Unbeknownst to those trembling in fear of a crushing recession, the crushing recession they fear is the only curative for a fatally distorted system which has lost touch with reality. Everyone looking at the inevitability of recession with alarm is forgetting the many upsides of recession, especially one that crushes all attempts to reverse it with the usual tricks. Let’s not forget the simple joys of lighter traffic, faster commutes and the relative ease of getting a table at your favorite bistro–if it survives the bust.Graveyard levity aside, there really is no equivalent to the positive force of crushing recessions. Only recessions which defy the usual tricks of monetary easing (create trillions of new dollars) and fiscal stimulus (give away a few of those new

Topics:

Charles Hugh Smith considers the following as important: 5.) Charles Hugh Smith, 5) Global Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

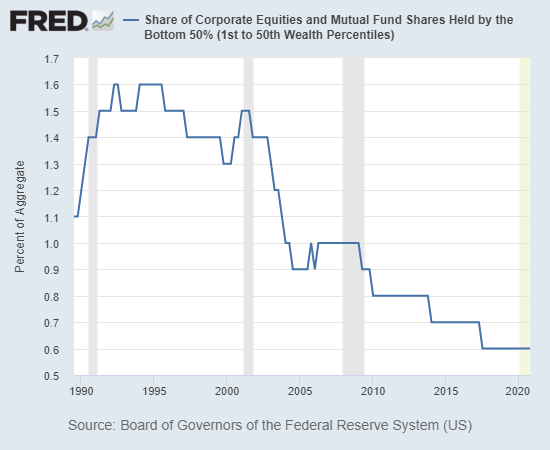

The problem with free money is that there’s no mechanism to distinguish between waste and productive investment or fraud and productive utilization. All uses of free money are equally beneficial because if this free money is squandered, there’s always more to spend tomorrow. In other words, in a system in which free money is the solution to all problems, there’s no motivation to limit waste, friction or fraud because there’s always enough free money for both waste, friction and fraud and needed spending and investment.

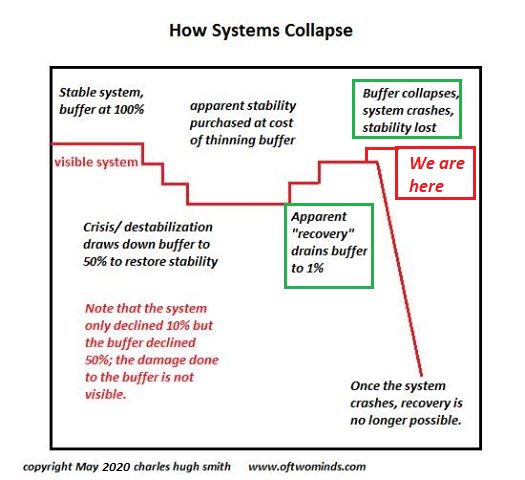

Recessions driven by inflation and the collapse of speculative bubbles aren’t fixable with free money because free money fires up the afterburner of inflation. Once there are limits on how much free money can be created and distributed, squandering what’s left on waste, friction and fraud means there’s not enough left to fund essential services and invest in the only real-world source of income and wealth, increasing productivity–doing more with less capital, labor and resources.

Only crushing recessions introduce the discipline of having to choose between waste, friction and fraud and essential services and investments. Waste, friction and fraud aren’t simply gargantuan drains on resources; they corrupt the system by incentivizing friction (unproductive complexity and gatekeeping) and fraud (collusion fraudulent billing, buying political favors, insider trading, etc.) and giving the recipients of friction and fraud the financial means to protect their fiefdoms with complexity thickets and political protection.

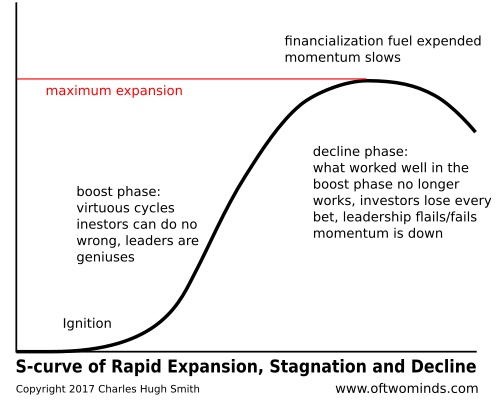

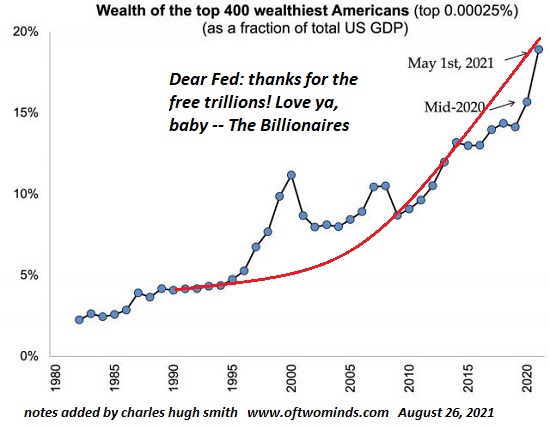

| Financial systems that never experience crushing recessions can’t tell the difference between a speculative mania driven by corporate buybacks and a bull market driven by improving productivity that lifts both profits and wages. The phony charade of speculative bubbles inflated by the Federal Reserve’s spew of free money for financiers fatally distort the entire incentive structure of the financial system, which then balloons up and fatally distorts the entire economy.

Unbeknownst to those trembling in fear of a crushing recession, the crushing recession they fear is the only curative for a fatally distorted system which has lost touch with reality: yes, there is a difference between speculative bubbles and bull markets, and yes, there is a difference between an economy riddled with the cancers of waste, friction and fraud and one strengthened by incentives and corrective mechanisms that bury unproductive zombie financial entities and reward those who actually increase productivity rather than destroy it. |

Tags: Featured,newsletter