(Disclosure: Some of the links below may be affiliate links) Selma is a Robo-Advisor in Switzerland. They offer a different approach than other Robo-Advisors in Switzerland. Indeed, you will have your own virtual personal assistant.This assistant will guide you through investing. And through your chat with the assistant, the system will design a personalized portfolio.In this post, I am going to review Selma in detail. By the end of the article, you will know whether Selma is a good fit for your investing.Keep in mind that I am not investing with Robo-Advisors. For people willing to put the time and effort, DIY Investing is better and will save you money. But for other people, investing with Robo-Advisors is the next best thing. Contents show Selma Selma is a Swiss Robo-Advisor. They

Topics:

Mr. The Poor Swiss considers the following as important: Investing

This could be interesting, too:

Lance Roberts writes CAPE-5: A Different Measure Of Valuation

Lance Roberts writes CAPE-5: A Different Measure Of Valuation

Lance Roberts writes Estimates By Analysts Have Gone Parabolic

Lance Roberts writes The Impact Of Tariffs Is Not As Bearish As Predicted

(Disclosure: Some of the links below may be affiliate links)

Selma is a Robo-Advisor in Switzerland. They offer a different approach than other Robo-Advisors in Switzerland. Indeed, you will have your own virtual personal assistant.

This assistant will guide you through investing. And through your chat with the assistant, the system will design a personalized portfolio.

In this post, I am going to review Selma in detail. By the end of the article, you will know whether Selma is a good fit for your investing.

Keep in mind that I am not investing with Robo-Advisors. For people willing to put the time and effort, DIY Investing is better and will save you money. But for other people, investing with Robo-Advisors is the next best thing.

Selma

Selma is a Swiss Robo-Advisor. They started offering services in 2016. Since then, they have expanded their offer and are becoming more and more popular.

They now have more than 1500 clients. And they are managing assets in the 7-digit range. They have been growing quickly these last few years.

In 2019, they also started offering access to a third pillar. So, you can have your third pillar managed by Selma’s advisor. It follows the same model as their investment account.

You can start investing with Selma from 2000 CHF. 2000 CHF is an excellent minimum. It means you do not have to start with a large amount. You can test their service with a small amount to see if it suits you.

You can learn a lot more by reading the interview I did with Selma’s CEO, Patrik Schär.

Selma Investments

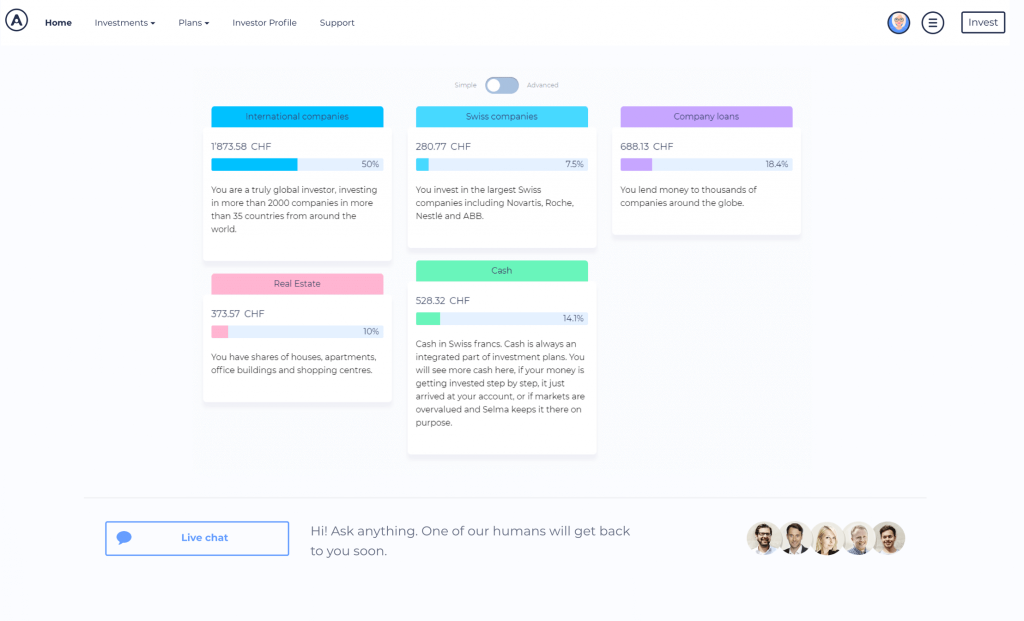

Based on your assessment with the virtual assistant, a portfolio will be decided for you. Various investing instruments can compose your portfolio:

