See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Orders of Preference Last week, we discussed the growing stress in the credit markets. We noted this is a reason to buy gold, and likely the reason why gold buying has ticked up since just before Christmas. Many people live in countries where another paper scrip is declared to be money — to picture the absurdity, just imagine a king declaring that the tide must roll back and not get his feet wet when his throne is placed on the beach — not real money like the US dollar. It should be obvious, but we have seen much disinformation out there promoting the idea that the dollar is collapsing. Most of the time, most of these people buy dollars as the escape hatch from their native currencies. They buy the dollar first, and gold (for now) is a distant second. That leads to the question of silver. Do they buy silver in equal measure as gold, or is silver a distant second to gold, as gold is a distant second to the dollar. Theory tells us that gold is more portable. It is much, much more portable. First, the same weight of gold is about half the volume of silver. A 1oz gold Maple Leaf coin (which is pure gold) is much smaller than a 1oz silver Maple.

Topics:

Keith Weiner considers the following as important: dollar price, Featured, Gold and its price, gold basis, Gold co-basis, gold price, gold silver ratio, newsletter, Precious Metals, silver basis, Silver co-basis, silver price

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango.

Orders of PreferenceLast week, we discussed the growing stress in the credit markets. We noted this is a reason to buy gold, and likely the reason why gold buying has ticked up since just before Christmas. Many people live in countries where another paper scrip is declared to be money — to picture the absurdity, just imagine a king declaring that the tide must roll back and not get his feet wet when his throne is placed on the beach — not real money like the US dollar. It should be obvious, but we have seen much disinformation out there promoting the idea that the dollar is collapsing. Most of the time, most of these people buy dollars as the escape hatch from their native currencies. They buy the dollar first, and gold (for now) is a distant second. That leads to the question of silver. Do they buy silver in equal measure as gold, or is silver a distant second to gold, as gold is a distant second to the dollar. Theory tells us that gold is more portable. It is much, much more portable. First, the same weight of gold is about half the volume of silver. A 1oz gold Maple Leaf coin (which is pure gold) is much smaller than a 1oz silver Maple. |

Holding back the tides is serious business… apart from his odd obsession with the waves, King Cnut the Great, son of Sweyn Forkbeard, King of all England and Denmark and the Norwegians and of some of the Swedes, is reportedly known to historians as the most effective Danish King England ever had [PT] - Click to enlarge |

| And right now, the value of an ounce of gold is just about 70 times greater than the value of an ounce of silver. The math works out that the same value of silver is 126x more bulky than gold.

If you are paying for storage, that may be important. It sure is, if you are thinking you may need to carry it on your person. A gold bar worth $120,000 would fit in your trouser pocket (a bit heavy at 3kg, but you could do it). That much silver would be almost 7 of those big bars which are the size of small loaves of bread. Each. All that silver would weigh about as much as two heavyweight boxers. Gold is also more liquid. |

|

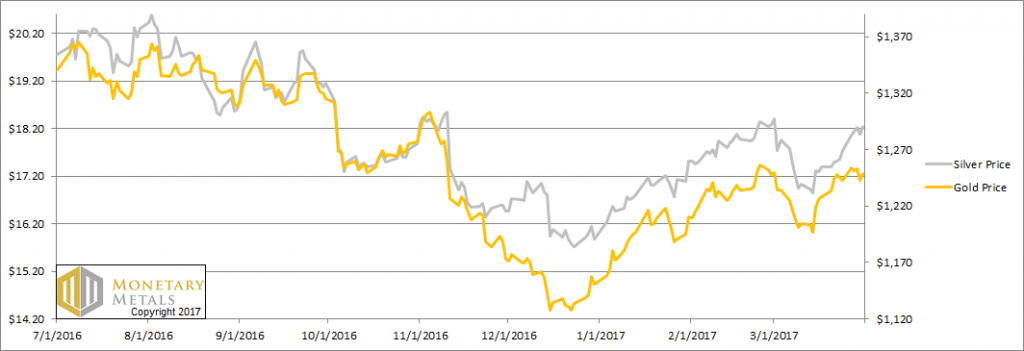

Fundamental DevelopmentsWhat does the data tell us about demand for silver relative to gold right now? We will look at that below in the only true picture of supply and demand in the gold and silver markets. But first, the price and ratio charts. |

Gold and Silver Price(see more posts on gold price, silver price, ) |

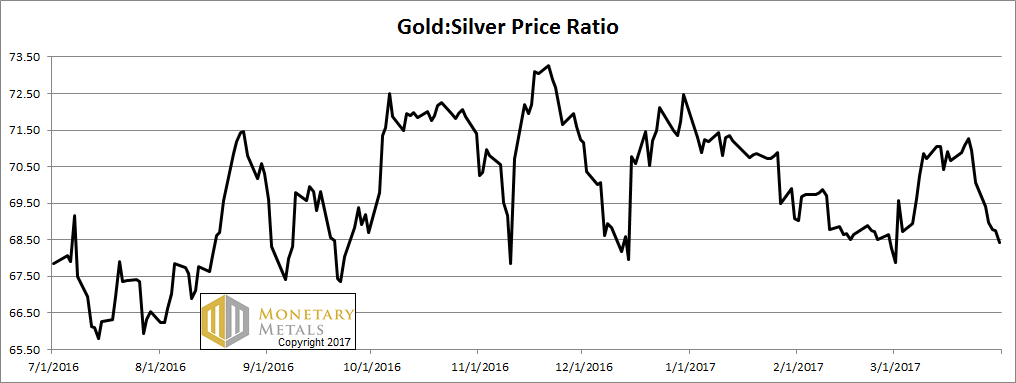

Gold:Silver RatioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It moved down this week. Is it approaching a line of support?

