Swiss Franc The Euro has risen by 0.18% at 1.1264 EUR/CHF and USD/CHF, April 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The heads of state may have agreed on the modernization of NAFTA, but the necessary legislative approval may not be forthcoming this year. The US legislative process has been complicated by the fact that the Democrats secured a majority in the House of Representatives last year. The new trade agreement appears to be mostly updating the current one and melding with the advances of the Trans-Pacific Partnership that many Democrats supported as a signature Obama trade agreement (though not Clinton or Sanders). The USMCA, as NAFTA 2.0 is

Topics:

Marc Chandler considers the following as important: 4) FX Trends, Featured, NAFTA, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

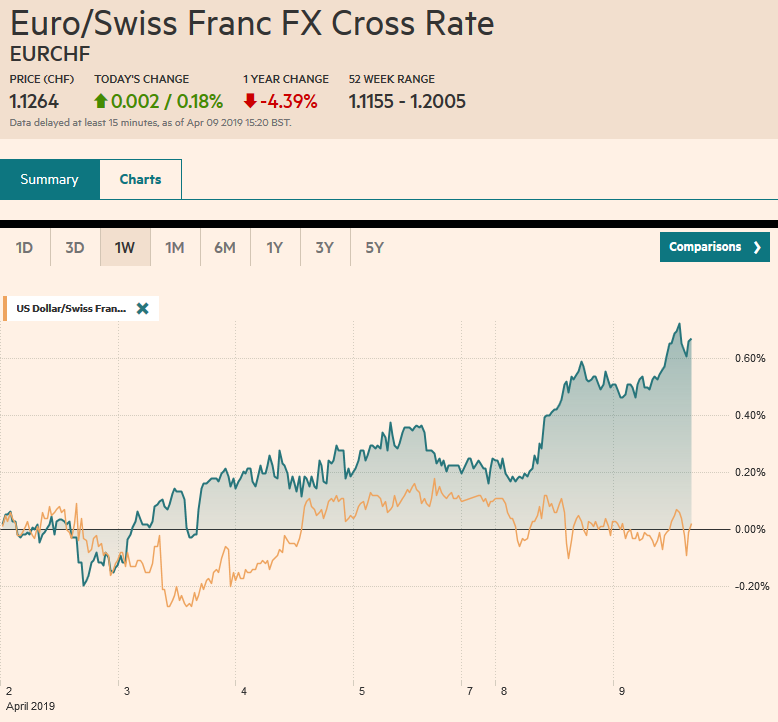

Swiss FrancThe Euro has risen by 0.18% at 1.1264 |

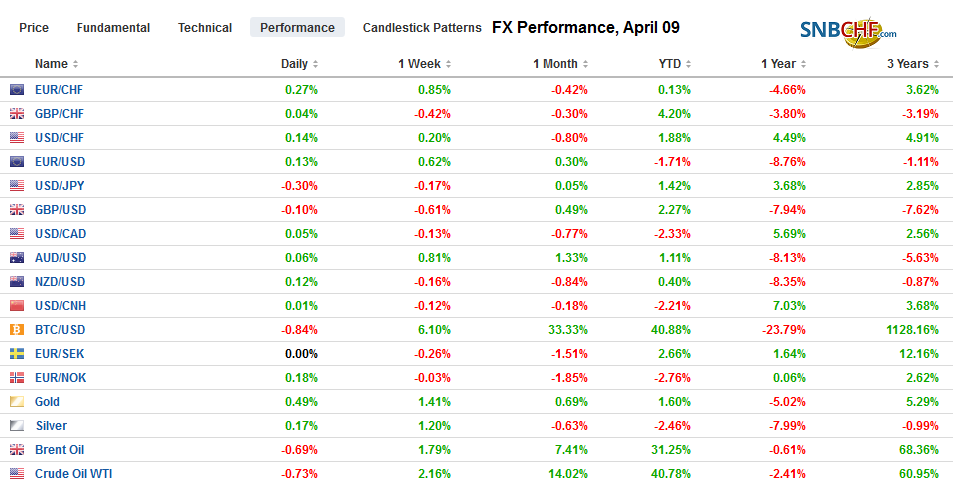

EUR/CHF and USD/CHF, April 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe heads of state may have agreed on the modernization of NAFTA, but the necessary legislative approval may not be forthcoming this year. The US legislative process has been complicated by the fact that the Democrats secured a majority in the House of Representatives last year. The new trade agreement appears to be mostly updating the current one and melding with the advances of the Trans-Pacific Partnership that many Democrats supported as a signature Obama trade agreement (though not Clinton or Sanders). The USMCA, as NAFTA 2.0 is formally known, is both broader and deeper than its predecessor. It has a third more chapters, and the domestic content rule is complex to include a wage metric. The labor and environmental safeguards appear to have advanced from the first, but the Democrats are insisting on more. Mexico is poised to strengthen its domestic collective bargaining rights. Labor and environment disputes will, if the agreement is approved, be heard by the same panels that adjudicate trade, and the selection and terms of the panelists have been improved. This ought to facilitate more timely decisions. There are consequences of the complexity may be under-appreciated: compliance takes more effort. Ironically, the free-trade agreement will require a larger bureaucracy. Commercial activity needs to be monitored, and the rules must be enforced. This is a way to avoid (reduce the number) of disputes. There is also the domestic content compliance burden in the auto sector, which taken together will boost the cost of auto production in North America. |

