US factories are humming along, constrained only by supply issues which might occasionally limit production. That’s the story, anyway. There’s too much business because of them, manufacturers taking in only more orders by the day leaving them struggling to catch up. But what kind of stuff is it that is being ordered from our nation’s factories? Without thinking too much about it, you’d probably say that they’re ridiculously busy trying as best as possible to fill demand for consumer goods. After all, federal government helicopters delivered hundreds of billions right into consumer pockets and then right out the door to Amazon.com. Except, no. According to the Census Bureau, it is not consumer goods which are making such massive waves in production. On the

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, consumer goods, currencies, economy, factory orders, Featured, Federal Reserve/Monetary Policy, manufacturing, Markets, newsletter, transportion industries

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| US factories are humming along, constrained only by supply issues which might occasionally limit production. That’s the story, anyway. There’s too much business because of them, manufacturers taking in only more orders by the day leaving them struggling to catch up.

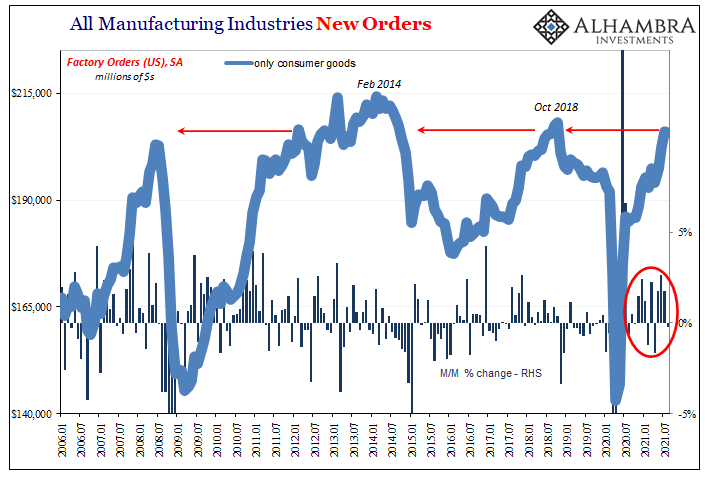

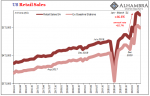

But what kind of stuff is it that is being ordered from our nation’s factories? Without thinking too much about it, you’d probably say that they’re ridiculously busy trying as best as possible to fill demand for consumer goods. After all, federal government helicopters delivered hundreds of billions right into consumer pockets and then right out the door to Amazon.com. Except, no. According to the Census Bureau, it is not consumer goods which are making such massive waves in production. On the contrary, factory orders for strictly consumer products are, actually, visibly unimpressive. |

|

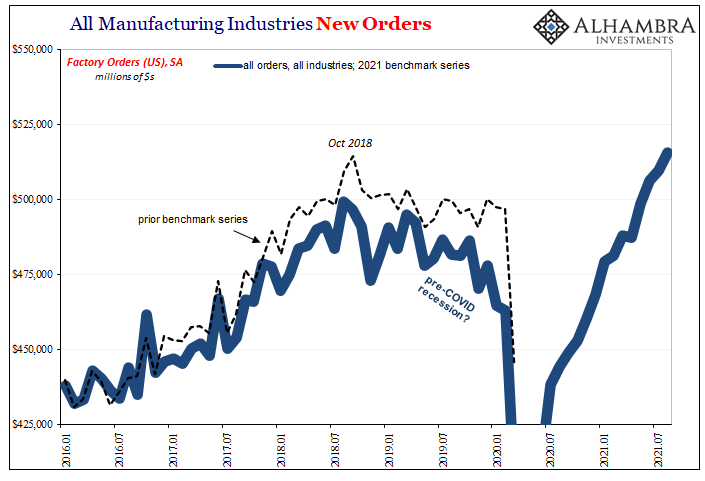

| These are the kinds of numbers we’ve seen in countless other datasets; while better today (or, latest estimates for August 2021), “somehow” there were fewer total orders (despite “inflation” in prices) than compared to the prior peak in October 2018 (just before Euro$ #4’s landmine); which was already below the peak before, early 2014 at the start of Euro$ #3.