- International Stocks

- Swiss Stocks

- International Corporate bonds

- International Real Estate

- Cash

Here is an example based on my chat with Selma:

This not how I would have invested myself. I do not like corporate bonds because they have too much correlation to stocks themselves. So they do not serve the purpose of reducing the volatility as bonds could do. Given the current state of bonds in Europe. I believe that bonds should be bypassed altogether. I would also have gotten more Swiss stocks to have an edge against the currency risk in the other categories. The rest makes sense for me.

The high number of cash is because Selma uses Dollar Cost Averaging (DCA). They do this to reduce the risks of investing at the worst time. So they will initially keep some cash and invest it over time. It would be cool if they showed the target portfolio and the current portfolio.

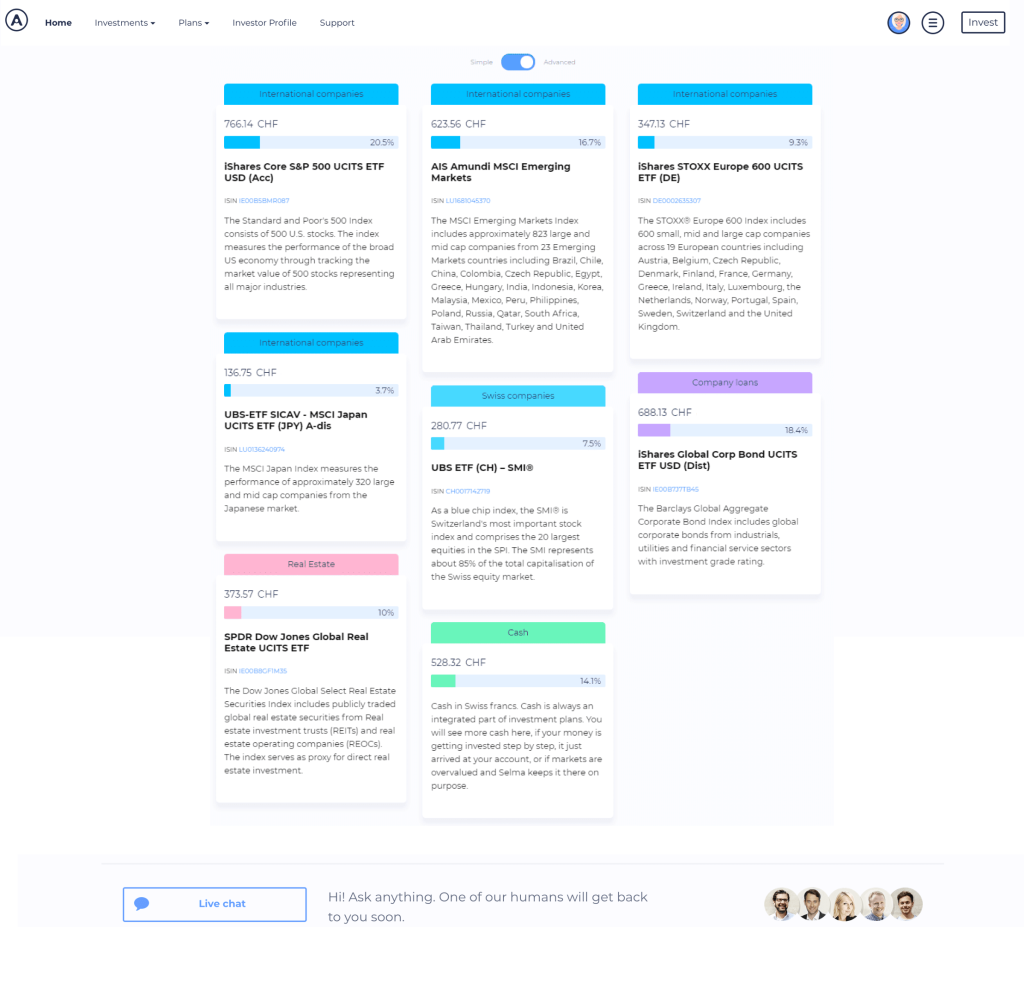

You have access to the exact ETFs composing your portfolio:

