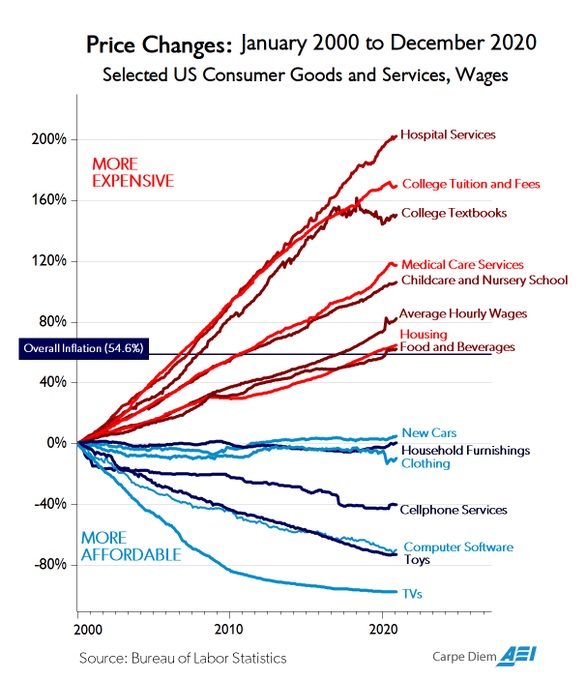

By Daniel Mitchell While I freely self-identify as a libertarian, I don’t think of myself as a philosophical ideologue. Instead, I’m someone who likes digging into data to determine the impact of government policy. US Consumer Goods and Services, Wages Price Change, 2000 - 2020 - Click to enlarge And because I’ve repeatedly noticed that more government almost always leads to worse outcomes, I’ve become a practical ideologue. In other words, when looking at at an issue, I now have a default assumption that government is going to be the problem, not the solution. I think more people will share my viewpoint if they peruse this chart from Mark Perry. It shows changes in prices for selected goods and services over the past 21 years, and the

Topics:

hayek_admin considers the following as important: 6b.) Austrian center, 6b) Austrian Economics, blog, Featured, newsletter

This could be interesting, too:

Clemens Schneider writes Café Kyiv

Clemens Schneider writes Germaine de Stael

Clemens Schneider writes Museums-Empfehlung National Portrait Gallery

Clemens Schneider writes Entwicklungszusammenarbeit privatisieren

|

While I freely self-identify as a libertarian, I don’t think of myself as a philosophical ideologue. Instead, I’m someone who likes digging into data to determine the impact of government policy. |

US Consumer Goods and Services, Wages Price Change, 2000 - 2020 |

| And because I’ve repeatedly noticed that more government almost always leads to worse outcomes, I’ve become a practical ideologue.

In other words, when looking at at an issue, I now have a default assumption that government is going to be the problem, not the solution. I think more people will share my viewpoint if they peruse this chart from Mark Perry. It shows changes in prices for selected goods and services over the past 21 years, and the inescapable conclusion (as I noted when writing about the 2014 version of his chart) is that we get higher relative prices in sectors where there’s the most government intervention. Especially healthcare and higher education. By contrast, we see falling relative prices (and sometimes falling absolute prices!) in sectors where there is little or no government intervention. Here’s some of Mark’s description of what we can learn from his chart.

|

|

| …Various observations that have been made about the huge divergence in price patterns over the last several decades… The greater (lower) the degree of government involvement in the provision of a good or service the greater (lower) the price increases (decreases) over time, e.g., hospital and medical costs, college tuition, childcare with both large degrees of government funding/regulation and large price increases vs. software, electronics, toys, cars and clothing with both relatively less government funding/regulation and falling prices.

