Going back to 2014, it was common for whenever whatever economic data point disappointed that whomever optimistic economist or policymaker would overrule it by pointing to “global growth.” It was the equivalent of shutting down an uncomfortable debate with ad hominem attacks. You can’t falsify “global growth” because you can’t really define what it is. Japan was common then among the world’s various economies to be relying so much on it. As I wrote that September: The curious part about that “pick-up in global demand” is exactly what I am driving at. What he [BoJ Deputy Governor Kikuo Iwata] is saying is that the economy in Japan will get better because some nebulous notion of the global economy will get better; or,

Topics:

Jeffrey P. Snider considers the following as important: China, currencies, demand, economy, eurodollar system, Europe, exports, Featured, Federal Reserve/Monetary Policy, Global Growth, global trade, imports, Markets, newslettersent, The United States, tic, U.S. Trade Balance

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

| Going back to 2014, it was common for whenever whatever economic data point disappointed that whomever optimistic economist or policymaker would overrule it by pointing to “global growth.” It was the equivalent of shutting down an uncomfortable debate with ad hominem attacks. You can’t falsify “global growth” because you can’t really define what it is.

Japan was common then among the world’s various economies to be relying so much on it. As I wrote that September:

|

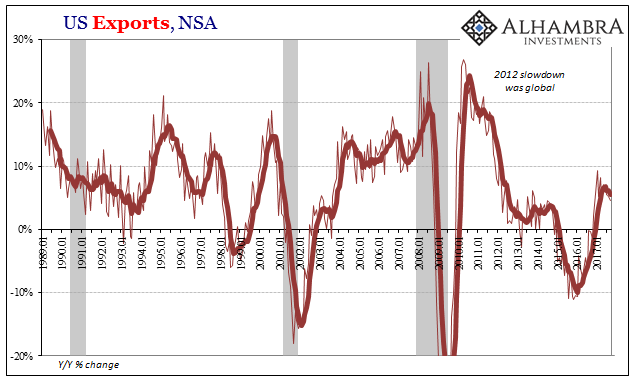

US Exports, Jan 1989 - 2017 |

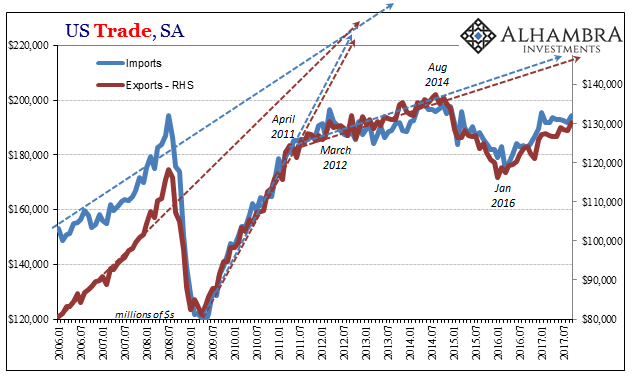

It became a staple of mainstream analysis because it was easy and non-specific. And in many ways it has become so again, in 2017 perhaps even to that much more of an impressive (sounding) degree. This time around not only is “global growth” supposedly picking up, it is doing so in synchronized fashion. Being applied to Japan again and more so China, it’s the first time in seven or perhaps ten years, apparently, that this has happened – therefore we are meant to be very impressed by it even if it still remains undefined.

|

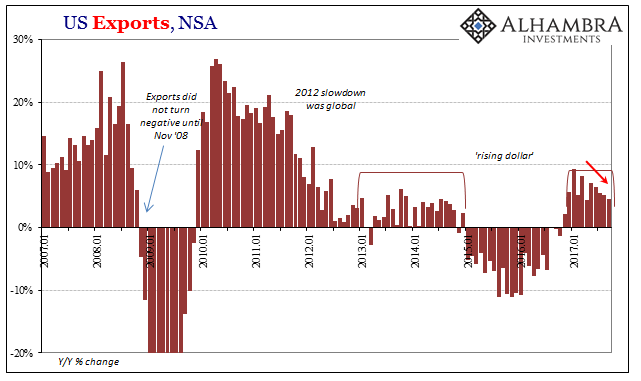

US Exports, Jan 2007 - 2017 |

And:

