As Austrian Business Cycle Theory explains, big-ticket capital expenditures are heaving influenced by interest rates, as we discussed here.Since housing is a big-ticket capital expenditure, demand for housing is strongly influenced by interest rates, which makes it an excellent leading indicator of the business cycle. The weakness we are seeing in housing now is one key reason I expect a major recession to likely start this year.The Fed Caused Housing Bubble 1.0The Federal Reserve intentionally created a housing bubble in the early 2000s that they busted in the Great Recession and Global Financial Crisis of 2008-2009.In response to the Tech Bust and recession of the early 2000s, then Fed Chair Alan “The Maestro” Greenspan slashed the Federal Funds rate from nearly

Topics:

Jon Wolfenbarger considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

As Austrian Business Cycle Theory explains, big-ticket capital expenditures are heaving influenced by interest rates, as we discussed here.

Since housing is a big-ticket capital expenditure, demand for housing is strongly influenced by interest rates, which makes it an excellent leading indicator of the business cycle. The weakness we are seeing in housing now is one key reason I expect a major recession to likely start this year.

The Fed Caused Housing Bubble 1.0

The Federal Reserve intentionally created a housing bubble in the early 2000s that they busted in the Great Recession and Global Financial Crisis of 2008-2009.

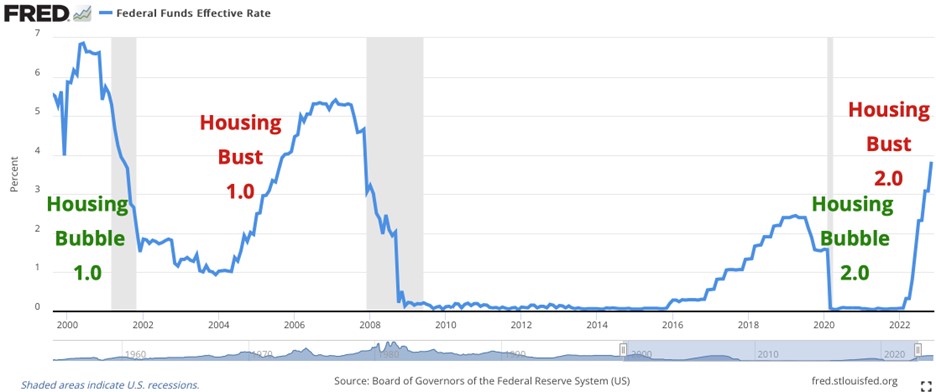

In response to the Tech Bust and recession of the early 2000s, then Fed Chair Alan “The Maestro” Greenspan slashed the Federal Funds rate from nearly 7 percent in 2000 to just 1 percent in 2002.

In a 2002 speech, Greenspan explained his rationale for lowering interest rates to increase housing demand and stimulate the economy as follows, “Besides sustaining the demand for new construction, mortgage markets have also been a powerful stabilizing force over the past two years of economic distress by facilitating the extraction of some of the equity that homeowners have built up over the years”.

As the Federal Reserve later explained in a 2005 paper, ”Like other asset prices, house prices are influenced by interest rates, and in some countries, the housing market is a key channel of monetary policy transmission.” It sounds like the Fed had finally been reading Ludwig von Mises.

In April 2005, Greenspan gave a speech praising subprime mortgage loans by saying:

Innovation has brought about a multitude of new products, such as subprime loans and niche credit programs for immigrants. Such developments are representative of the market responses that have driven the financial services industry throughout the history of our country...With these advances in technology, lenders have taken advantage of credit-scoring models and other techniques for efficiently extending credit to a broader spectrum of consumers...Where once more-marginal applicants would simply have been denied credit, lenders are now able to quite efficiently judge the risk posed by individual applicants and to price that risk appropriately. These improvements have led to rapid growth in subprime mortgage lending; indeed, today subprime mortgages account for roughly 10 percent of the number of all mortgages outstanding, up from just 1 or 2 percent in the early 1990s.

As a result of Greenspan’s aggressive money creation, the median home price soared by over 50 percent from 2000 to 2007.

The Fed Caused Housing Bust 1.0

In a February 2004 speech, Greenspan advocated adjustable-rate mortgages. After he encouraged millions of Americans to use these mortgages, he then proceeded to raise the Federal Funds rate from 1 percent to 5.3 percent over the next two and a half years, thereby triggering the biggest housing bust in US history up to that time.

As a result, the median home price collapsed by nearly 20% from 2007 to 2009, which triggered the Great Recession and Global Financial Crisis of 2008-2009.

The Fed Caused Housing Bubble 2.0

In response to the government-imposed lockdowns over the covid virus in 2020, the Fed and banks increased the money supply by an incredible 40% when the Fed cut the Federal Funds rate to nearly zero percent. As a result of this unprecedented money creation, inflation shot up to 9 percent by 2022, the highest level in four decades.

