Gold falls from seven year high weekly close◆ Gold prices fell 0.6% today after reaching a seven year weekly high close at $1587.90/oz on Friday, gold’s highest weekly price settlement since March 2013, a 4% gain in January and its second straight monthly climb. ◆ Chinese stocks crashed over 7.7% overnight as investors got a chance to react to the worsening coronavirus outbreak which also saw European equities seeing some selling and economically sensitive...

Read More »February Monthly

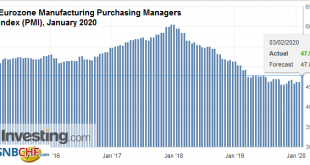

The global capital markets were roiled in recent weeks by the new virus that jumped species in China. It is contagious during the incubation periods and appears similar though more aggressive than SARS in 2003-2004. And China is larger and significantly more integrated into the global political economy. The new coronavirus is impactful in several areas outside of the human tragedy. It is a blow to ideas of better growth impulses to start the year. The outlook...

Read More »Monetary Metals Gold Brief 2020

We apologize for not posting articles during January. We have been busy, and going forward will publish a separate Market Report every Monday morning plus macroeconomics essays later in the week, as time permits. This is our annual analysis of the gold and silver markets. We look at the market players, dynamics, fallacies, drivers, and finally give our predictions for the prices of the metals over the coming year. Introduction Predicting the likely path of the...

Read More »FX Daily, February 3: Inauspicious Start to the Year of the (Flying) Rat

Overview: The Year of the Rat is off to an inauspicious start as apparently a fly rat (a bat) virus has jumped to humans. China’s markets re-opening amid much fanfare, and the Shanghai Composite dropped 7.7%, which is about what the futures in Singapore had anticipated. Several other markets in the region (Japan’s Nikkei, Australia, Singapore, Taiwan, and Thailand) fell by more than 1%. However, European and US shares are edging higher, and other measures of...

Read More »How Keynesian Ideas Weaken Economic Fundamentals

Whenever there are signs that the economy is likely to fall into an economic slump most experts advise that the central bank and the government should embark on loose monetary and fiscal policies to counter the possible economic recession. In this sense, most experts are following the ideas of the English economist John Maynard Keynes. Briefly, John Maynard Keynes held that one could not have complete trust in a market economy, which is inherently unstable. If left...

Read More »Julius Bär to cut 300 jobs after 2019 profit drop

The private bank wants to boost profitability with a new three-year strategy - Click to enlarge Swiss wealth manager Julius Bär will cut 300 jobs this year, its chief executive said on Monday, as it looks to boost profitability after a double-digit percentage earnings fall in 2019. The private bank wants to boost profitability with a new three-year strategy to deal with continued margin pressures, Philipp Rickenbacher said. The Zurich-based lender aims to improve...

Read More »EM Preview for the Week Ahead

EM remains vulnerable to deteriorating risk sentiment as the coronavirus spreads. China announced a series of measures over the weekend to help support its financial markets, but this may not be enough to turn sentiment around yet. China markets reopen Monday after the extended Lunar New Year holiday and it won’t be pretty. AMERICAS Brazil reports January trade Monday. December IP will be reported Tuesday, which is expected to fall -0.8% y/y vs. -1.7% in...

Read More »Why Democracy Doesn’t Give Us What We Want

That Americans are in the throes of a crisis in democracy has become a commonplace refrain of late. I have noticed that almost all such commentary treats political democracy, implicitly or explicitly, as the ideal. Yet in truth it is a seriously flawed ideal. In fact, as F. A. Hayek noted years ago, all the inherited limitations on government power are breaking down before…unlimited democracy…the problem today. Perhaps the most blatant evidence against the idea that...

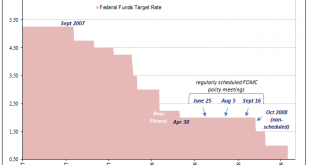

Read More »History Shows You Should Infer Nothing From Powell’s Pause

Jay Powell says that three’s not a crowd, at least not for his rate cuts, but four would be. As usual, central bankers like him always hedge and say that “should conditions warrant” the FOMC will be more than happy to indulge (the NYSE). But what he means in his heart of hearts is that there probably won’t be any need. Three should do the trick nicely. And a lot of people, from what I can tell, believe him if not simply because he’s already stopped. The last two...

Read More »The Era of Boom and Bust Isn’t Over

At the 2020 World Economic Forum in Davos, Bob Prince, co-chief investment officer at Bridgewater Associates, attracted attention when he suggested in a news interview that the boom and bust cycle as we have come to know it in the last decades may have ended. This viewpoint may well have been encouraged by the fact that the latest economic upswing (“boom”) has been going for around a decade and that an end is not in sight as suggested by incoming macro- and...

Read More » SNB & CHF

SNB & CHF