According to the popular way of thinking, our knowledge of the economy is elusive. Consequently, the best that we can do is to attempt to ascertain some facts of economic reality by applying various statistical methods to the so-called macro data. For instance, an economist is of the view (i.e., he has a theory) that consumers’ outlays on goods and services are determined by personal disposable income and the interest rate. The personal disposable income and the interest rate, according to the economist’s view, are the driving variables of consumer outlays. By means of a statistical method, the economist then converts this view into an equation. The established equation in turn is employed in the assessment of the future direction of consumer outlays. If the

Topics:

Frank Shostak considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

According to the popular way of thinking, our knowledge of the economy is elusive. Consequently, the best that we can do is to attempt to ascertain some facts of economic reality by applying various statistical methods to the so-called macro data.

According to the popular way of thinking, our knowledge of the economy is elusive. Consequently, the best that we can do is to attempt to ascertain some facts of economic reality by applying various statistical methods to the so-called macro data.

For instance, an economist is of the view (i.e., he has a theory) that consumers’ outlays on goods and services are determined by personal disposable income and the interest rate. The personal disposable income and the interest rate, according to the economist’s view, are the driving variables of consumer outlays.

By means of a statistical method, the economist then converts this view into an equation. The established equation in turn is employed in the assessment of the future direction of consumer outlays.

If the equation generates accurate forecasts, then it is regarded as a good tool to ascertain the facts of reality. If it fails to produce accurate forecasts, then it no longer helpful in the establishment of the facts of reality. In this case, the theory must be abandoned or modified.

The popularizer of this way of thinking, Milton Friedman, wrote:

The ultimate goal of a positive science is the development of a “theory” or “hypothesis” that yields valid and meaningful (i.e., not truistic) predictions about phenomena not yet observed.1

In this way of thinking, as long as the theory “works,” it is regarded as a valid framework as far as the assessment of economic conditions is concerned.

According to Friedman, since it is not possible to establish “how things really work,” then it does not really matter what the underlying assumptions of a theory are. It does not matter whether consumer outlays are driven by disposable income and the interest rate only, or perhaps also by some additional variables. In fact, anything goes, as long as the theory can generate accurate forecasts.

According to Friedman:

he relevant question to ask about the “assumptions” of a theory is not whether they are descriptively “realistic,” for they never are, but whether they are sufficiently good approximations for the purpose in hand. And this question can be answered only by seeing whether the theory works, which means whether it yields sufficiently accurate predictions.2

Friedman’s view sets predictive capability as the standard for accepting a theory, and this is problematic. For example, we can say confidently that all other things being equal, an increase in the demand for bread will increase its price.

This conclusion is true and not tentative. Will the price of bread go up tomorrow or sometime in the future? This cannot be established by the theory of supply and demand. Should we dismiss this theory as useless because it cannot predict the future price of bread?

On this Ludwig von Mises held that

[e]conomics can predict the effects to be expected from resorting to definite measures of economic policies. It can answer the question whether a definite policy is able to attain the ends aimed at and, if the answer is in the negative, what its real effects will be. But, of course, this prediction can be only “qualitative.”3

Economics Is about Purposeful Human Action

Economics is not about the gross domestic product, the Consumer Price Index, or other economic indicators, but about human purposeful activities that seek to promote individuals’ lives and well-being. Individuals operate within a framework of ends and means; they are using various means to secure ends. Purposeful action implies that individuals assess or evaluate various means at their disposal against their ends.

At any point in time, individuals may have an abundance of ends that they would like to achieve. What limits the attainment of various ends is the scarcity of means. Once more means become available, a greater number of ends, or goals, can be achieved (i.e., individuals’ living standards are likely to increase).

The knowledge that individuals employ means to attain goals can be utilized in the assessment of historical data. For instance, the fact that individuals are operating in the framework of ends and means enables us to evaluate the popular view that central bank policy makers can grow an economy by means of monetary pumping.

Despite its importance as the medium of exchange, money is not suitable for the production of goods and services. It is also not suitable for consumption.

According to Murray N. Rothbard:

Money, per se, cannot be consumed and cannot be used directly as a producers’ good in the productive process. Money per se is therefore unproductive; it is dead stock and produces nothing.4

Money does not sustain nor fund economic activity. Money’s main job is simply to fulfill the role of the medium of exchange. Note that without the medium of exchange (i.e., money), neither the division of labor nor the market economy could have emerged. The existence of money enables individuals to specialize. Moreover, money is not the means of payment. Individuals pay with the goods and services they produce—they do not pay with money. Money only helps to facilitate payments. Hence, we can establish that money is not a suitable means to attain the goal, which is economic growth.

