(Disclosure: Some of the links below may be affiliate links) There are many third pillar providers in Switzerland. Some of them are good, but most of them are too expensive. You do not want to waste your retirement bank on fees. Therefore, you need to choose the best third pillar provider. In 2018, VIAC started on the market of third pillars. VIAC is the first mobile third pillar. And they are really interesting! VIAC has very low fees and lets you invest up to 97% exposure in stocks. It is significantly better than what I have found before in other third-pillar providers. In this post, I am going to do an in-depth review of VIAC! Among other things, we will look at the investing strategies and the fees of this service. VIAC VIAC LogoVIAC is a

Topics:

Mr. The Poor Swiss considers the following as important: Investing, retirement, Switzerland

This could be interesting, too:

Lance Roberts writes CAPE-5: A Different Measure Of Valuation

Lance Roberts writes CAPE-5: A Different Measure Of Valuation

Lance Roberts writes Estimates By Analysts Have Gone Parabolic

Fintechnews Switzerland writes Top 12 Fintech Courses and Certifications in Switzerland in 2025

(Disclosure: Some of the links below may be affiliate links)

There are many third pillar providers in Switzerland. Some of them are good, but most of them are too expensive. You do not want to waste your retirement bank on fees. Therefore, you need to choose the best third pillar provider.

In 2018, VIAC started on the market of third pillars. VIAC is the first mobile third pillar. And they are really interesting! VIAC has very low fees and lets you invest up to 97% exposure in stocks. It is significantly better than what I have found before in other third-pillar providers.

In this post, I am going to do an in-depth review of VIAC! Among other things, we will look at the investing strategies and the fees of this service.

VIAC

VIAC is a recent actor in the third pillar area. It was launched in 2018. And it is becoming more and more popular.

It is new compared to other big banks. It is important to mention that VIAC is not a bank. The money that you have invested with them is stored in the WIR bank. As such, you will have full protection up to 100’000 CHF like the other banks. This protection is very important. Without that, I would not consider this provider at all. You want your money to have maximum protection.

VIAC is quite different from the other providers. You will only have access through a mobile application or web application. They do not have offices where you can do operations with them. This absence of bank offices is what makes them offer very low fees.

They started with only a mobile application. But since then, VIAC added support for a web application. The web application is great for people like me who are not fond of mobile phones. And most people will probably like the mobile application since people are fond of phones these days.

To learn more about VIAC, you can read my Interview of Daniel Peter, CEO of VIAC.

So, let’s see how good VIAC is as a third pillar in Switzerland.

Investing Strategies

For long-term investors, the investing strategy of a third pillar is extremely important.

VIAC offers three sets of strategies: Global, Switzerland, and Global Sustainable. The first one is investing in the entire world. The second one is focusing on Swiss stocks. And the third one also invests in the whole world but omits some stocks such as nuclear, tobacco, or weapons stocks. This is called sustainable investing.

For each of these strategies, they have five variants: 20, 40, 60, 80, and 100. These variants are specifying the allocation to stocks.

You can also define your strategy by composing it with the different underlying funds that they are using. This is a great way for you to choose exactly what you want to invest in. But then, you need to have a good idea of how to create a custom portfolio. I would not recommend this to a starter investor.

The fact that we can go up to 100% invested is really great! For a long-term aggressive investor, this is ideal. It is actually investing only 97% since they keep 3% in cash in each portfolio. But 97% is already a great amount invested in stocks.

They do not use bonds since Swiss bonds have a negative yield. Swiss cash is currently much better than Swiss bonds. So, if you use a strategy with a lower amount of stocks, cash will be used instead of bonds. Also, you will not pay fees on the cash part, it will even give you a tiny interest rate.

You can also have several portfolios, up to five. This is great if you want to optimize taxes by doing staggered withdrawals.

VIAC Global 100 Fund

The most interesting strategy is the VIAC Global 100 strategy. This is what I chose for my VIAC account.

This fund invests 97% in stocks. Out of these stocks, 40% are Swiss stocks. This is a regulation limit that they cannot cross. The rest is invested in the entire world based on market-cap weight. The remaining 3% is allocated to cash.

The TER of this strategy is o.51%. And there are no other fees! This makes it a very cheap solution for Switzerland!

