See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Gold Scarcity Intensifies Further Last week (a holiday-shortened week, as Monday was President’s Day in the US), the price of the dollar fell. In gold, it fell almost half a milligram to 24.75mg, and prices in silver it dropped 30mg, to 1.7 grams of the white monetary metal. Looks good… and since last week, costs more. Photo credit: istara - Click to enlarge Prices of gold and silver Flipped upside down, gold went up 23 notes from the Federal Reserve, and silver appeared to go up by 41 cents. Below, we will show the only true picture of the gold and silver supply and demand fundamentals. But first, the price and ratio charts. Prices of gold and silver(see more posts on gold price, silver price, ) - Click to enlarge Gold-silver ratio Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It moved sideways again last week, which would normally be odd for a time when the prices of the metals are rising. Gold-silver ratio(see more posts on gold silver ratio, ) - Click to enlarge For each metal, we will look at a graph of the basis and co-basis overlaid with the price of the dollar in terms of the respective metal.

Topics:

Keith Weiner considers the following as important: dollar price, Featured, Gold and its price, Gold and silver prices, gold basis, Gold co-basis, gold price, gold silver ratio, newsletter, Precious Metals, silver basis, Silver co-basis, silver price

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango.

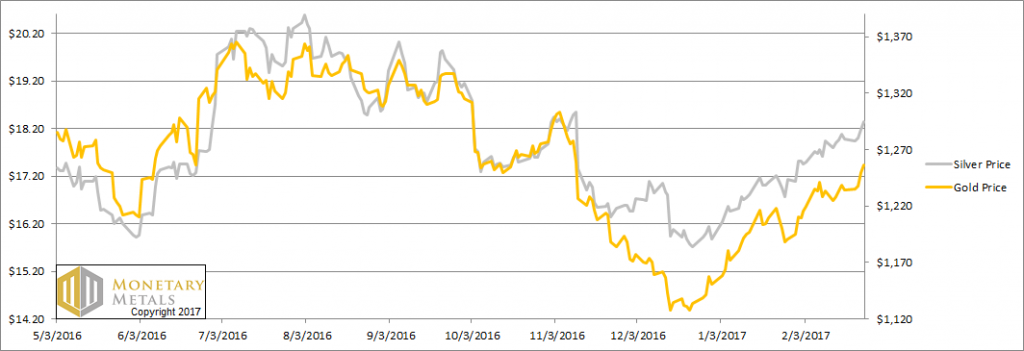

Gold Scarcity Intensifies FurtherLast week (a holiday-shortened week, as Monday was President’s Day in the US), the price of the dollar fell. In gold, it fell almost half a milligram to 24.75mg, and prices in silver it dropped 30mg, to 1.7 grams of the white monetary metal. |

|

Prices of gold and silverFlipped upside down, gold went up 23 notes from the Federal Reserve, and silver appeared to go up by 41 cents. Below, we will show the only true picture of the gold and silver supply and demand fundamentals. But first, the price and ratio charts. |

Prices of gold and silver(see more posts on gold price, silver price, ) |

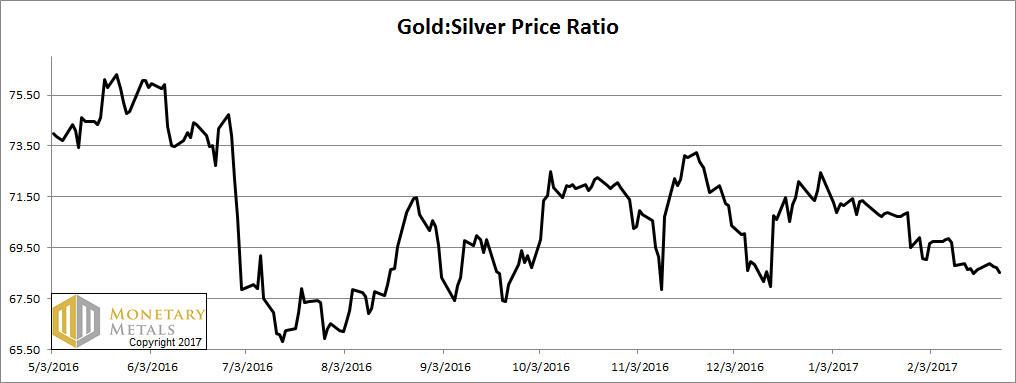

Gold-silver ratioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It moved sideways again last week, which would normally be odd for a time when the prices of the metals are rising. |