|

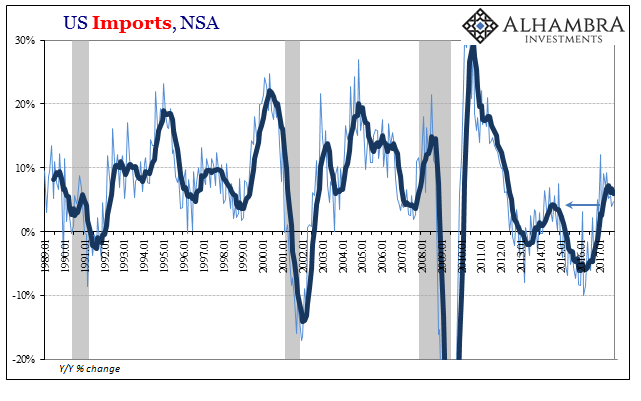

US Imports, Jan 1989 - 2017 |

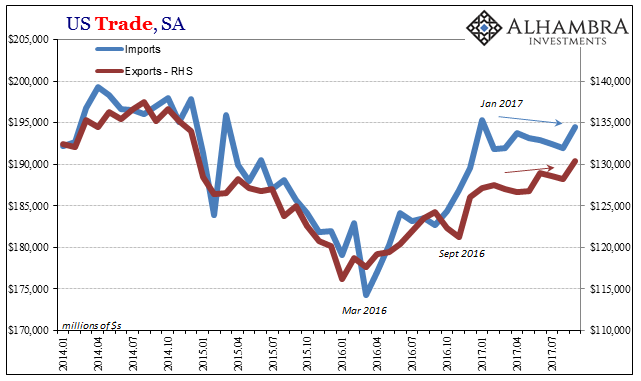

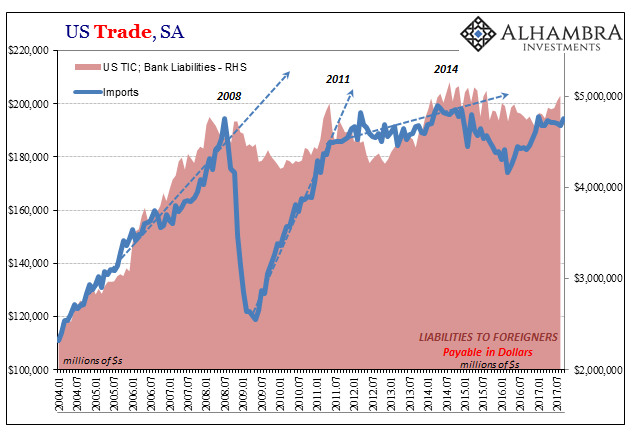

| If such a thing was to occur, its presence would immediately be felt in global trade. There was some rise in trade late last year and even for a few months early this year, but in the interim since that just hasn’t been the case. Global trade has stalled in various localities, none more so than the United States.

The Census Bureau reported today that total US exports of goods in September 2017 rose by just 4.5% year-over-year (NSA). That result continues to suggest fading rather than accelerating global demand for US goods. On the other side, US imports were up but 4.8% in that same month. It alternately proposes fading rather than accelerating US demand for global goods. |

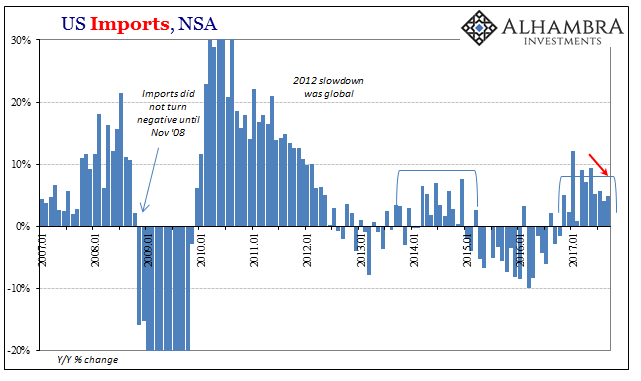

US Imports, Jan 2007 - 2017 |

| The estimates in seasonally-adjusted terms were slightly more favorable, with both exports and imports rising month-over-month. |