This also caused median home prices to skyrocket nearly 50% percent from 2020 to 2022, resulting in Housing Bubble 2.0.

The Housing Affordability Index has fallen nearly 50% in the past couple of years and is now at the low levels seen during the peak of Housing Bubble 1.0.

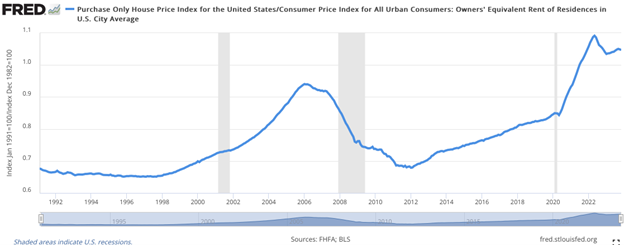

This chart shows the housing price-to-rent ratio is still near historical highs and well above the highs seen during Housing Bubble 1.0 of the 2000s. This high ratio means house prices are very vulnerable to major declines, since people can choose to rent instead of buying at high prices.

The Fed Caused Housing Bust 2.0

Current Fed Chair Jay Powell insisted the high price inflation would be “transitory”, but that turned out to be wishful thinking, which is a typical trait of Fed Chairs, as I discussed here.

In response to the high price inflation they created, the Fed was forced to follow rapidly rising market interest rates and hike the Federal Funds rate at the most aggressive pace in 40 years.

This rise in interest rates caused mortgage rates to skyrocket from under 3 percent in early 2021 to nearly 7 percent now.

As a result, Housing Bubble 2.0 is busting and likely has a long way to go.

Signs Of A Housing Bust

Signs of a busting housing bubble abound.

Due to the high interest rates and high home prices, over 80 percent of Americans say now is a “Bad Time To Buy A House”, according to the latest Fannie Mae Housing Survey. That is more than triple the 27 percent level seen in 2020 and more than double the long-term average of 39 percent.

Demand for mortgages fell to a 30-year low in January, which is down 14 percent from last year and down over 50 percent from the covid peak.

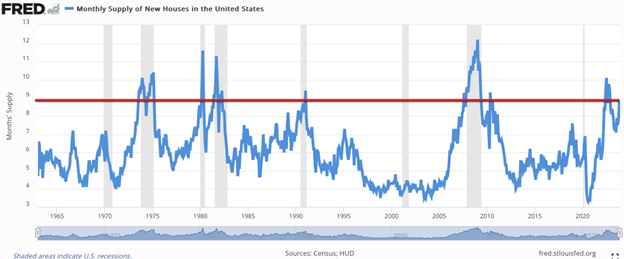

The supply of houses is now at 9 months of demand, which is a level typically only seen in recessions, as this chart shows. This excess supply of housing suggests much lower prices to come to better balance supply and demand.

Due to lower demand, new housing starts fell nearly 15 percent in January, which is the biggest monthly drop since April 2020. That was well below estimates of 0% and the 3.3 percent increase in December. In addition, the NAHB Housing Market Index, which is based on a survey of homebuilders on housing demand, has been below the neutral 50 level for 15 of the past 18 months.

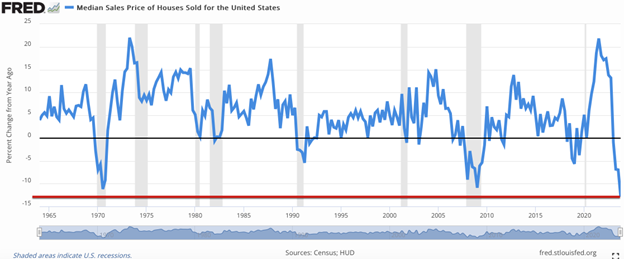

The US median home price is now down nearly 13 percent year-over-year. As this chart shows, that is the biggest decline in the past 60 years and even worse than the decline seen during the housing bust of 2008-2009!

Imagine what will happen to housing demand when unemployment rises further in the recession that is likely coming soon.

It’s Time to Solve The Boom & Bust Problem

This chart of the Federal Funds rate shows how the central planning bureaucrats at the Federal Reserve created Housing Bubble 1.0 in the early 2000s by slashing interest rates. Then they caused Housing Bust 1.0 by hiking interest rates in the mid-2000s. Then they caused Housing Bubble 2.0 by slashing interest rates in 2020. Then they caused Housing Bust 2.0 by hiking interest rates the past two years.

As long as we continue to allow and even encourage unelected bureaucrats to try to centrally plan the economy by creating money out of thin air and manipulating interest rates, we will continue to have these boom-and-bust cycles. In addition to causing tremendous economic uncertainty and volatility, as well as bankrupting companies and individuals, this also leads to lower overall living standards by wasting scarce resources.

I outlined the solution to this problem in my article “How To Prevent the Boom-Bust Business Cycle”. The sooner we solve this boom-bust problem, the better for all Americans.

Tags: Featured,newsletter