After two-quarters of contraction, many still do not accept that the US economy is in a recession. Federal Reserve officials have pushed against it, as has Treasury Secretary Yellen. The nearly 530k rise in July nonfarm rolls, more than twice the median forecast in Bloomberg's survey, and a new cyclical low in unemployment (3.5%) lent credibility to their arguments. If Q3 data point to a growing economy, additional support will likely be found. While the interest...

Read More »Downside Risks to the US Employment Report?

Overview: The US dollar enjoys a firmer bias against the major currencies ahead of the July employment data. Emerging market currencies are mixed. Asian currencies are generally firm while central Europe is a bit softer. Some detect a relaxation in tensions around Taiwan, though China’s aerial harassment continues. Taiwanese shares jumped 2.25% to lead the region that saw China’s CSI 300 rally over 1%. Europe’s Stoxx 600 is giving back yesterday’s 0.2% gain, even...

Read More »Over to the BOE

Overview: Strong gains in US equities yesterday and easing fears following Pelosi’s visit to Taiwan helped lift most Asia Pacific equities, with Hong Kong leading the way with a 2% rally. Taiwan, Australia, and India did not participate in the regional rally. The Stoxx 600 is edging higher today. It was flat on the week through yesterday. US futures are a little firmer. The greenback is offered against the major currencies led the Antipodeans. The Japanese yen...

Read More »Attention Turns to US GDP, Ahead of Tomorrow’s EMU GDP and CPI

Overview: The Federal Reserve delivered its second consecutive 75 bp rate hike, and Chair Powell left the door open for another large hike at the next meeting in September. Yet, the market took away a dovish message and the dollar suffered, rates slipped, and equities rallied. Central banks with currencies pegged to the dollar had to hike too. This includes Hong Kong, Saudi Arabia, Bahrain, and UAE, which matched the move in full. Kuwait and Qatar hiked by 25 bp and...

Read More »Dismal EMU Flash PMI on Heels of First ECB Rate Hike since 2011

Overview: The euro is over a cent lower from yesterday’s peak, pressured by the drop in the flash PMI composite below 50 for the first time since early last year. More generally, the flash PMIs have shown the global economic momentum is waning, and the bond markets have responded accordingly. The US 10-year yield is flirting with 2.80%, its lowest level in more than two weeks. European yields are 15-20 bp lower and the spread between Italian and German bonds has...

Read More »Johnson Resigns, but Still not Clear if He Controls the Timing

Overview: The resignation of a UK prime minister makes for high political drama, but the markets hardly moved on it. Sterling, like most of the major currencies, are recovering against the dollar today. UK equities are higher but are not really outperforming their peers. Asia Pacific bourses rallied, with Taiwan leading the way with a 2.5% surge. Europe’s Stoxx 600 is up 1.4% after yesterday’s 1.65% gain. US futures are around 0.25%-0.35% better. Benchmark bond...

Read More »Is a 0.3% Miss on Headline CPI Really Worth a 77 bp Rise in the December Fed Funds Yield?

Overview: Better than expected Chinese data and an unscheduled ECB meeting are the highlights ahead of the North American session that features the May US retail sales report and other high frequency data before the outcome of the FOMC meeting. Asia Pacific equities outside of Hong Kong and China fell. Europe’s Stoxx 600 is up almost 1% as it tries to snap a six-day slide. US futures are posting modest gains. Bond markets in Europe and the US are rallying. The ECB...

Read More »Dollar Gains Pared

Overview: Asia Pacific equities were mostly lower. China and India bucked the trend. Europe’s Stoxx 600 is steady with no follow through selling after yesterday reversal. US index futures are posting modest gains and are trying to snap a two-day drop. The US 10-year yield is firm at 2.91%, while European benchmark rates are 2-3 bp higher. Asia Pacific bonds were dragged lower by the sell-off in the US yesterday. The dollar is broadly lower. The Swedish krona...

Read More »Bank of Canada’s Turn

Overview: The recent equity rally is stalling. Asia Pacific equities were mixed, with Japan, South Korea, and Australia, among the major bourses posting gains. Europe’s Dow Jones Stoxx 500 is slipping lower for the second consecutive session, ending a four-day bounce. US equity futures are little changed. The US 10-year yield is edging higher at 2.86%, while European yields are slightly lower. The greenback is firm against most of the major currencies. The Australian...

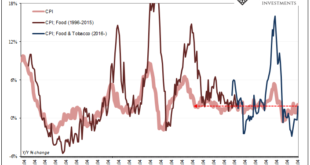

Read More »Synchronizing Chinese Prices (and consequences)

It isn’t just the vast difference between Chinese consumer prices and those in the US or Europe, China’s CPI has been categorically distinct from China’s PPI, too. That distance hints at the real problem which the whole is just now beginning to confront, having been lulled into an inflationary illusion made up from all these things. To start with, yesterday China’s NBS reported the index for its consumer prices rose 2.1% year-over-year in April 2022. That’s up from...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org