Gold-silver ratio(see more posts on gold silver ratio, ) |

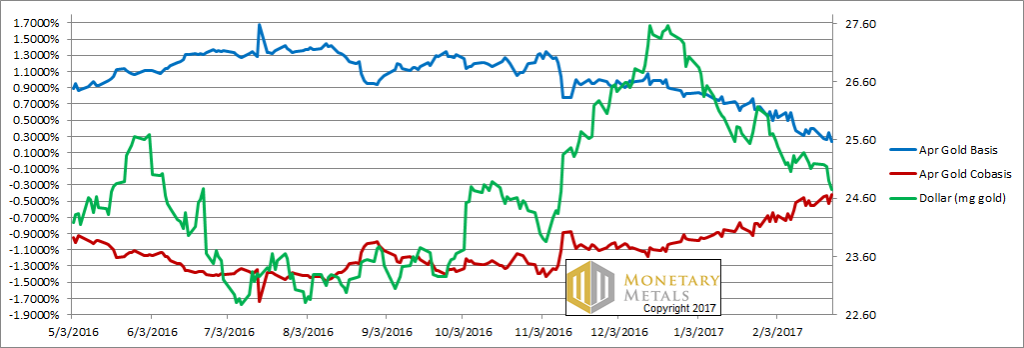

Gold basis and co-basis and the dollar priceHere is the gold graph. For a very long time, we would post graphs that looked almost the same. Oh, the specifics of month, price, and basis would be different. But they had a certain sameness. The price of the dollar (i.e., the inverse of the price of gold, in dollar terms) would move along with the co-basis (i.e. scarcity of gold). So as the dollar would rise (i.e. the price of gold would fall), the scarcity would rise, and vice versa. This means changes in price were due to changes in the behavior of speculators. And now we have a clear picture of… the opposite. The dollar has been falling since mid-December. And over the same time period, the co-basis (scarcity of gold) has been rising. Yes, gold has been getting scarcer while becoming pricier. How is this possible? Doesn’t the law of supply and demand work for gold? You know, the standard “X” graph from Econ. 101? Gold’s Unique CharacteristicsGold has several unique properties. One is that it is not purchased for consumption, but for monetary reserves or jewelry (which in most of the world is monetary reserves). Contrast that to copper which is purchased by plumbing manufacturers to make pipe. It’s a competitive market, and if the price of copper plumbing goes up too much then home builders will switch to plastic. Demand drops as price rises. Also, the marginal copper mine will increase production. Supply rises as price rises. It is self-correcting. Gold, not being bought to consume, does not have a limit to demand as price rises. If anything a rising price (i.e., a falling currency) signals to people that holding gold is a good thing. They were wise to get out of their falling paper currency, and should consider buying more gold. Also, virtually all of the gold ever mined in human history is still in human hands. All of this gold is potential supply, at the right price and under the right conditions. Even if gold mining worked like copper mining, and miners could just produce more, changes in mine production at the margin are not material to the overall gold supply. By official estimates, the total inventory of gold would take over 70 years to be produced at current mine production rates (and we believe this is a low estimate). Readers may object that this question is a bit unfair, as any commodity can experience rising tightness and that will accompany its rising price for a while until the market can correct itself. That is true, but what we are looking at in gold is not that at all. When the market corrects itself — which we think is very likely, we do not see Armageddon just yet — it will not be because gold miners have cranked up their output, nor because gold users have substituted another metal for it. There is no substitute for monetary reservation, particularly as paper currencies are in the terminal stages of failure. Our calculated fundamental price is now up to almost $1,400. |

Gold basis and co-basis and the dollar price(see more posts on dollar price, gold basis, Gold co-basis, ) |

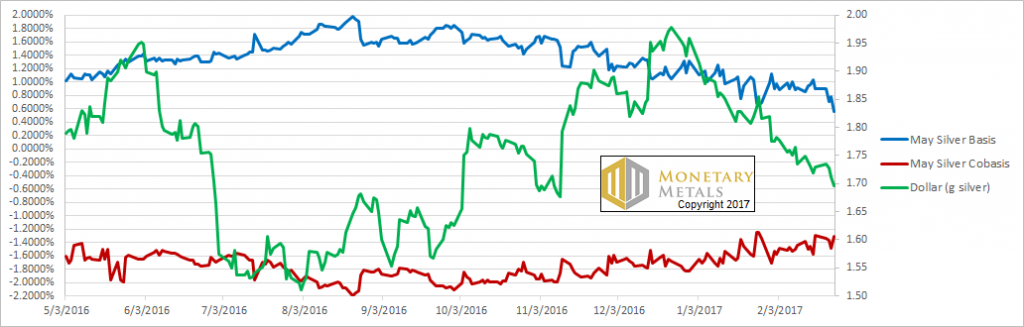

Silver Market Only Moderately TighterNow let’s look at silver. The trend of falling dollar (i.e. rising price of silver) and rising co-basis (scarcity) is here in silver, too, but it’s weaker. Silver does not quite have the same stocks to flows ratio as gold, but it has far and away a higher ratio than copper or any other ordinary commodity. That is why silver is the other monetary metal. The fundamental price of silver is now up to about $18.70. While this is above the market price of the metal, it’s not nearly so much above as gold. This is why we calculate a fundamental gold-silver ratio of over 74. |

Silver basis and co-basis and the dollar price(see more posts on dollar price, silver basis, Silver co-basis, ) |

Tags: dollar price,Featured,Gold and silver prices,gold basis,Gold co-basis,gold price,gold silver ratio,newsletter,Precious Metals,silver basis,Silver co-basis,silver price