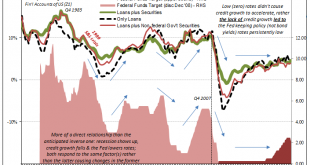

Well, that wasn’t he had in mind. The whole point of a rate cut, any rate cut let alone an emergency fifty, is to signal especially the stock market that the Fed is in the business of…something. The public has been led, by and large, to assume that something good happens when the Fed Chair shows up on TV. If you ask anyone to be specific, however, they can’t really answer you beyond the primitive superstition of low rates being especially beneficial to borrowers....

Read More »Economy: Curved Again

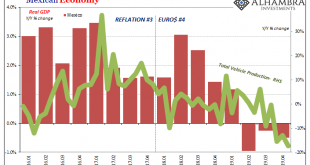

Earlier today, Mexico’s Instituto Nacional de Estadística y Geografía (INEGI) confirmed the country’s economy is in recession. Updating its estimate for Q4 GDP, year-over-year output declined by 0.5% rather than -0.3% as first thought. On a quarterly basis, GDP was down for the second consecutive quarter which mainstream convention treats as a technical recession. On a yearly basis, it was actually the third straight. Nothing seems to have changed as 2019 drew to...

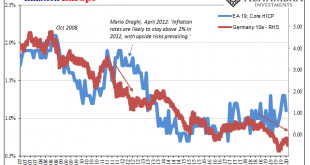

Read More »Schaetze To That

When Mario Draghi sat down for his scheduled press conference on April 4, 2012, it was a key moment and he knew it. The ECB had finished up the second of its “massive” LTRO auctions only weeks before. Draghi was still relatively new to the job, having taken over for Jean-Claude Trichet the prior November amidst substantial turmoil. The non-standard “flood of liquidity” was an about-face from his predecessor (who had been raising rates in 2011 before the wheels...

Read More »Was It A Midpoint And Did We Already Pass Through It?

We certainly don’t have a crystal ball at the ready, and we can’t predict the future. The best we might hope is to entertain reasonable probabilities for it oftentimes derived from how we see the past. Which is just what statistics and econometrics attempt. Except, wherein they go wrong we don’t have to make their mistakes. For example, in the Fed’s main model ferbus there’s no way to input a global dollar shortage. Even if there was, to this statistical...

Read More »Time Again For Triple Digit Dollar

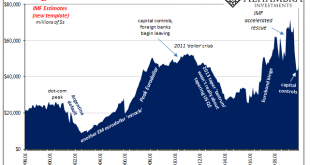

Being a member of the institutional “elite” means never having to say you’re sorry; or even admit that you have no idea what you are doing. For Christine Lagarde, Mario Draghi’s retirement from the European Central Bank could not have come at a more opportune moment. Fresh off the Argentina debacle, she failed herself upward to an even better gig. Lagarde had staked a lot on the organization’s largest ever rescue plan. It was a show of force meant to shore up...

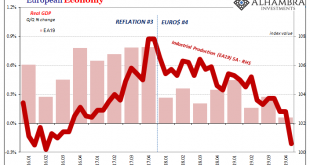

Read More »European Data: Much More In Store For Number Four

It’s just Germany. It’s just industry. The excuses pile up as long as the downturn. Over across the Atlantic the situation has only now become truly serious. The European part of this globally synchronized downturn is already two years long and just recently is it becoming too much for the catcalls to ignore. Central bankers are trying their best to, obviously, but the numbers just aren’t stacking up their way. We’ve seen all this before, repeatedly. Part of the...

Read More »US Sales and Production Remain Virus-Free, But Still Aren’t Headwind-Free

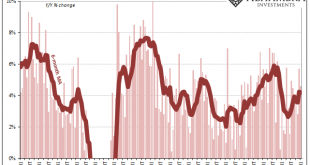

The lull in US consumer spending on goods has reached a fifth month. The annual comparisons aren’t good, yet they somewhat mask the more recent problems appearing in the figures. According to the Census Bureau, total retail sales in January rose 4.58% year-over-year (unadjusted). Not a good number, but better, seemingly, than early on in 2019 when the series was putting out 3s and 2s. As has been the pattern in these things, global synchronized downturns, the...

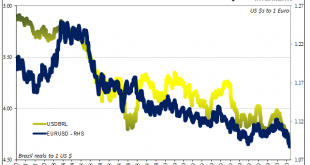

Read More »You Shouldn’t Miss The Cupom

I actually wanted to focus on this yesterday but confirmation wasn’t forthcoming until today. So, it ended up being a broader note on the dollar which only included some mention of Brazil in passing. Still a worthwhile couple of minutes. There were rumors that Banco (central) do Brasil was intervening or was going to intervene in its local currency markets, which may be an important signal. More of swaps that aren’t really currency swaps (which you can read about...

Read More »As the Data Comes In, 2019 Really Did End Badly

The coronavirus began during December, but in its early stages no one knew a thing about it. It wasn’t until January 1 that health authorities in China closed the Huanan Seafood Wholesale Market after initially determining some wild animals sold there might have been the source of a pneumonia-like outbreak. On January 5, the Wuhan Municipal Health Commission issued a statement saying it wasn’t SARS or MERS, and that the spreading disease would be probed. In other...

Read More »Two Years And Now It’s Getting Serious

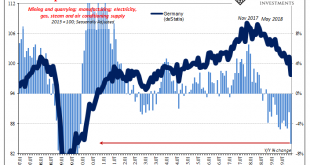

We knew German Industrial Production for December 2019 was going to be ugly given what deStatis had reported for factory orders yesterday. In all likelihood, Germany’s industrial economy ended last year sinking and maybe too quickly. What was actually reported, however, exceeded every pessimistic guess and expectation – by a lot. IP absolutely plummeted in the final month of 2019. Compared to the prior December, the index was down an alarming 6.7%. Minus seven...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org