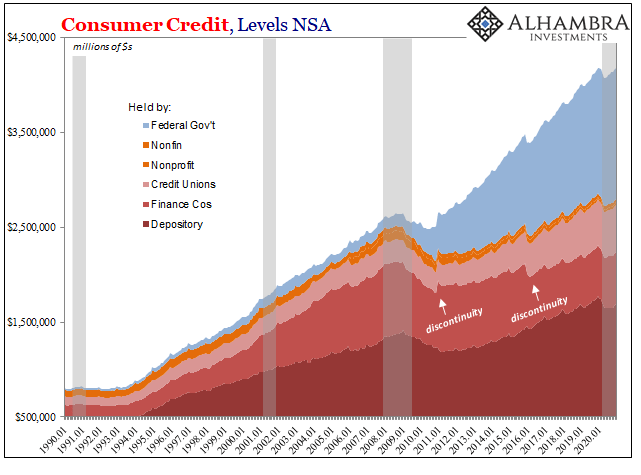

Even the feds haven’t been able to keep up. Without the government having taken over student loans in the wake of 2008-09’s Great “Recession”, there’d have been almost no additional consumer credit extended during the decade since. It’s one more facet to the recovery-less recovery; like Japan, a dominant even overbearing government influence that doesn’t stimulate anything but its own proportionally larger footprint. Given all that, the “need” for maintaining its footprint during the current recession is that much more paramount. With an employment crisis far worse than twelve years ago, any channel for raw aid, even student loans and stipends for those unfortunate college graduates staring into this even deeper labor market abyss, is an absolute necessity.

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, Consumer Credit, currencies, economy, Featured, Federal Reserve/Monetary Policy, Markets, newsletter, non-revolving credit, permanent income hypothesis, revolving credit

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Even the feds haven’t been able to keep up. Without the government having taken over student loans in the wake of 2008-09’s Great “Recession”, there’d have been almost no additional consumer credit extended during the decade since. It’s one more facet to the recovery-less recovery; like Japan, a dominant even overbearing government influence that doesn’t stimulate anything but its own proportionally larger footprint.

Given all that, the “need” for maintaining its footprint during the current recession is that much more paramount. With an employment crisis far worse than twelve years ago, any channel for raw aid, even student loans and stipends for those unfortunate college graduates staring into this even deeper labor market abyss, is an absolute necessity. |

Consumer Credit, Levels NSA 1990-2020 |

|

Uncle Sam may be willing but colleges and universities haven’t been. So far as consumer credit has been concerned, the singular positive boost in it has experienced waning growth, too. According to the Federal Reserve’s latest estimates for December 2020, federal government holdings of consumer credit rose “just” 4.8% year-over-year. While that’s clearly the best so far as the whole segment may be concerned, at the same time it’s the lowest rate since October 2007. Better than 7% late in 2019, you don’t have to go back that far for double-digits (2017). In other words, though the rate has been slowing since the takeover in 2009, over recent months it has decelerated noticeably faster having into 2021. These updated estimates for consumer credit beyond the student loan portion of them suggests only continued caution and risk-aversion – both consumers and debt issuers. |