While we try to sort this out, there’s already the possibility that this part of the economy is slowing down anyway. According to these updated estimates, factory orders for consumer goods were a bit less in August than they had been in July. After a couple of good months, the pace of ordering has moderated over the past few since June. It’s the same for the larger categories of factory orders, too, where a recent slowdown apart from those issued for consumer goods is widespread. It may be delta COVID, though why that might limit new orders for manufactured goods isn’t clear. This might also just be a temporary soft spot for any number of reasons. |

|

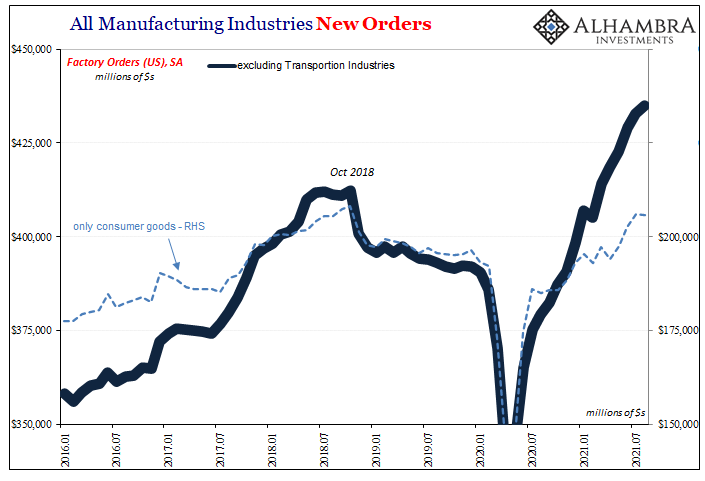

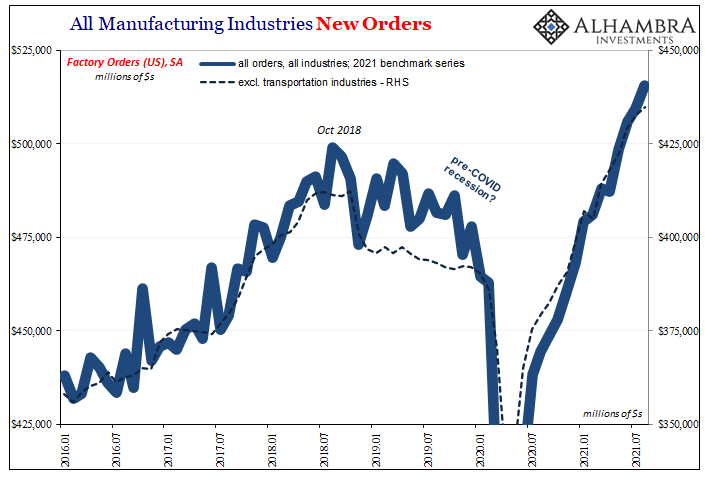

| By far, the most robust and untouchable factory category is for transportation equipment and goods. Compared to demand excluding those, new orders for that particular segment is and continues to be unstoppable. Cars and other vehicles, sure, but also transportation equipment – as in, trucks and other means of conveying the robust bulge of goods consumers are purportedly buying. | |

| Not consumers, though. What if we’re seeing a wave of orders which are largely based upon trying to mitigate these transportation and handling chokepoints themselves? There hasn’t been a huge increase in either consumer goods demand nor in global trade volumes, yet there has been a nightmare of limited capacity to handle even this much.

How much of factory orders is really shippers, handlers, and freighters (as well as, possibly, warehousing and inventory management capabilities) attempting to get some new equipment just to fix these bottlenecks? It would be almost circular as it would turn out to be transitory; consumers go nuts buying some goods but not others, goods demand rebounds faster than constrained supply can handle, and in that imbalance the supply chain flush with high prices rushes to upgrade and add new equipment that may not otherwise have been needed if not for the original and artificial disruption. Once this becomes clear… |

