[unable to retrieve full-text content]As momentum builds in the developing deflationary spiral, we are seeing increasingly desperate measures to keep the global credit ponzi scheme from its inevitable conclusion. Credit bubbles are dynamic — they must grow continually or implode — hence they require ever more money to be lent into existence.

Read More »Spectacular Chinese Gold Demand Fully Denied By GFMS And Mainstream Media

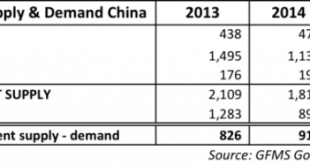

Submitted by Koos Jansen of BullionStar In the Gold Survey 2016 report by GFMS that covers the global gold market for calendar year 2015 Chinese gold consumption was assessed at 867 tonnes. As Chinese wholesale demand, measured by withdrawals from Shanghai Gold Exchange designated vaults, accounted for 2,596 tonnes in 2015 the difference reached an extraordinary peak for the year. In an attempt to explain the 1,729...

Read More »Best Countries To Store Gold (How Did America, A Serial Defaulter, Make The Cut?)

Submitted by Peter Diekmeyer via SprottMoney.com, An era of slowing growth, falling corporate profits, record debt levels, and currency debauchment has many investors buying gold as a bet against global central banks. Holding that gold outside the banking system, and for some, outside one’s own country, are increasingly popular options. Canada, Switzerland, and four other countries have particularly attractive...

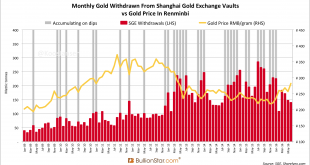

Read More »Chinese Gold Demand 973 tonnes in H1 2016, Nomura SGE Withdrawals Chart False

Chinese wholesale gold demand, as measured by withdrawals from the vaults of the Shanghai Gold Exchange (SGE), reached a sizable 973 metric tonnes in the first half of 2016, down 7 % compared to last year. Although Chinese gold demand year to date at 973 tonnes is slightly down from its record year in 2015 – when China in total net imported over 1,550 tonnes and an astonishing 2,596 tonnes were withdrawn from SGE...

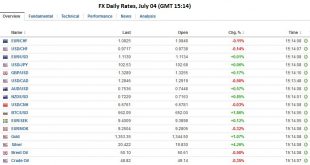

Read More »FX Daily, July 04: Four Things that Happened on the Anniversary of the Original Brexit

Summary Inflation expectations fall in Japan. UK construction PMI fell sharply before Brexit. The Australian dollar recovers from the dip as investors await more results. It is not clear that Brexit has sparked a wave of nationalism or anti-EU sentiment. FX Rates Monday, while Americans were celebrating the original Brexit, the US dollar drifted lower. The Australian dollar fully recovered from electoral...

Read More »FX Daily, July 01: Markets Head Quietly into the Weekend

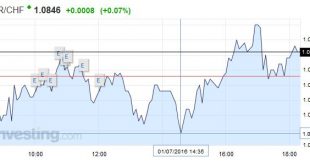

EUR/CHF stronger in Brexit week The EUR/CHF finished the week after Brexit with slight improvement of 0.18% (see the FX performance table below). The scare mongering by the Swiss media was misplaced. The euro even recovered from a dip after BoE governor Carney’s comments on Thursday. We do not see strong SNB interventions at this elevated price level. We judged that the interventions happened below 1.08. Click to...

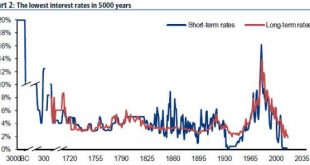

Read More »Visualizing “The 5000 Year Long Run” In 18 Stunning Charts

In the long run, as someone once said, we are all dead, but in the meantime, as BofAML’s Michael Hartnett provides a stunning tour de force of the last 5000 years illustrates long-run trends in the return, volatility, valuation & ownership of financial assets, interest rates & bond yields, economic growth, inflation & debt… The Longest Pictures reveals the astonishing history investors are living through...

Read More »Futures Flat, Gold Rises On Weaker Dollar As Traders Focus On OPEC, Payrolls

After yesterday's US and UK market holidays which resulted in a session of unchanged global stocks, US futures are largely where they left off Friday, up fractionally, and just under 2,100. Bonds fell as the Federal Reserve moves closer to raising interest rates amid signs inflation is picking up. Oil headed for its longest run of monthly gains in five years, while stocks declined in Europe. Treasuries retreated in the first full day of trading since Yellen said late Friday that the improving...

Read More »Global Stocks Slide, S&P Set To Open Red For The Year As Hawkish Fed Ignites “Risk Off”

After yesterday's algo-driven mad dash to close the S&P green both for the day and for the year following Fed minutes that came in shocking hawkish, the selling has continued overnight, led by the commodity complex as rate hike fears have pushed oil back down some 2% from yesterday's 7 month highs, which in turn has dragged global stocks lower to a six-week low, while pushing bond yields higher across developed nations as the market suddenly reprices the probability of a June/July rate...

Read More »State Of Fear – Corruption In High Places

Submitted by Pater Tenebrarum via Acting-Man.com, Mr. X and his Mysterious Benefactors As the Australian Broadcasting Corporation (ABC) reports, a money-laundering alarm was triggered at AmBank in Malaysia, a bank part-owned by one of Australia’s “big four” banks, ANZ. What had triggered the alarm? Money had poured into the personal account of one of the bank’s customers, a certain Mr. X, in truly staggering amounts. A recent photograph of Mr. X. Hundreds of millions of dollars were...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org