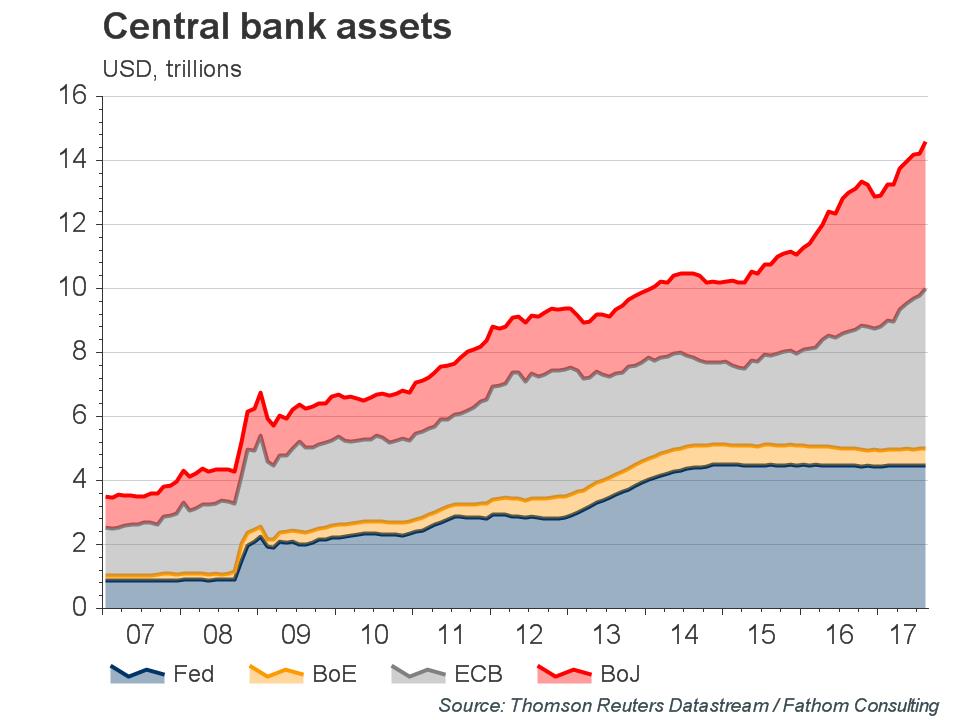

Global Outlook – Mad, Mad, Mad, MAD World: News in Charts by Fathom Consulting via Thomson Reuters Alarm bells are ringing for economic fundamentalists such as Fathom Consulting. Asset prices look increasingly out of step with fundamentals, and in some cases they look downright bubbly. And other geopolitical developments are similarly alarming. One might even describe them as… Central Bank Assets, 2007 - 2017 - Click to enlarge Mad: Equity prices in developed economies, and specifically in the US, are more than one standard deviation higher than their long-run average in relation to nominal GDP. Mad: The Nasdaq has again played its part, posting an even greater degree of fundamental overvaluation than the S&P

Topics:

Mark O'Byrne considers the following as important: Daily Market Update, Featured, GoldCore, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Global Outlook – Mad, Mad, Mad, MAD World: News in Charts

by Fathom Consulting via Thomson Reuters Alarm bells are ringing for economic fundamentalists such as Fathom Consulting. Asset prices look increasingly out of step with fundamentals, and in some cases they look downright bubbly. And other geopolitical developments are similarly alarming. One might even describe them as… |

Central Bank Assets, 2007 - 2017 |

| Mad:

Equity prices in developed economies, and specifically in the US, are more than one standard deviation higher than their long-run average in relation to nominal GDP. Mad: The Nasdaq has again played its part, posting an even greater degree of fundamental overvaluation than the S&P 500. Its degree of overvaluation in relation to nominal GDP is now close to its dotcom bubble high. Mad: Government bond prices across the developed world are at all-time highs. Bond prices have been increasing consistently since the 1980s, with a series of global shocks driving that move. Total central bank assets across the developed world now stand at over $14 trillion, having increased by about $10 trillion since the recession … This is genuinely uncharted territory: here be dragons! Full article by Fathom Consulting can be read on Thomson Reuters |

Tags: Daily Market Update,Featured,newsletter