US Trade Balance, Jan 2014 - Jul 2017(see more posts on U.S. Trade Balance, ) |

| Despite that, however, there has clearly been a slowdown (or worse, as in the case of imports) from the “reflation” impulse experienced in the second half of last year coming of the global downturn. |

US Trade Balance, Jan 2006 - Jul 2017(see more posts on U.S. Trade Balance, ) |

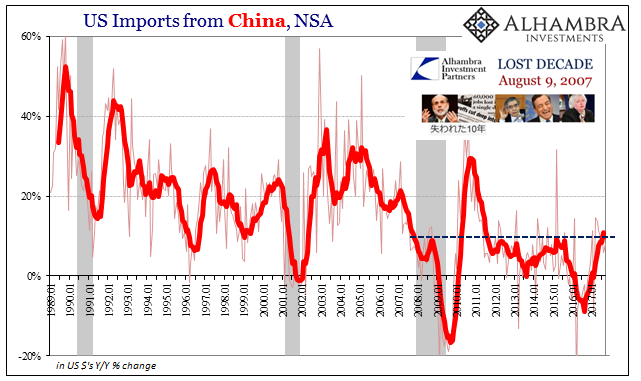

| Given that the slump was almost two years ago now, and the deviation on the upside dating back to the start of this year, it is fair to conclude that “synchronized global growth” is more of a loose term of art (predicated on bias and hope) than anything actually specific and solid. In short, it is exactly like 2014.

That’s certainly the case for the external view of US trade, where global partners keep waiting for the month or even year where US demand for their material comes close to matching the mainstream descriptions. Imports from China were up 8.1% in September (NSA, Y/Y), a growth rate again among the lesser results in 2017 and nowhere near what the Chinese really need for their economy to do more than raise constant questions. |

US Imports from China, Jan 1989 - 2017 |

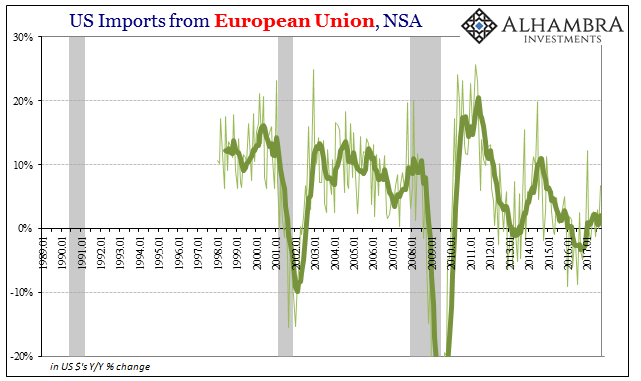

| The Census Bureau estimates similar numbers in imports from Europe, where in 2017 US demand for trade from across the Atlantic hasn’t at any time during the past year and a half been even close to comparable to 2017. |

US Imports from European Union, Jan 1989 - 2017 |

| Part of the reason for this disconnect is that the global economy, such that it is, really should be experiencing profound growth. The economy fell off and often sharply around the world during 2014-16, which in normal times usually gives way to an equally or better rebound. Instead, this upturn continues to be worse on every front.

By all cyclical accounts, there is every reason to expect an actually strong growth impulse in all these various places – every reason but one: |

US Trade Balance, Jan 2004 - Jul 2017(see more posts on U.S. Trade Balance, ) |

Tags: China,currencies,demand,economy,eurodollar system,Europe,exports,Featured,Federal Reserve/Monetary Policy,global growth,global trade,imports,Markets,newslettersent,tic,U.S. Trade Balance