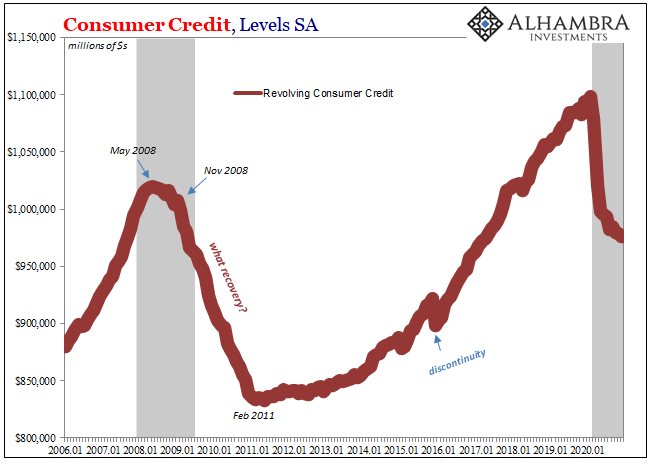

Consumer Credit, Levels SA 2006-2020 |

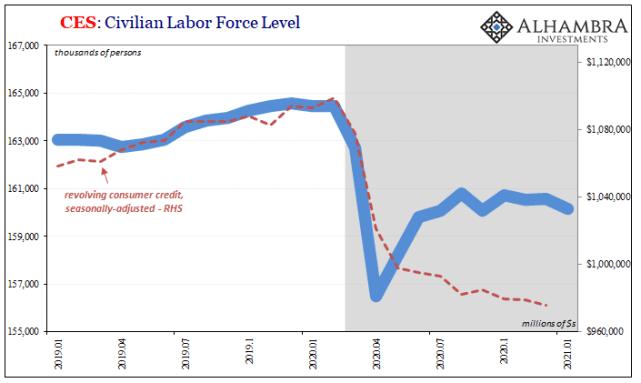

| In particular, revolving credit balances keep declining as they are, in the aggregate, paid down by consumers as workers who don’t (yet?) see a legitimate rebound on the horizon. Just like PCE estimates follow labor income, so, too, does the propensity for discretionary borrowing.

What makes these figures perhaps more important is that December had been the first month following November’s plastered announcements about vaccines (and what they were supposed to mean), as well as close enough to the expected release of more fiscal “stimulus” (outside of the student loan channel) – as it happened toward the end of that month. |

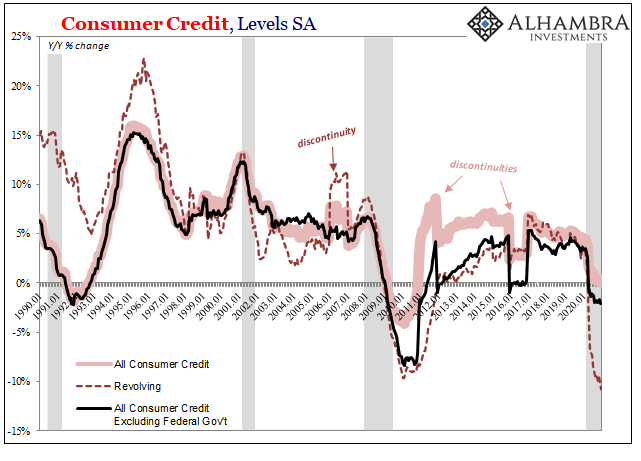

Consumer Credit, Levels SA 1990-2020 |

| Yet, at least the initial phase of vaccine-phoria and stimulus-hysteria has been shrugged off. Instead, like the payroll numbers, consumer have shown they’ll behave based on what’s really going on in the labor market – not how much the feds promise they’ll make temporary, one-time payments, or how much vaccinations dominates perceptions of a COVID-free future.

Even non-revolving credit – outside the government – is shrinking. Still deep within the grasp of 2020’s recession. |

