Swiss Franc The Euro has fallen by 0.08% to 1.064 EUR/CHF and USD/CHF, February 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Investors appear to be increasingly looking past the latest coronavirus from China as new afflictions slow. Despite the soggy close of US equities yesterday, Asia Pacific bourses are nearly all higher, led by more than 1% gains in Singapore and Thailand. The Dow Jones Stoxx 600 is...

Read More »FX Daily, February 11: New Calm in the Capital Markets Continues, Powell Moves to Center Stage

Swiss Franc The Euro has risen by 0.15% to 1.0675 EUR/CHF and USD/CHF, February 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Investors are taking solace from reports indicating that the increase in the new coronavirus at ground zero (Hubei) is slowing. After the S&P 500 reversed early losses yesterday to close at new record highs helped keep the bullish sentiment intact. Benchmarks in Hong Kong, South...

Read More »FX Daily, February 10: Quiet Start to the New Week in which Politics may Dominate

Swiss Franc The Euro has fallen by 0.19% to 1.0681 EUR/CHF and USD/CHF, February 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global capital markets have begun the new week on a cautious tone as investors seek to assess the latest news on the new coronavirus. Nearly all the markets in Asia fell but China. European bourses are lower as well, with the Dow Jones Stoxx 600 off about 0.3%. US shares are...

Read More »FX Weekly Preview: US Soars while Rivals are Hobbled

We are approaching the mid-point of the first quarter, and the coronavirus from China is the new key development for businesses and investors. The economic impact appears to be still growing as the disruption to supply chains, production, and demand continues. The re-opening of China from the extended Lunar New Year holiday brought some relief to the markets as officials ensured ample liquidity, leaned against short selling, and offered concessions to businesses...

Read More »FX Daily, February 7: Dollar Rides High as Eurozone Disappoints, and Caution Sets In

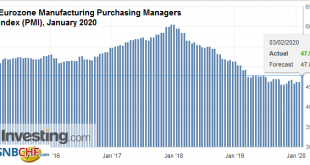

Swiss Franc The Euro has fallen by 0.07% to 1.0692 EUR/CHF and USD/CHF, February 7(see more posts on EUR/CHF, USD/CHF, ) Source: makets.ft.com - Click to enlarge FX Rates Overview: A more cautious tone is evident today in the markets, which seem to have run well ahead of macro developments and evidence that the new coronavirus is not yet contained. After a roughly 3.5% advance in the past three sessions, the MSCI Asia Pacific index pulled back with nearly the...

Read More »FX Daily, February 6: Stocks Push Higher but more Cautious Tone may be Emerging

Swiss Franc The Euro has risen by 0.07% to 1.071 EUR/CHF and USD/CHF, February 6(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The bullish enthusiasm that carried the S&P 500 to new closing highs yesterday is helping Asia Pacific and European shares today. The MSCI Asia Pacific Index rose for the third session with Tokyo, Hong Kong, and Korea jumping two percent. Europe’s Dow Jones Stoxx 600 gapped to new...

Read More »FX Daily, February 5: Markets Extend Recovery, but Look for a Pause

Swiss Franc The Euro has risen by 0.13% to 1.0716 EUR/CHF and USD/CHF, February 5(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The S&P 500 gapped higher and surged 1.5% yesterday, the most since in six months, helping set the stage for a continued recovery in global equities, and stoked risk appetites more broadly. An experimental antiviral treatment is to begin clinical testing. All of the markets in the...

Read More »FX Daily, February 4: Relief Rally Fueled by Liquidity not Peak in Coronavirus

Swiss Franc The Euro has risen by 0.21% to 1.0701 EUR/CHF and USD/CHF, February 4(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The combination of the rally in US shares yesterday and the continued efforts of China to inject liquidity helped lift sentiment today. The MSCI Asia Pacific Index snapped an eight-day slide, and many markets jumped more than 1%. Led by energy and materials, Europe’s Dow Jones Stoxx...

Read More »February Monthly

The global capital markets were roiled in recent weeks by the new virus that jumped species in China. It is contagious during the incubation periods and appears similar though more aggressive than SARS in 2003-2004. And China is larger and significantly more integrated into the global political economy. The new coronavirus is impactful in several areas outside of the human tragedy. It is a blow to ideas of better growth impulses to start the year. The outlook...

Read More »FX Daily, February 3: Inauspicious Start to the Year of the (Flying) Rat

Overview: The Year of the Rat is off to an inauspicious start as apparently a fly rat (a bat) virus has jumped to humans. China’s markets re-opening amid much fanfare, and the Shanghai Composite dropped 7.7%, which is about what the futures in Singapore had anticipated. Several other markets in the region (Japan’s Nikkei, Australia, Singapore, Taiwan, and Thailand) fell by more than 1%. However, European and US shares are edging higher, and other measures of...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org