|

Gold:Silver Ratio(see more posts on gold silver ratio, ) |

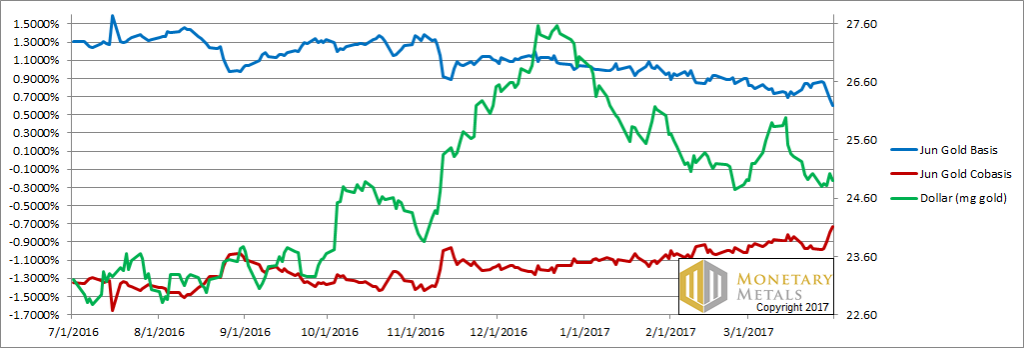

Gold Basis and Co-basis and the Dollar PriceHere is the gold graph. The price of the dollar fell a bit more (this is the inverse of the rising price of gold, measured in dollars, +$14). But look at that move in the co-basis (i.e. the red line, our measure of scarcity). What does it mean when the price of gold rises, but the metal becomes more scarce? We have been saying for a few weeks that fundamental buying — when people take real metal home, presumably not to bring it back to the market for the foreseeable future — is “sputtering”. Last week, gold buying this week was biased towards speculation on futures. This week, the bias is back to physical metal. Our calculated fundamental price of gold is up over $30. It’s just a hair under $200 over the market price. Gold is being offered at a quite a discount. |

Gold Basis and Co-basis and the Dollar Price(see more posts on dollar price, gold basis, Gold co-basis, ) |

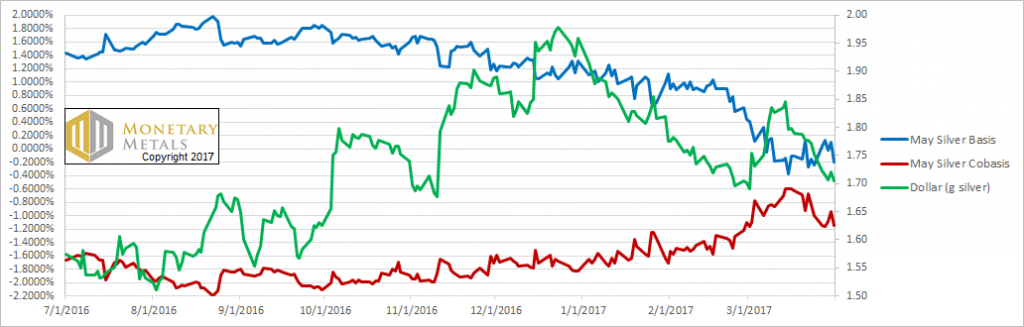

Silver Basis and Co-basis and the Dollar PriceNow let’s look at silver. Uh oh. We can see immediately, that the co-basis has fallen in silver about 2/3 as much as it rose in gold. Granted, the price of silver rose 2.9% whereas that of gold went up only 0.5%. The speculators were much more aggressive in the silver market, as they often are. Our calculated silver fundamental price is up about 40 cents, whereas the market price was up 51 cents. The silver fundamental price is now about $0.80 over the market price. Getting back to our question at the top, we can see in the data that people buy first gold when they fear credit stress and default. Speculators can temporarily move the price quite a lot, as they attempt to front-run the market. So, naturally, they are focusing on the silver market as the general rule when gold goes up, silver goes up more. That may be true when central banks’ stimulus efforts are successful in causing an increase in production of goods, including goods that contain silver. Less so, when metal buyers are not buying to consume but to opt out of the banking system. There are people who buy silver metal in preference to gold, for example those who cannot afford to buy gold. But at this stage, the balance favors gold. We calculate a fundamental gold-silver ratio of about 75.8. |

Silver Basis and Co-basis and the Dollar Price(see more posts on dollar price, silver basis, Silver co-basis, ) |

Charts: © 2017 Monetary Metals

Tags: dollar price,Featured,gold basis,Gold co-basis,gold price,gold silver ratio,newsletter,Precious Metals,silver basis,Silver co-basis,silver price