For the Swiss press, 2015 has been the year of the “Swiss franc shock“. Based on the GDP release from the Swiss ministry of economics (SECO), we wanted to know what in the Swiss economy got really “shocked”. The following table compares the Swiss GDP components and population data since 2009. Economists might think that the “Swiss franc shock“, the suddenly far stronger franc in January 2015 should lead to less exports and more imports, hence to a considerable weakening of “Net Exports”. But this was not the case. On the contrary, exports of goods rose by 5%, while imports of goods contracted. Net exports increased by nearly 1%. Similarly as 2014, it contributed most to GDP growth. 2009 2010 2011 2012 2013 2014 2015 Gross Domestic Product -2.1% +3.0% +1.8% +1.1% +1.8% +1.9% +0.9% Consumption +1.6% +1.4% +1.0% +2.6% +2.1% +1.3% +1.2% Consumption of private householdsand NPISHs +1.3% +1.6% +0.8% +2.6% +2.1% +1.3% +1.1% General government consumption +2.1% +0.2% +2.1 +2.1% +1.3% +1.3% +1.7% Investments in equipment/software -12.9% +4.9% +5.3% +2.8% +0.0% +1.3% +3.2% Construction investments +3.0% +3.5% +2.5% +2.9% +3.1% +3.3% -1.2% Local Demand(consumption+investment+inventories) -0.9% +2.2% +1.9% +2.7% +1.8% +1.5% +1.2% Net Exports Growth in percent(divided by GDP) -1.92% +0.30% -0.09% -0.25% -0.58% +1.01% +0.98% Exports of goods(excl.

Topics:

George Dorgan considers the following as important: CHF, Featured, newsletter, Swiss Franc shock

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

For the Swiss press, 2015 has been the year of the “Swiss franc shock“. Based on the GDP release from the Swiss ministry of economics (SECO), we wanted to know what in the Swiss economy got really “shocked”. The following table compares the Swiss GDP components and population data since 2009.

Economists might think that the “Swiss franc shock“, the suddenly far stronger franc in January 2015 should lead to less exports and more imports, hence to a considerable weakening of “Net Exports”. But this was not the case. On the contrary, exports of goods rose by 5%, while imports of goods contracted. Net exports increased by nearly 1%. Similarly as 2014, it contributed most to GDP growth.

| 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | |

|---|---|---|---|---|---|---|---|

| Gross Domestic Product | -2.1% | +3.0% | +1.8% | +1.1% | +1.8% | +1.9% | +0.9% |

| Consumption | +1.6% | +1.4% | +1.0% | +2.6% | +2.1% | +1.3% | +1.2% |

|

+1.3% | +1.6% | +0.8% | +2.6% | +2.1% | +1.3% | +1.1% |

|

+2.1% | +0.2% | +2.1 | +2.1% | +1.3% | +1.3% | +1.7% |

| Investments in equipment/software | -12.9% | +4.9% | +5.3% | +2.8% | +0.0% | +1.3% | +3.2% |

| Construction investments | +3.0% | +3.5% | +2.5% | +2.9% | +3.1% | +3.3% | -1.2% |

| Local Demand (consumption+investment+inventories) |

-0.9% | +2.2% | +1.9% | +2.7% | +1.8% | +1.5% | +1.2% |

| Net Exports Growth in percent (divided by GDP) |

-1.92% | +0.30% | -0.09% | -0.25% | -0.58% | +1.01% | +0.98% |

|

-8.7% | +11.4% | +6.2% | +0.9% | -2.3% | +5.1% | +5.0% |

|

-4.2% | +1.2% | -2.2% | +7.4% | +4.7% | +2.4% | -0.2% |

|

-8.3% | +10.9% | +3.1% | +2.3% | +0.7% | +1.7% | -0.9% |

|

+4.7% | +6.6% | +8.6% | +9.3% | 2,9% | +5.1% | +7.4% |

| Net Exports in % of GDP | 11.8% | 11.7% | 11.4% | 11.0% | 10.3% | 11.1% | 11.9% |

| Population (Q4 data) | +1.08% | +1.07% | +1.06% | +1.25% | +1.20% | ||

| Working Population (Q4 data) | +1.07% | +2.61% | +1.23% | +1.97% | +2.33% | +0.54% | |

| GDP Deflator | +0.3% | +0.2% | -0.2% | 0.0% | -0.7% | -1.3% | |

| (snbchf.com, based on SECO and Swiss statistics) | *Import and exports of “non-monetary gold” and valuables are excluded from the GDP calculation |

||||||

Swiss Franc Shock Propaganda

During the whole year the Swiss press spoke about the layoffs that will happen due to the strong franc. They were partially right: In 2015, the working population rose by 0.54% instead of 2.3% in 2014. The unemployment rate increased from 3.4% in December 2014 to 3.7% in December 2015.

But looking at the detailed figures, we recognize that household consumption is the GDP component that got hampered most by the “Swiss franc shock” , but not net exports. Household consumption increased by only 1.1%, while still in 2012 and 2013 values of over 2% were achieved. True, some jobs got lost in one major export sector, namely in industrial production. But the pharmaceutical and chemicals strongly expanded their export figures.

The Swiss economy could not replace lost export jobs with new consumption-based jobs. The major reason is the negative Swiss press that only speaks about the “Swiss franc shock” and the lost jobs in the export area, but not about increased purchasing power and new jobs in the internal economy. Hence, the Swiss press managed to scare the population more than needed, with the “Swiss Franc Shock Propaganda”.

In the United States things are different: A stronger dollar most often comes together with cheaper gas prices. This leads to more money in the pockets of US consumers, to more optimism in the press, to more consumption, to more jobs and – often to an even stronger dollar.

The big Swiss rebalancing has not started yet

Based on Michael Pettis’ book The Great Rebalancing, I coined the term the “Big Swiss Rebalancing” on a post in Ökonomenstimme.

The Swiss economy is still driven by anemic consumption and by a heavy dependency on exports. The Swiss produce, the rest of world must consume. One good example of a consumption-driven economy is Spain with consumption growth of 3.5% in 2015.

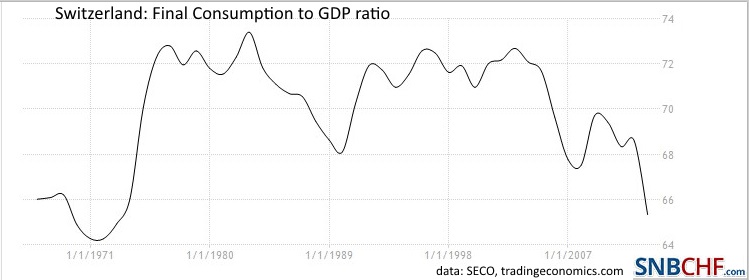

The first big Swiss rebalancing started in 1978, when the first cap on CHF finally led to higher wages, higher inflation and a higher ratio between consumption and GDP (see below). The second big Swiss rebalancing happened in the early 1990s when high public spending in Germany after the reunification boosted Swiss growth, wages and consumption.

As I suggested in the Oekonomenstimme, the only receipe to rebalance the Swiss economy, are considerable increases in wages that will lead to more consumption. Mainstream economists, however, suggest that Swiss wages should increase only modestly.