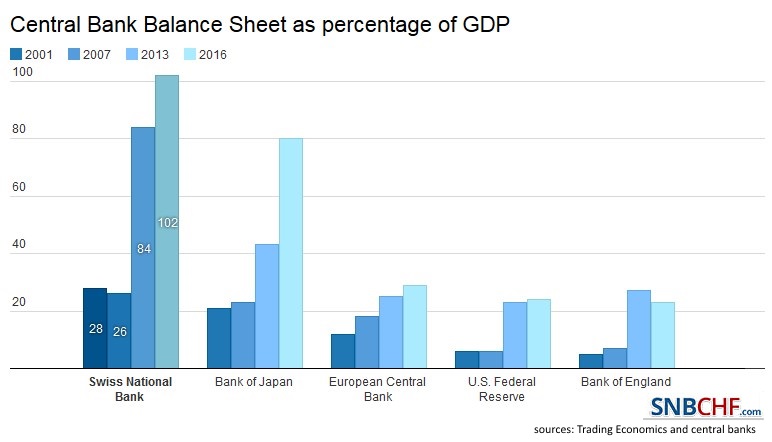

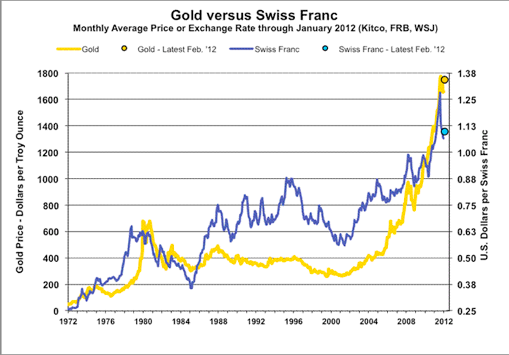

If anything, we can suggest that the monetary pumping, by setting an exchange of nothing for something, is going to undermine the process of wealth generation and thereby economic growth. From this we can establish that policy makers cannot grow an economy by means of monetary pumping.

Causes in Economics Emanate from Human Beings

The fact that individuals pursue purposeful actions implies that causes in the world of economics emanate from individuals and not from outside factors.

For instance, contrary to popular thinking, outlays on consumer goods do not always increase in response to an increase in personal income. In his own unique context, every individual decides how much of a given income will be used for consumption and how much for investment.

Every individual evaluates the increase in income against a particular set of goals he wants to achieve. He might decide that it is more beneficial to increase his investment in financial assets rather than to increase his consumption.

Observe that the knowledge that individuals pursue purposeful actions is not tentative. It is always valid. Anyone attempting to suggest that this is not the case is engaging in contradiction, for he is in fact engaging in purposeful action to argue that this is not so.

The fact that people consciously pursue purposeful actions provides us with a definite knowledge that is always valid as far as human beings are concerned.

This knowledge is the base for a coherent framework that permits a meaningful assessment of the state of an economy. In contrast, analyses that rely on statistical methods are likely to be problematic. Observe that these methods describe but do not explain the data.

Without ascertaining the meaning of economic activity (i.e., why individuals are doing what they are doing) the most advanced statistical methods cannot tell us the essence of what is going on in the world of human beings. Without the knowledge that human actions are purposeful, it is not possible to make sense of historical data.

On this Rothbard wrote:

One example that Mises liked to use in his class to demonstrate the difference between two fundamental ways of approaching human behavior was in looking at Grand Central Station behavior during rush hour. The “objective” or “truly scientific” behaviorist, he pointed out, would observe the empirical events: e.g., people rushing back and forth, aimlessly at certain predictable times of day. And that is all he would know. But the true student of human action would start from the fact that all human behavior is purposive, and he would see the purpose is to get from home to the train to work in the morning, the opposite at night, etc. It is obvious which one would discover and know more about human behavior, and therefore which one would be the genuine “scientist.”5

Concepts in Economics Must Originate from Reality

In his “Philosophical Origins of Austrian Economics,” David Gordon writes that Eugen von Böhm-Bawerk (one of the founders of the Austrian school) maintained that the concepts employed in economics must originate from the facts of reality—they need to be traced to their ultimate source. If one cannot trace a concept, it should be rejected as meaningless.

Similarly, Ayn Rand held that concept formation is not something arbitrary. The role of concepts is to integrate relevant existents and the role of definitions is to identify the nature of existents of a concept. According to Rand:

A definition is a statement that identifies the nature of the units subsumed under a concept. It is often said that definitions state the meaning of words. This is true, but not exact. A word is merely a visual-auditory symbol used to represent a concept; a word has no meaning other than that of the concept it symbolizes, and the meaning of a concept consists of its units. It is not words, but concepts that man defines—by specifying their referents. The purpose of a definition is to distinguish a concept from all other concepts and thus to keep its units differentiated from all other existents.6

By this way of thinking, we must reject conclusions that are based on theories that are detached from the facts of reality. A theory which is not derived from reality cannot possibly explain the real world.

Conclusion

By popular economics, because our knowledge of the economy is elusive, in order to find out what is going on we should rely on theories that produce accurate forecasts. As long as the theory generates accurate forecasts, it is considered as reflecting the economic reality. Once the theory breaks down, it is regarded as no longer reflecting reality and must be replaced.

To be applicable, an economic theory must emanate from the essence of what drives human conduct. This essence is purposeful action. The knowledge that individuals pursue purposeful action permits an analyst to make sense of economic data. Sophisticated statistical methods are of little help here. All they can do is describe the various historical pieces of information. Statistical methods do not explain.

- 1. Milton Friedman, Essays in Positive Economics (Chicago: University of Chicago Press, 1953), p. 7.

- 2. Milton Friedman, Essays in Positive Economics, p. 15.

- 3. Ludwig von Mises, The Ultimate Foundation of Economic Science: An Essay on Method (Princeton, NJ: D. Van Nostrand, 1962), p. 67.

- 4. Murray N. Rothbard, Man, Economy, and State (Los Angeles: Nash Publishing, 1970), p. 670.

- 5. Murray N. Rothbard, preface to Theory and History: An Interpretation of Social and Economic Evolution, by Ludwig von Mises (Auburn, AL: Ludwig von Mises Institute, 1985), p. xvi.

- 6. Ayn Rand, Introduction to Objectivist Epistemology, ed. Harry Binswanger and Leonard Peikoff, exp. 2d. ed. (New York: Meridian Books, 1990), p. 40.

Tags: Featured,newsletter

Permanent link to this article: https://snbchf.com/2022/02/shostak-economic-knowledge-qualitative-quantitative/

Leave a Reply