Stock Markets EM FX ended on a mixed note Friday, but capped off a very strong week overall. Best performers over the past week were RUB, ZAR, and COP, while the worst were PHP, CNY, and TWD. There is not much happening this week that could disrupt the weak dollar narrative, and so EM FX should continue to rally. Stock Markets Emerging Markets, February 14. Thailand Thailand reports Q4 GDP Monday, with growth expected to remain steady at 4.3% y/y. Despite the robust economy, price pressures remain low. CPI rose 0.7% y/y in January, below the 1-4% target range. BOT just left rates steady at 1.5% and signaled it was in no hurry to tighten. Next policy meeting is March 28, no change is expected. Poland Poland

Topics:

Win Thin considers the following as important: emerging markets, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

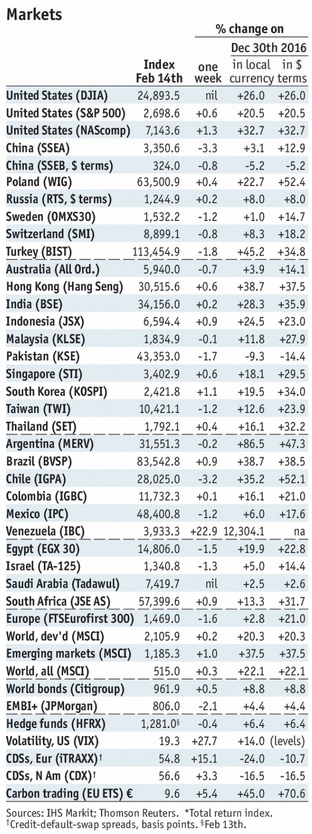

Stock MarketsEM FX ended on a mixed note Friday, but capped off a very strong week overall. Best performers over the past week were RUB, ZAR, and COP, while the worst were PHP, CNY, and TWD. There is not much happening this week that could disrupt the weak dollar narrative, and so EM FX should continue to rally. |

Stock Markets Emerging Markets, February 14 |

ThailandThailand reports Q4 GDP Monday, with growth expected to remain steady at 4.3% y/y. Despite the robust economy, price pressures remain low. CPI rose 0.7% y/y in January, below the 1-4% target range. BOT just left rates steady at 1.5% and signaled it was in no hurry to tighten. Next policy meeting is March 28, no change is expected. PolandPoland reports January industrial and construction output, PPI, and retail sales Tuesday. Real sector activity is expected to pick up from December, but price pressures remain tame. CPI inflation eased to 1.9% y/y from 2.1% in December and PPI inflation is expected to ease to 0.1% y/y from 0.3% in December. While the economy remains robust, low inflation could allow the central bank to remain on hold this year. Next policy meeting is March 7, no change is expected. IsraelIsrael reports December manufacturing production Tuesday. Over the weekend, it reported Q4 GDP, with growth at 3.6% SAAR vs. 3.1% expected and a revised 3.9%( was 3.5%) in Q3. Despite the robust economy, price pressures remain low. CPI rose 0.7% y/y in January, below the 1-4% target range. Next policy meeting is February 26, no change is expected. Political risk is rising as markets await a decision on charging Prime Minister Netanyahu. KoreaKorea reports trade data for the first 20 days of February Wednesday. After slowing in Q4 to single digits, export growth rebounded to 22% y/y in January. One by-product of the yen’s strength against the majors is the rise in JPY/KRW. Korean exporters like this cross above 10 and that’s where it’s been this past week. A sustained move above 10 should boost exports ahead. South AfricaSouth Africa reports January CPI Wednesday, which is expected to rise 4.4% y/y vs. 4.7% in December. If so, this would be the lowest rate since March 2015 and would put inflation in the bottom half of the 3-6% target range. This supports the case for lower rates. The central bank started the easing cycle last July with a 25 bp cut to 6.75%, but has been on hold since. If the rand remains relatively firm, we think another 25 bp cut to 6.5% is likely at the next policy meeting March 28. MexicoMexico reports mid-February CPI Thursday, which is expected to rise 5.46% y/y vs. 5.51% in mid-January. Banco de Mexico just hiked rates 25 bp again to 7.5%. Next policy meeting is April 12, and another hike then is possible. Mexico reports Q4 current account data Friday. Political risk is rising as markets ignore AMLO’s rising popularity ahead of the July election. SingaporeSingapore reports January CPI Friday, which is expected to rise 0.3% y/y vs. 0.4% in December. While the MAS does not have an explicit inflation target, low price pressures should allow it to remain on hold at its April policy meeting. Real sector data have been coming in a bit mixed, so we think MAS can afford to wait until the October to tighten policy. BrazilBrazil reports mid-February CPI Friday and is expected to rise 2.87% y/y vs. 3.02% in mid-January. In its latest minutes, the central bank left the door open for further cuts if inflation remains low. They just cut 25 bp to 6.75% and most believed that was the end of the cycle. With the economy picking up, we think more cuts would be risky. Next COPOM meeting is March 21, and we need to see how the data come in before then. |

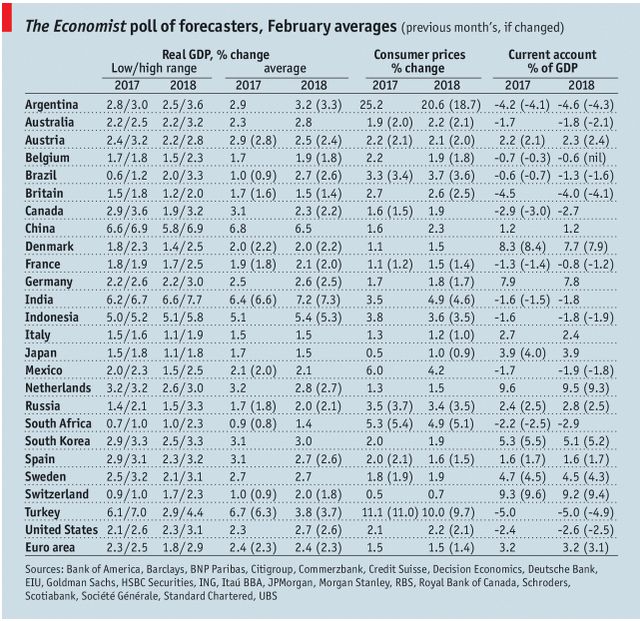

GDP, Consumer Inflation and Current Accounts Source: economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newsletter