The blockchain sector started in Zug’s Crypto Valley (represented here with a chart of companies), but has spread to other areas of Switzerland. © Keystone / Urs Flueeler The Swiss blockchain industry appears to be in rude health despite the economic fallout of the coronavirus pandemic. The number of new companies and jobs produced by the sector increased in the first six months of the year. Is this trend set to last? The number of Crypto Nation (including...

Read More »Day1 MARC CHANDLER

Register for part 2 of the Traders Summit 2020 Online Event starting on September 25th: https://tradersummit.net/?ref=148

Read More »Day1 MARC CHANDLER

Register for part 2 of the Traders Summit 2020 Online Event starting on September 25th: https://tradersummit.net/?ref=148

Read More »FX Daily, September 16: Dollar Eases Ahead of the FOMC

Swiss Franc The Euro has fallen by 0.04% to 1.0751 EUR/CHF and USD/CHF, September 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The dollar has been sold against nearly all the world’s currencies ahead of what is expected to be a dovish Federal Reserve, even if no fresh action is taken. The Scandis and Antipodean currencies are leading the majors. The South African rand and Mexican peso are leading the...

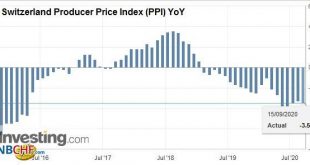

Read More »Swiss Producer and Import Price Index in August 2020: -3.5 percent YoY, -0.4 percent MoM

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015 (see below), compared to -3% in Europe or -1% in...

Read More »Sacrifice for Thee But None For Me

The banquet of consequences for the Fed, the elites and their armies of parasitic flunkies and factotums is being laid out, and there won’t be much choice in the seating. Words can be debased just like currencies. Take the word sacrifice. The value of the original has been debased by trite, weepy overuse to the point of cliche. Like other manifestations of derealization and denormalization, this debasement is invisible, profound and ultimately devastating. Consider...

Read More »Merger rumours boost UBS and Credit Suisse shares

Will UBS and Credit Suisse, here in Zurich’s Paradeplatz, become more than neighbours? Keystone Shares of Credit Suisse and UBS moved to the top of SMI stocks on Monday morning after a media report said the Swiss banks were planning a merger. The chairmen of UBS Group and Credit Suisse Group were exploring a potential merger to create one of Europe’s largest banks, wrote Inside Paradeplatz, citing unidentified people inside the two lenders. The project, nicknamed...

Read More »Coronavirus: no quarantine for people entering Switzerland from border regions

© Frankposz | Dreamstime.com On 11 September 2020, Switzerland’s federal government announced that people entering Switzerland after spending time in regions next to the country’s national borders will be exempted from mandatory quarantine requirements should those regions end up with high rates of infection. Cross-border worker are already exempted from quarantine requirements. The announcement marks a significant shift away from the current system which requires...

Read More »Gold is Looking Strong as it Tests Resistance

Since it’s sell-off from it’s early August high, gold has been stuck in an ever decreasing range. Having had a remarkable rally to an intra-day high of $2,078 on the 7th of August Gold has traded sideways and consolidated. This has been viewed by many market commentators as a healthy pause in gold’s bull rally as when markets go parabolic they tend to retrace just as fast. The underlying rationale for owning gold has not change over the last month and some would say...

Read More »Swiss wind power held up by legal challenges

The gentle ridges of the Jura mountain range are suitable for the installation of wind turbines (here the Mont-Crosin park, in the Bernese Jura), but most projects are now at a standstill. © Keystone / Jean-christophe Bott For a decade, wind energy in Switzerland has been stalled. Opponents have used every possible means to stop projects. At the end of September, one community will vote on the future of this kind of energy. Power derived from wind is already...

Read More » SNB & CHF

SNB & CHF