|

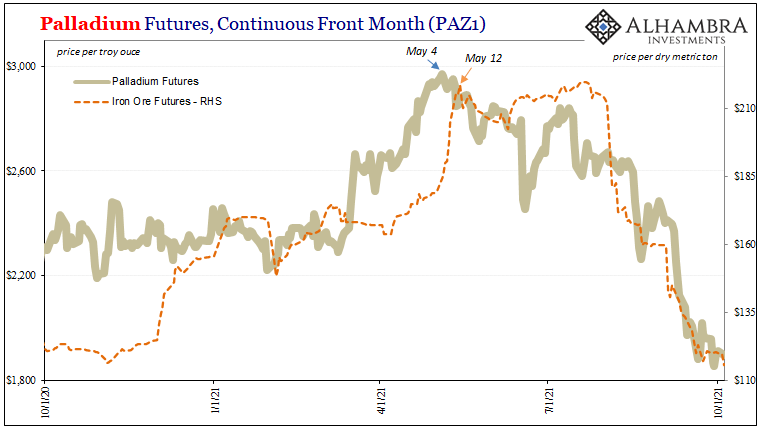

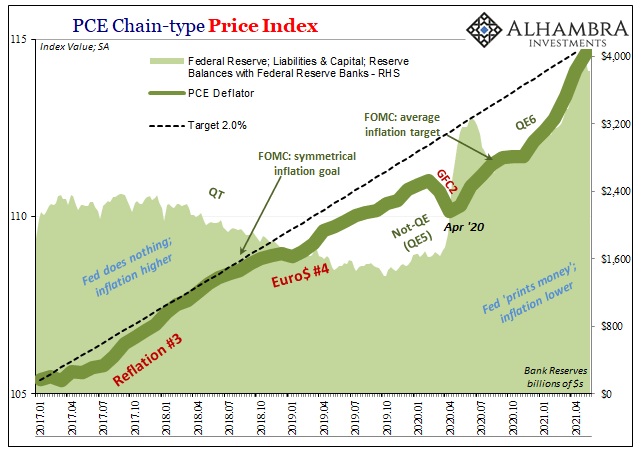

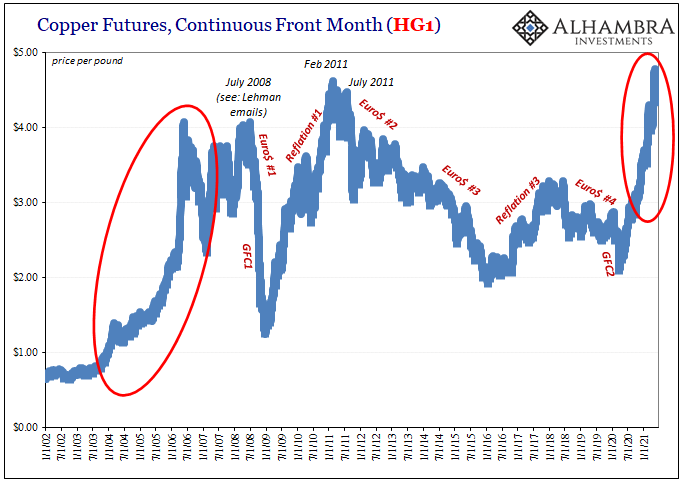

| Like commodity prices, expectations for huge ongoing demand would have to be adjusted to a very different set of macro circumstances starting with demand. And that’s an even more uncertain problem given the inability of the government’s statistical beancounters to more accurately estimate these non-recovery rebounds (see: recent benchmark revisions below which make it clear just how much activity is overstated by overzealous statistical assumptions).

You could at least understand why and how this kind of speculative scenario might develop; huge government intervention which gets Economists to produce incredibly optimistic forecasts on top of real problems in the supply chain. Those dealing with those problems might then become a little too aggressive in buying new equipment comforted by their Economists and econometric projections. Why not buy a bunch of new trucks, railroad cars, and new containers, even if they are effective at alleviating the supply bottlenecks, they’d still be productive given how, according to forecasts, the economy is going to be inflationary and roaring for a long time. New equipment not just for today’s issues, useful also into tomorrow’s undented consumer demand. |

But if that demand was overestimated all along, and Uncle Sam’s influence not nearly so lasting, then there’s more than a trivial chance of what is right now still too little transportation capacity becoming too much.

Even if this might not seem likely, it isn’t impossible and may be considered less unlikely the more the second half of 2021 continues to disappoint.

Tags: consumer goods,currencies,economy,factory orders,Featured,Federal Reserve/Monetary Policy,manufacturing,Markets,newsletter,transportion industries