A prominent U.S. Senator just called the head of the nation’s central bank “dangerous.” Unfortunately, the true dangers of U.S. monetary and fiscal policy were lost on everyone involved. On Tuesday, Federal Reserve Chairman Jerome Powell testified before the Senate banking committee, where Senator Elizabeth Warren led the left wing of the Democratic Party’s attack. “Over and over, you have acted to make our banking system less safe. And that makes you a dangerous man...

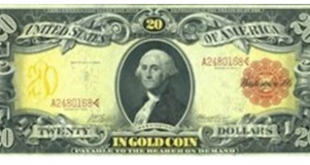

Read More »Moving from Gold-Redeemable to Irredeemable Currency

When we saw the following comment from a prominent otherwise-free-marketer, we knew it was time to write this article. “…the value of the Fed’s “liabilities”(which are so in name only) [scare quotes and parenthetic comment in original] bears only a very loose connection to the value of its assets.” This statement seems so simple. The Fed is the issuer of America’s and the world’s reserve currency (mainstream pronunciation “muhn-ee”). Observing that this paper has...

Read More »Biden’s Dangerous Inflation Denials

[unable to retrieve full-text content]President Joe Biden is in denial about inflation. This week he superficially addressed the problem by admitting the obvious – that prices have been rising rapidly this year – while denying that the inflation surge represents anything out of the ordinary.

Read More »Ohio House Votes to Fix Blunder, Remove Sales Tax on Sound Money

The Ohio House of Representatives just approved a bill which helps Buckeye State citizens protect themselves from the loss of monetary purchasing power caused by federal money printing. Introduced by Representative Oeslager, House Bill 110 includes a provision to eliminate the sales and use tax on purchases of gold, silver, platinum, and palladium coins and bullion in Ohio. Ohio recently repealed a longstanding sales tax exemption on the sale of precious metals....

Read More »Stefan Gleason: The Big Inflation Scam

[embedded content] Tom welcomes Stefan Gleason, president of Money Metals Exchange, to the show. The idea of sound money is something that holds it’s value over time in contrast to fiat currencies. The market has chosen gold and silver over thousands of years as the money that sustains and preserves purchasing power. They focus on improving public policy at the state level via the Sound Money Defense League. There are more options for improving laws at a state level...

Read More »Rising Debt Means a Weaker Dollar

Americans appear to be growing more concerned about the skyrocketing national debt level – officially $28.1 trillion and counting. The Peter G. Peterson Foundation’s monthly Fiscal Confidence Index recently shed five points, dropping to a level of 47, in the wake of the Biden Administration’s latest $2 trillion stimulus package. That $2 trillion bill is simply piled on top of already massive budget deficits. And it adds furthers to concerns over the country’s...

Read More »Prices Are Set to Soar

“Government,” observed the great Austrian economist Ludwig von Mises, “is the only institution that can take a valuable commodity like paper and make it worthless by applying ink.” Mises was describing the curse of inflation, the process whereby government expands a nation’s money supply and thereby erodes the value of each monetary unit—dollar, peso, pound, franc, or whatever. It shows up in various ways, most visibly in the form of rising prices, which a lot of...

Read More »A Georgia Gold Rush Story: The Rise and Fall of America’s First Private Gold-Coin Mint

(Note: This article is dedicated to the memory of Carl Watner, who died on December 8, 2020 at the age of 72. A long-time defender of individual liberty and free markets, his 1976 article in Reason magazine, “California Gold, 1849-65,” helped renew awareness and appreciation for private money in American history). Put the federal government in charge of the supply of money, let it outlaw private competition and bestow a “legal tender” privilege on its own paper and...

Read More »Fed Recommits to Misleading the Public About Inflation

Did the Federal Reserve just usher in the next phase of the U.S. dollar’s decline? On Wednesday, the central bank recommitted to leaving its benchmark interest rate near zero for the foreseeable future. Fed officials also vowed to keep pumping cash into financial markets. Following Fed chairman Jerome Powell’s remarks, the wavering U.S. Dollar Index turned down – hitting a fresh new low for the year. Gold gained modestly on the day while silver got a bigger boost to...

Read More »Media Celebrates after Trump’s Pro-Gold Fed Nominee Gets Blocked

It was only after he entered politics that President Donald Trump began to fully grasp the bias, dishonesty, and fakeness that runs throughout the so-called mainstream media. But gold bugs and sound money advocates have long known to distrust the reporting of establishment news sources. Journalists’ anti-gold and anti-Trump biases converged this week as the Senate took up President Trump’s nomination of Judy Shelton to the Federal Reserve Board. Shelton, a fierce...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org