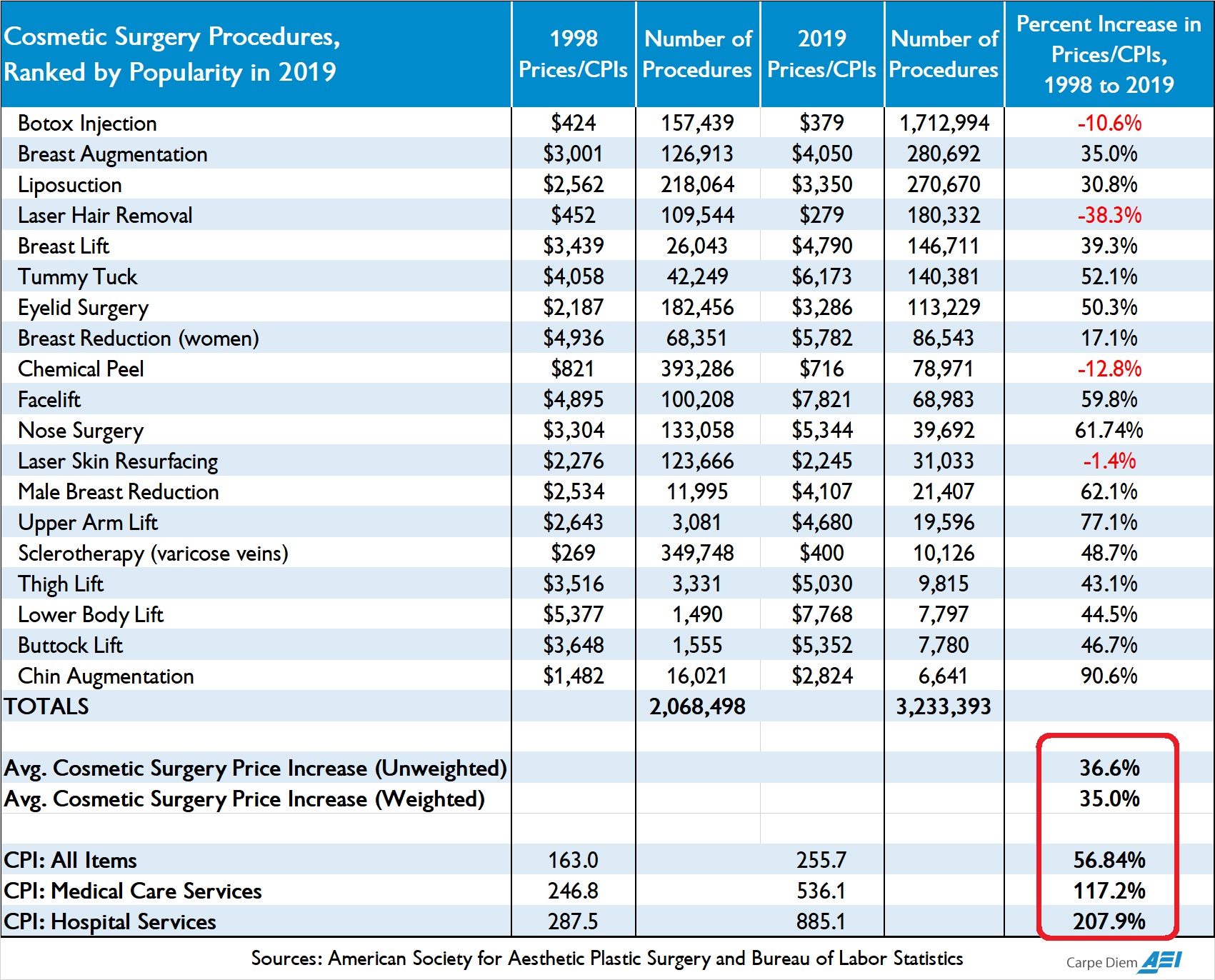

By the way, I can’t resist also calling attention to |

Cosmetic Surgery Procedures |

Mark’s data on what’s happened over time to prices for various health care services and procedures.

We find that prices have skyrocketed in areas of the healthcare sector where government plays a big role, especially hospital care.

By contrast, prices have been steady (or even falling!) in areas of the healthcare sector where competitive markets are allowed to operate, most notably for cosmetic procedures.

It’s almost as if it makes sense to have a default assumption that government is the problem rather than the solution.

P.S. While the data in Mark’s chart tell a depressing story about the harmful effect of government intervention, he shares one bit of good news in his article.

The annual increase in college tuition and fees of only 1.4% last year was the smallest annual increase in the history of the CPI for college tuition and fees going back to 1978, and the only annual increase ever below 2%. That increase is far below the average annual increase in college tuition of nearly 7% over the last 42 years. So perhaps the “higher education bubble” is finally starting to show signs of deflating?

I hope he’s right, but worry he’s wrong.

P.P.S. Sadly (but predictably), some people seem to think government-caused price increases are a reason to support more government intervention.

Daniel J. Mitchell is a public policy economist in Washington, D.C. He has been a Senior Fellow at the Cato Institute and the Heritage Foundation, an economist for Senator Bob Packwood and the Senate Finance Committee, and a Director of Tax and Budget Policy at Citizens for a Sound Economy. He has published in The Wall Street Journal, The New York Times, Investor’s Business Daily and The Washington Times. Dr. Mitchell received a Bachelor’s degree and a Master’s degree from the University of Georgia, and holds a PhD in economics from George Mason University.

Source: International Liberty

The post In One Image, Everything You Need to Know about Government Intervention appeared first on Austrian Economics Center.

Tags: Blog,Featured,newsletter