FX Performance, April 09 |

Two dramas being played out in the US. The first revolves around the Democrat demands both substantive and partisan. Previously as Speaker, Pelosi did successfully block pending trading agreements with Colombia, South Korea, and Central America. Even in the best of circumstances, the legislative approval process can take a couple of quarters.

One drama comes from the legislative branch and the other from the executive branch. Canada and Mexico are chaffing under the steel and aluminum tariffs on national security grounds, which have not been lifted. It is insulting. The IMF’s review of the USMCA concluded that getting rid of the steel and aluminum tariffs and the retaliatory measures were the source of the agreement’s greatest value (otherwise it thought the impact was marginal).

Canada’s Parliament cannot approve USMCA with these still in place, all the more so, given the slowdown in the economy and the pending national elections. If the tariffs were not in place, consent would be secured by the June recess. If the levies are still in place by the end of Q2, the odds of approval this year would fall. The US election cycle kicks-in to overdrive early 2020, making approval in 2020 unlikely.

Nor does there seem to be an advantage for Canada to pass it well ahead of the US. And the same of course applies to Mexico about the US and Canada. The agenda of the left-populist AMLO converges with the nationalists and labor in the North, to strengthen the rights and pay of Mexican workers. AMLO may have secured another concession. It appears that the oil chapter may be an exception to the broader and deeper evolution generalization we made, allowing him a freer hand domestically.

NAFTA 1.0 seemed to reinvigorate GATT and helped push it toward metamorphosizing into the WTO. NAFTA 2.0 may not be as grandiose as codifying and furthering the development of a continental market, but two seemingly innocuous elements may indeed become templates in the US trade negotiations with Europe and Japan.

First, the US insists that intervention in the foreign exchange market should transparent. It will not impact Canada or Mexico, for they rarely intervene directly but indirectly through the setting of overnight interest rates, and not to target a particular level but to mitigate the economic consequences. It will not be an issue in the US-Europe talks, and although Japan’s activist intervention days are in the past, it is more the target.

Second, even though the US and China continue to work on a trade deal, if Canada or Mexico enter into an agreement with a “non-market economy” (euphemism for China), the US can choose to opt-out of the USMCA. The US buys about 80% of Mexico’s exports and around 75% of Canada’s. Although Canada and Mexico are parties are other free-trade agreements, putting a large barrier in the way of an agreement with China does not seem applicable.

It would make sense if it were a precedent for other agreements, though it is difficult to imagine Europe being able to abide by it. It also makes sense if one anticipated a new global division along the line,s perhaps, as we have suggested, of a new Cold War. NAFTA 2.0 would seem to consolidate and update the continental market, for which the US, its interests and companies dominate. China makes inroads into Asia and Africa, and even half of the EU members have MOUs with China’s Belt-Road Initiative. Trade within NAFTA is roughly twice the size of US-China trade.

Mexico’s political elite across the political spectrum have embraced the US as its development engine. Commerce has evolved from traditional trade to intra-industry and intra-firm emphasis. It is not just trade, it is joint production, and Mexico has moved up the value-added chain. A 2016 study found that US-Mexican trade, which has increased six-fold under NAFTA, supports roughly five million jobs compared with 700k in 1993.

However, the clumsy, dare one say, oafish, American behavior seems to be alienating its continental partners. There were threats to close the border over immigration and asylum seekers, some from the mess in Venezuela and over drugs. Instead of closing the border, the US President renewed his threat of 25% tariff on auto imports. Trump claimed that it overrode USMCA. This is not how to persuade others to risk their political capital one iota.

NAFTA 1.0 was going to be modernized through the Trans-Pacific Partnership, but the US withdrew from the negotiations, forcing the continental trade agreement to be re-opened. Trump had campaigned against NAFTA 1.0. However, the US behavior, including the persistence of the steel and aluminum tariffs now nearly six-months after heads of state struck the agreement, takes away any sense of urgency. This is especially true given the President Trump’s weaker domestic political hand after losing his majority in the lower chamber. Canada and Mexico seem content to continue living with NAFTA 1.0 if that is the alternative.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: Featured,NAFTA,newsletter