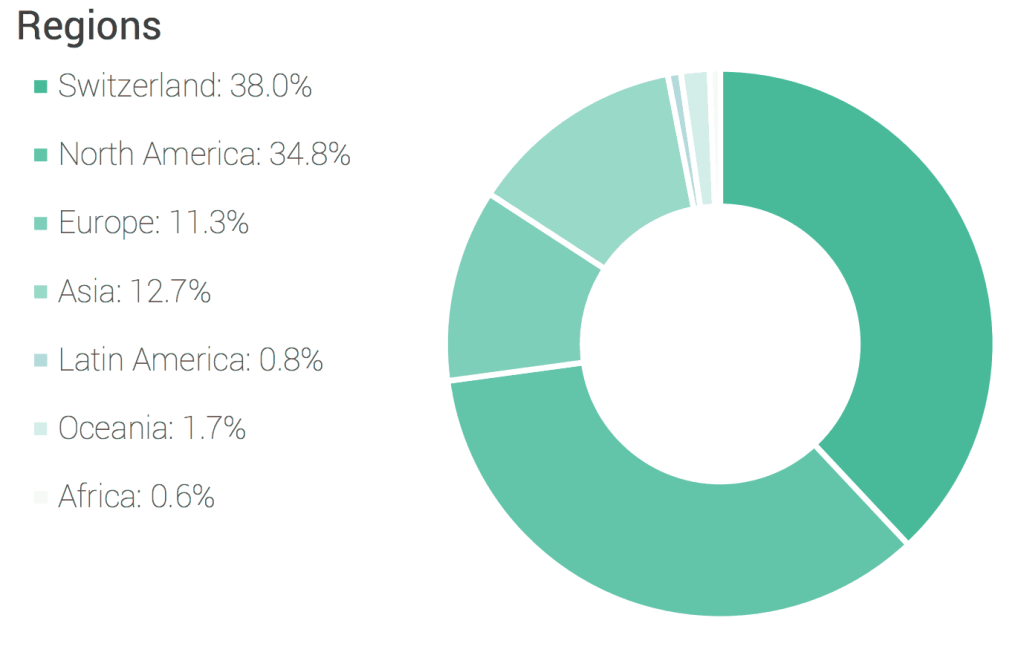

Here is the allocation by region of the Global 100 fund:

And there is the exact allocation of each sub-fund (as of September 2018):

- SMI (Swiss): 27.75%

- SPI Extra (Swiss): 9.25%

- Europe ex-CH: 10.60%

- S&P 500: 31.51%

- Canada: 1.93%

- Pacific ex-Japan: 2.54%

- Japan: 4.46%

- Emerging Markets: 8.96

- Cash: 3.00%

This offer is great. It is better than most other candidates:

- The allocation to stocks is high

- The allocation to international stocks is the maximum permitted by their regulations.

In the long-term, this nice allocation to stocks and the relatively low fees will result in significantly more returns.

Fees

When you are investing for the long-term, it is incredibly important to look at the fees.

The base fee of VIAC is 0.52% per year. But you only pay this fee on the invested part (the stocks). So, if you have more cash, you get fewer fees. Also, some external funds have higher fees, so you may end up with higher fees with a custom strategy.

The fees at VIAC are different for each universe and strategy. For instance, here are the fees for the global strategies:

- Global 20: 0.17% per year

- Global 40: 0.28% per year

- Global 60: 0.40% per year

- Global 80: 0.51% per year

- Global 100: 0.51% per year

Overall, these are excellent fees! Compared to most offers in Switzerland, this is better!

Life and disability insurance

VIAC has something special that differentiates them a little from other third pillar providers.

Indeed, with VIAC, you can get either life insurance or disability insurance. With each 10’000 CHF invested in your account (only the invested part counts), you get 2’500 CHF insurance.

You have to choose in your account whether you want disability (in case of at least 70% disability) insurance or life insurance. In the case of life insurance, this will be paid to your beneficiaries with the money of your third pillar. And in case of disability, you will get the insurance payment directly yourself.

I think it is a nice bonus, but this is not life-changing. This will only be useful if you die or get disabled (and you have to choose) before your retirement age. And the amount is still quite limited, so for many people, this will not replace a proper life or disability insurance. But this could still be very useful. And since it is free, it is obviously not a bad deal for VIAC users.

Security

We can also take a look at the security of the VIAC third pillar.

The technical security of the applications (both web and mobile) are pretty good. All the communication is encrypted between the application and the server. And since you cannot do anything with your third pillar until you retire (or in few other special cases), the apps are well protected.

The only thing I would like is a proper second-factor of authentication on the web application. But again, since you cannot do much, it is not that important.

If you hold cash, it will be held by WIR bank, the custodian bank of VIAC. This will be privileged in case of bankruptcy up to 100’000 CHF. This protection is the same as the bankruptcy protection of other Swiss banks. If you are an aggressive investor, this should not matter much since you should have very little cash.

The securities themselves are invested in institutional funds. These funds are very stable and are held in your name. The funds are not in the balance sheet of VIAC directly but on the balance sheet of the foundation. So, if VIAC goes bankrupt, these funds are safe in the foundation. It will be up to the foundation to find a new manager for these funds and to get you access to this money again.

Finally, I have never heard of any leak of data that would have occurred at VIAC. This is always a good sign, even for recent companies.

Overall, I think that the security of VIAC is quite good and well regulated. The applications are well done and the foundation is organized in such as way that your assets are well-protected.

Pros

Let’s summarize the pros of VIAC:

- You can allocate up to 97% in Stocks

- The fees are very low

- VIAC is very transparent

- A small interest rate on the cash part

- Strategies with low allocation to stocks are cheaper

- Mobile and web applications

Cons

Let’s summarize the cons of VIAC:

- You need a minimum of 40% on Swiss Stocks

- You need to keep 3% in cash

- Not the cheapest third pillar

Conclusion

The conclusion is pretty simple! VIAC is an excellent third pillar provider in Switzerland. The fees are very low and they offer a high allocation to stocks. This is great for long-term investors. And since most third pillar investors are in for the long-term, this is excellent.

There is something else I like about VIAC. It is their transparency. They communicate well, and they share as much information as possible. VIAC is the best third pillar provider for the information they share. The information is also very clean and modern. They do not try to hide fees. And they have been quite helpful in answering my questions for this article.

When VIAC was introduced, they were the best third pillar available. Now, there have been other competitors. If you want to keep up to date, I have an article about the best third pillars in Switzerland.

I still have a third pillar account at VIAC. When I discovered VIAC, I opened a VIAC account and transferred my previous third pillar there. Now, I also have another third pillar account at Finpension. In the future, I will see if I transfer everything to Finpension or not. But both are excellent options!

Which third pillar do you use? What do you think of VIAC?