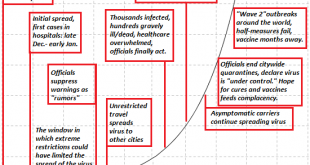

The new coronavirus that originated in China, apparently first detected in December, emerged on the world’s stage in January and continues to dominate the investment climate. There are two critical questions for investors and businesses whose answers will likely be clearer in the first part of March. First, will Covid-19 be contained for the most part by the end of Q1? China altered its methodology a couple of times, and many observers questioned the quality of the...

Read More »Swiss National Bank to distribute 4 billion francs of profit

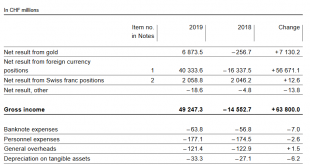

© Michael Müller | Dreamstime.com In 2019, the Swiss National Bank (SNB) made a profit of around CHF 49 billion. These profits came mainly from the rising value of the assets on the bank’s balance sheet. In 2019, the value of its holdings of foreign currency and gold rose substantially. When combined with interest, dividend income and gains on shares total profits for the year were CHF 49 billion. When combined with past retained profits, the SNB’s total accumulated...

Read More »Silver Backwardation Returns, Gold and Silver Market Report 2 March

The big news this week was the drop in the prices of the metals (though we believe that it is the dollar which is going up), $57 and $1.81 respectively. Of course, when the price drops the injured goldbugs come out. We have written the authoritative debunking of the gold and silver price suppression conspiracy here. We provide both the scientific theory and the data. So we won’t say anything more about it today. On 17 Feb, we wrote about the widening bid-ask spread...

Read More »FX Daily, March 2: Central Banks’ Words of Assurance have Short Life

Swiss Franc The Euro has risen by 0.10% to 1.0632 EUR/CHF and USD/CHF, March 2(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Comments beginning with Powell before the weekend, and BOJ and BOE earlier today promising support have saw equity markets briefly stabilize after last week’s dramatic moves. The G7 will hold a teleconference this week, but speculation of a coordinated rate move does not seem...

Read More »Potential relief for some Swiss renters

© Ocskay Mark | Dreamstime.com Every three months the rate of interest used to benchmark Swiss rents is reviewed. If it goes down some renters have the right to request a decrease in rent. This time the reference rate fell from 1.50% to 1.25%. The last time it dropped was 2 June 2017 when it fell to 1.5%. The rate is based on the average Swiss mortgage rate over three months. This rate is then rounded to the nearest 0.25%. On 31 December 2019 that rate was 1.37%,...

Read More »SNB Profit in 2019: 48.9 billion (2018: loss of CHF 14.9 billion, 2020 Does not Look Good)

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Good years of the Credit Cycle This trend was stopped in 2016, even without the need for a cap on the franc. But one should consider that we are in the good years of the credit cycle now. Bad quarters...

Read More »USD/CHF Price Analysis: 17-week-old falling trendline, 61.8 percent Fibonacci on bears’ radar

USD/CHF remains on the back foot near the multi-week low. Bearish MACD signals further downside, key support question the sellers. 200-week SMA acts as the key upside barrier. Despite bouncing off September 2018 lows, USD/CHF stays 0.11% down while trading around 0.9640 during early Monday. Also portraying the pair’s weakness are bearish conditions of MACD. That said, a downward sloping trend line since early October 2019, at 0.9600 now, acts as the immediate...

Read More »Drivers for the Week Ahead

The dollar has softened as Fed easing expectations have picked up Late Friday, Chair Powell issued an unscheduled statement saying the Fed is monitoring the virus and will act as appropriate This is a big data week for the US; the Fed releases its Beige Book report Wednesday Super Tuesday comes this week; Bank of Canada meets Wednesday Final eurozone and UK February PMI readings will be reported this week Reserve Bank of Australia meets Tuesday; BOJ Governor Kuroda...

Read More »Swiss price watchdog calls for reduction in train ticket prices

The price watchdog wants to see a 2% reduction in ticket prices once track fees for rail companies drop starting next year. (© Keystone / Walter Bieri) With track fees for rail companies set to drop, savings should be passed on to customers, Stefan Meierhans told the weekly NZZ am Sonntag. The call comes on the heels of revelations that two state-owned rail firms wrongly claimed millions in subsidies. Switzerland’s official price watchdog said that prices for train...

Read More »The Limits of Force: A Bayonet in the Back Will Not Restore China’s Economy

Force cannot restore legitimacy, trust or confidence, nor can it magically erase the consequences of a still-unfolding national trauma. The Chinese authorities threatening to punish workers who refuse to return to work are getting a lesson in the limits of force in an unprecedented national trauma: a bayonet in the back will not restore the legitimacy and confidence that have been lost. There are two enormous blind spots in conventional media coverage of the...

Read More » SNB & CHF

SNB & CHF