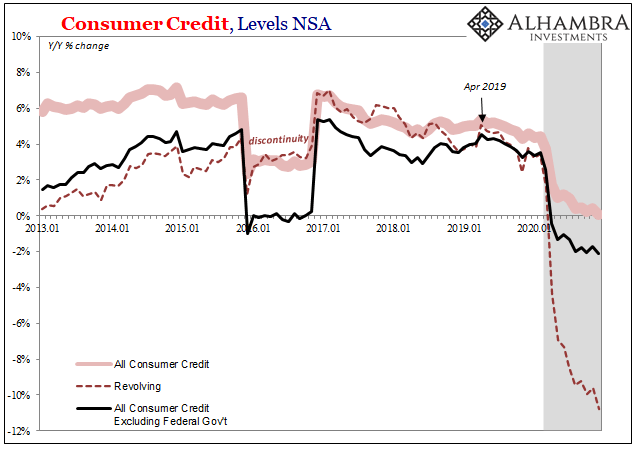

Consumer Credit, Levels NSA 2013-2020 |

CES: Civilian Labor Force Level, 2019-2021 |

|

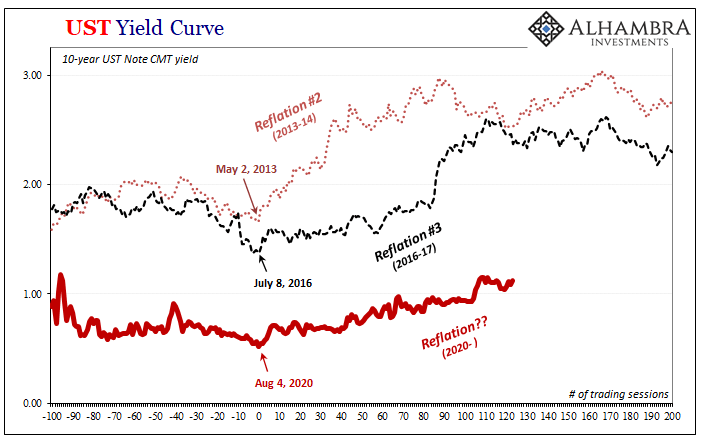

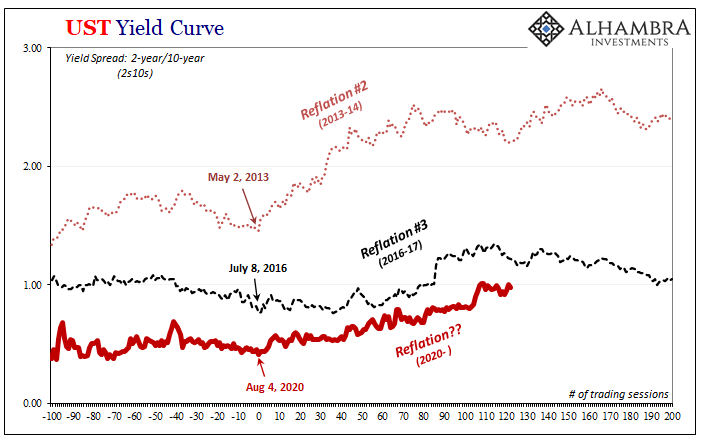

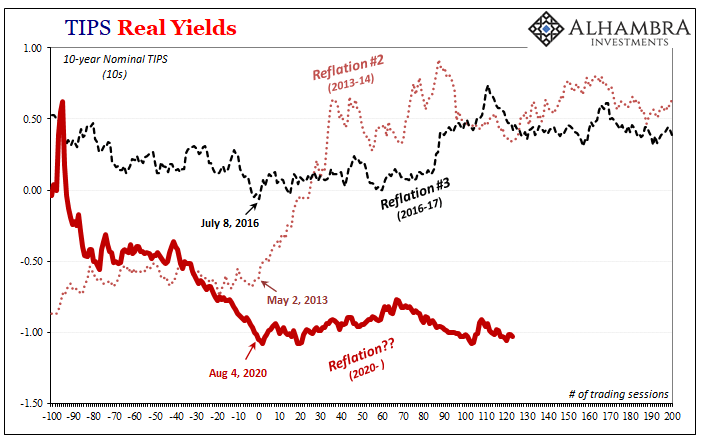

| Reflation(ish) has made its way into many markets, but maybe the reason it hasn’t gone so much further is that it hasn’t yet found itself in widespread fashion in the real economy. Maybe this won’t matter; many are betting it won’t. Perhaps the future won’t be tripped up by today’s woes, including the lack of rebound.

Consumer credit, however, is an indication of behavior beyond the raw numbers, even negative or barely positive payroll reports. As bad as it is for more than ten million to still be on the wrong end of the recession and out of work, and the nearly two million who didn’t have a chance to snag a new job that never happened, there is caution and risk-aversion which act as natural, rational, and extremely powerful depressants for an economy already struggling in historic fashion. That kind of behavior affects so many more than those 12 million raw unemployed. |

UST Yield Curve, 2013-2020 |

| The lack of risk-taking has the ability to more than cancel out Uncle Sam’s TGA-funded entitlement windfalls. In other words, the primary issue isn’t cash payments – of any kind – it’s jobs. Permanent income, not transfers. |

UST Yield Curve, 2013-2020 |

TIPS Real Yields |

Tags: Consumer Credit,currencies,economy,Featured,Federal Reserve/Monetary Policy,Markets,newsletter,non-revolving credit,permanent income hypothesis,revolving credit