It is excellent that you can see the ETFs that they use. That way, you will know precisely what you are investing in. I did not check all of these ETFs in detail. But they seem like good fits for their categories.

On the other hand, I think they should allow a higher level of personalization. Aside from your answers to the Selma assistant (your investor profile), there is nothing you can change about in your portfolio. It would be cool to have some advanced features.

For instance, having some say over how much local stocks we want. Or whether we want or not to invest in real estate. I tried tuning my investor profile to change my portfolio. But I did not succeed in enough customization. However, for people that do not want to invest themselves, this is probably better. An investor that does not do proper research should not choose his investments himself.

Now, although it is not automated, there are other ways of making changes to your portfolio. You can request a personal check-up with a Selma expert. Based on the discussion, it could be possible to adapt your portfolio slightly. It could also be possible to do with their chat. Selma employees are extremely responsive in their chat.

Also, it is important that using a Robo-Advisor means you will have less control. This is also an advantage. It means you cannot take bad decisions. But it means you will have to trust the portfolio made by Selma for you.

Investments at Selma are not entirely passive. They are using algorithms to detect when markets are cheap and buy less or when they are expensive and buy more. For me, this is getting close to market timing. They are checking whether some classes are overvalued or undervalued. This may not be pure market timing. But I would prefer it if the portfolio was more passive.

Selma Fees

When you invest your money, you do not want to lose your money in fees. Fees are eating up your profit and are making your losses even worse. The main problem with fees is that they do not stop if the market goes bad. So you want to minimize the fees you are paying.

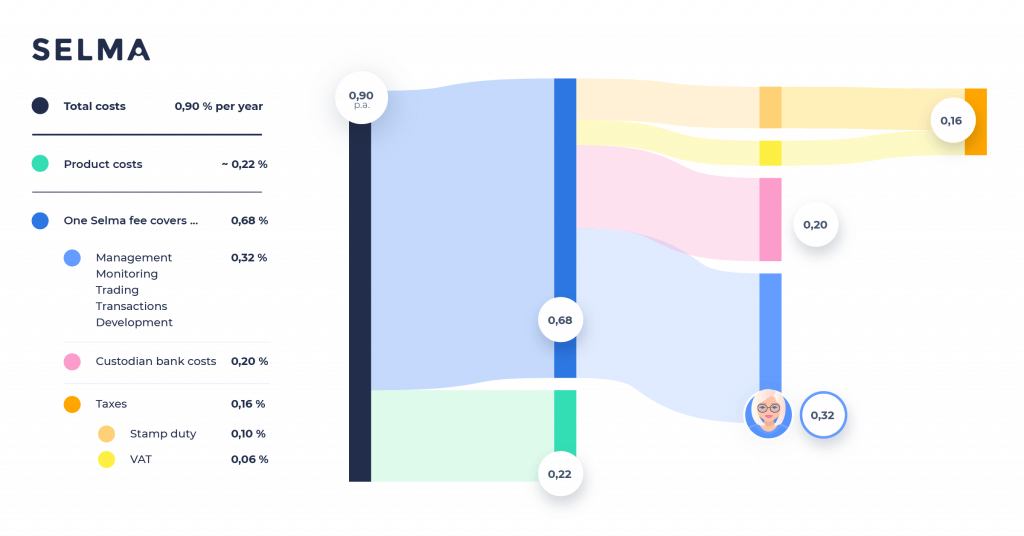

Selma is in the middle of the price range for Robo-Advisors in Switzerland. You will pay 0.68% fees for them to manage your money. On top of that, you will also have to pay the TER of the ETFs in which Selma invest. This last fee will depend on your portfolio. On average, they estimate the product cost to be 0.22%.

