisis, extraordinary monetary policy has become the norm. The financial markets seem to like it: Stocks are close to record levels...

Read More »Jim Grant: “Markets Trust Too Much In The Presence Of Central Banks”

Authored by Christoph Gisiger via Finanz und Wirtschaft, James Grant, Wall Street expert and editor of the renowned investment newsletter «Grant’s Interest Rate Observer», warns of the unseen consequences of super low interest rate and questions the extraordinary actions of the Swiss National Bank. Nearly ten years after the financial crisis, extraordinary monetary policy has become the norm. The financial markets seem to like it: Stocks are close to record levels and...

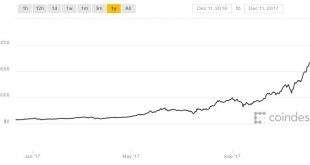

Read More »Bitcoin – Plan Your Exit Strategy Now – Maybe With Gold

Bitcoin - Plan Your Exit Strategy Now - Maybe With Gold Made money in bitcoin? Well done. Don’t wait until the stampede starts. Here’s what you must do now. by Dominic Frisby in Money Week So there I was on Sunday afternoon, doing what it is one does on a Sunday – very little in my case – and a notification comes up on my phone: “Bitcoin rises over 10% to $11,800”. Bitcoin in USD (1 Year). Source: CoinDesk On a Sunday. When every other market is closed. It’s bad enough that bitcoin is making...

Read More »A Look Inside The Secret Swiss Bunker Where The Ultra Rich Hide Their Bitcoins

Somewhere in the mountains near Switzerland’s Lake Lucerne lies a hidden underground vault containing a vast fortune. It’s no ordinary vault, according to Quartz. Built inside a decommissioned Swiss military bunker dug into a granite mountain, it’s precise location is a closely guarded secret, and access is limited by myriad security precautions. But instead of gold bars, the bunker contains hard drives on which...

Read More »Jim Grant Puzzled by the actions of the SNB

Retaken from Christoph Gisiger via Finanz und Wirtschaft, James Grant, Wall Street expert and editor of the investment newsletter «Grant’s Interest Rate Observer», warns of a crash in sovereign debt, is puzzled over the actions of the Swiss National Bank and bets on gold. From multi-billion bond buying programs to negative interest rates and probably soon helicopter money: Around the globe, central bankers are...

Read More »The Great Physical Gold Supply & Demand Illusion

Submitted by Koos Jansen from Bullionstar.com Gold supply and demand data published by all primary consultancy firms is incomplete and misleading. The data falsely presents gold to be more of a commodity than a currency, having caused deep misconceptions with respect to the metal’s trading characteristics and price formation. Numerous consultancy firms around the world, for example Thomson Reuters GFMS, Metals Focus,...

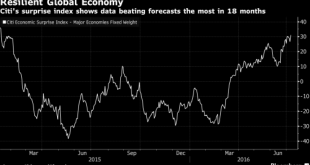

Read More »US Futures Rebound, European Stocks Higher As Oil Rises

The summer doldrums continue with another listless overnight session, not helpd by Japan markets which are closed for holiday, as Asian stocks fell fractionally, while European stocks rebounded as oil trimmed losses after the the IEA said pent-up demand would absorb record crude output (something they have said every single month). S&P futures have wiped out almost all of yesterday's losses and were up over 0.2% in early trading. Europe's Stoxx 600 rose 0.4% with miners and energy...

Read More »S&P 500 To Open At All Time Highs After Japan Soars, Yen Plunges On JPY10 Trillion Stimulus

Last Thursday, when we reported that Ben Bernanke was to "secretly" meet with Kuroda and Abe this week (he is said to have already met with Japan's central bank head earlier today), we said that "something big was coming" out of Japan which had "helicopter money" on the agenda. And sure enough, after a dramatic victory for Abe in Japan's upper house elections which gave his party an even greater majority, Abe announced the first hints of helicopter money when Nikkei reported, and Abe...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org