It gives you a total fee of 0.9% per year. It is not the best in Switzerland, but this is not the most expensive, either. I guess you have to pay for the unique feature of the virtual personal assistant.

Here is the full breakdown of the fees:

I feel like the fees are quite expensive for the service. It is not too bad for Switzerland. But for a DIY investor, these are substantial fees. To manage my portfolio, my fees are about 0.2%. But I have optimized them the most by using Interactive Brokers, by using U.S. ETFs and by carefully researching the ETFs I am investing in. And I have to buy and sell my ETFs directly. This takes time and is not a trivial task.

On the other hand, you will have nothing to do to manage your account. This where the advantage of Robo-Advisor lies. I would understand why some people would be ready to pay the price for this service. And it is also probably less stressful.

Also, if you compare this to investing through a bank or through a personal advisor, you will save money with Selma. You can easily lose between 1% and 2% by investing through a bank when you count everything.

How to open an account with Selma?

Opening an account is straightforward. It will take you no more than 10 minutes. Most of it is done through chat with Selma itself.

Go to selma.io and click the big Start For Free blue button. From there, they will ask you the standard questions. But what is interesting is that all the process will be done through chat with the personal assistant.

First, they will ask you the standard personal questions. But then, they will ask you questions about your money and your investing profile. Here is an example of questions:

Once you answered all the questions (there are not that many!), you will see your investor profile. And do not worry, you can always come back and change your answers. Many things can change in your life, and the assistant is aware of that so that your investor profile is not fixed.

Opening an account with Selma is a straightforward thing. The process is made easy, even for those that are unfamiliar with investments. I think this is the most interesting point about Selma: you can invest without knowing much about investing. It is not possible if you want to invest yourself or with some other

Is investing with Selma secure?

Yes! There are using several layers of protection to secure your money.

First, your money is not stored by Selma. It means that if they bankrupt, your money is still safe. The money is stored in Saxo Bank. It is something you always want in a financial company.

It should be the same for any respectable company. But they encrypt all your data from your computer to their datacenter. For this, they are using HTTPS.

You can also use second-factor authentication to secure your account. With this, you will need a second device to unlock your account. Your password will not be enough. I greatly recommend this for any service that provides it.

There are also using high standards of physical security in their offices. They are detailing their data security standards on the website.

If you want to keep your money safe, I have a guide about securing your money against cyber risk.

Other facts

One good thing is that Selma is very transparent about what they are doing. For instance, their public roadmap is on Trello. It means you can see what they are working on. Also, they are sharing many interesting things on their blog.

If you want, you can opt for the Sustainable option. With that, they will choose ETFs investing in sustainable alternatives. For instance, this will mean you will not invest in oil.

FAQ

What is the minimum you can invest with Selma?

You need to invest at least 2000 CHF.

How much will you pay in fees for Selma?

You will pay 0.68% of your portfolio to get it managed and you will an average of 0.22% for the products.

Who can invest with Selma?

Every Swiss resident that is at least 18 years old.

Conclusion

Overall, I think Selma is a good fit for people that want a Robo-Advisor with some extra assistance. The virtual personal assistant can help some people feel more at ease with investing.

Now, it is not for everybody. People that are knowledgeable with investing can find cheaper Robo-Advisors because Selma is not cheap. It may not be the most expensive Robo-Advisors in Switzerland. But it is not the cheapest either.

Also, they do not offer customization of the portfolio. So you cannot tweak your portfolio to what you think will perform better (or avoid investing in something that you do not believe in).

On the other hand, Selma is very easy to use. And they do everything to make you feel at home. It is very straightforward to create an account and start investing. And this is very important for new investors.

To learn more about Robo-Advisors, read my post about Robo-Advisors in Switzerland.

If you do not know where to start, I have a guide on getting started with investing.

What about you? What do you think about Selma?